Chevron 2007 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2007 Chevron annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

65

cash management and debt financing activities, corporate

administrative functions, insurance operations, real estate

activities, alternative fuels, and technology companies.

The company’s primary country of operation is the

United States of America, its country of domicile. Other

components of the company’s operations are reported as

“International” (outside the United States).

Segment Earnings The company evaluates the performance

of its operating segments on an after-tax basis, without con-

sidering the effects of debt financing interest expense or

investment interest income, both of which are managed by the

company on a worldwide basis. Corporate administrative

costs and assets are not allocated to the operating segments.

However, operating segments are billed for the direct use of

corporate services. Nonbillable costs remain at the corporate

level in “All Other.” After-tax segment income by major

operating area is presented in the following table:

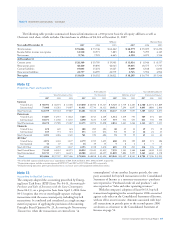

Segment Assets Segment assets do not include intercompany

investments or intercompany receivables. Segment assets at

year-end 2007 and 2006 are as follows:

At December 31

2007 2006

Upstream

United States $ 23,535 $ 20,727

International 61,049 51,844

Goodwill 4,637 4,623

Total Upstream 89,221 77,194

Downstream

United States 16,790 13,482

International 26,075 22,892

Total Downstream 42,865 36,374

Chemicals

United States 2,484 2,568

International 870 832

Total Chemicals 3,354 3,400

Total Segment Assets 135,440 116,968

All Other*

United States 6,847 8,481

International 6,499 7,179

Total All Other 13,346 15,660

Total Assets – United States 49,656 45,258

Total Assets – International 94,493 82,747

Goodwill 4,637 4,623

Total Assets $ 148,786 $ 132,628

* “All Other” assets consist primarily of worldwide cash, cash equivalents and mar-

ketable securities, real estate, information systems, the company’s investment in

Dynegy prior to its disposition in 2007, mining operations, power generation busi-

nesses, technology companies, and assets of the corporate administrative functions.

Segment Sales and Other Operating Revenues Operating seg-

ment sales and other operating revenues, including internal

transfers, for the years 2007, 2006 and 2005 are presented

in the following table. Products are transferred between

operating segments at internal product values that approxi-

mate market prices.

Revenues for the upstream segment are derived primarily

from the production and sale of crude oil and natural gas,

as well as the sale of third-party production of natural gas.

Revenues for the downstream segment are derived from the

refining and marketing of petroleum products, such as gaso-

line, jet fuel, gas oils, kerosene, lubricants, residual fuel oils

and other products derived from crude oil. This segment

also generates revenues from the transportation and trading

of crude oil and refined products. Revenues for the chemicals

segment are derived primarily from the manufacture and sale

of additives for lubricants and fuel. “All Other” activities

include revenues from mining operations of coal and other

minerals, power generation businesses, insurance operations,

real estate activities, and technology companies.

Other than the United States, no single country accounted

for 10 percent or more of the company’s total sales and other

operating revenues in 2007.

Year ended December 31

2007 2006 2005

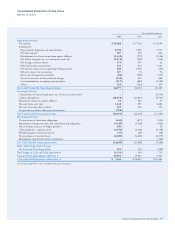

Income by Major Operating Area

Upstream

United States $ 4,532 $ 4,270 $ 4,168

International 10,284 8,872 7,556

Total Upstream 14,816 13,142 11,724

Downstream

United States 966 1,938 980

International 2,536 2,035 1,786

Total Downstream 3,502 3,973 2,766

Chemicals

United States 253 430 240

International 143 109 58

Total Chemicals 396 539 298

Total Segment Income 18,714 17,654 14,788

All Other

Interest expense (107) (312) (337)

Interest income 385 380 266

Other (304) (584) (618)

Net Income $ 18,688 $ 17,138 $ 14,099