Chevron 2007 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2007 Chevron annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

81

the date of grant. Performance units granted under the LTIP

settle in cash at the end of a three-year performance period.

Settlement amounts are based on achievement of performance

targets relative to major competitors over the period, and pay-

ments are indexed to the company’s stock price.

Texaco Stock Incentive Plan (Texaco SIP) On the closing

of the acquisition of Texaco in October 2001, outstand-

ing options granted under the Texaco SIP were converted

to Chevron options. These options, which have 10-year

contractual lives extending into 2011, retained a provision

for being restored. This provision enables a participant who

exercises a stock option to receive new options equal to the

number of shares exchanged or who has shares withheld to

satisfy tax withholding obligations to receive new options

equal to the number of shares exchanged or withheld. The

restored options are fully exercisable six months after the

date of grant, and the exercise price is the market value of

the common stock on the day the restored option is granted.

Beginning in 2007, restored options were granted under the

LTIP. No further awards may be granted under the former

Texaco plans.

Unocal Share-Based Plans (Unocal Plans) When Chevron

acquired Unocal in August 2005, outstanding stock options

and stock appreciation rights granted under various Unocal

Plans were exchanged for fully vested Chevron options and

appreciation rights. These awards retained the same provi-

sions as the original Unocal Plans. Awards issued prior to

2004 generally may be exercised for up to three years after

termination of employment (depending upon the terms of

the individual award agreements) or the original expiration

date, whichever is earlier. Awards issued since 2004 generally

remained exercisable until the end of the normal option term

if termination of employment occurred prior to August 10,

2007. Other awards issued under the Unocal Plans, including

restricted stock, stock units, restricted stock units and per-

formance shares, became vested at the acquisition date, and

shares or cash were issued to recipients in accordance with

change-in-control provisions of the plans.

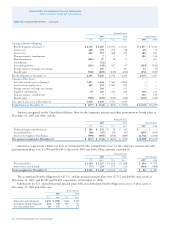

The fair market values of stock options and stock appre-

ciation rights granted in 2007, 2006 and 2005 were measured

on the date of grant using the Black-Scholes option-pricing

model, with the following weighted-average assumptions:

Year ended December 31

2007 2006 2005

Stock Options

Expected term in years1 6.3 6.4 6.4

Volatility2 22.0% 23.7% 24.5%

Risk-free interest rate based on

zero coupon U.S. treasury note 4.5% 4.7% 3.8%

Dividend yield 3.2% 3.1% 3.4%

Weighted-average fair value per

option granted $ 15.27 $ 12.74 $ 11.66

Restored Options

Expected term in years1 1.6 2.2 2.1

Volatility2 21.2% 19.6% 18.6%

Risk-free interest rate based on

zero coupon U.S. treasury note 4.5% 4.8% 3.8%

Dividend yield 3.2% 3.3% 3.4%

Weighted-average fair value per

option granted $ 8.61 $ 7.72 $ 6.09

Unocal Plans3

Expected term in years1 – – 4.2

Volatility2 – – 21.6%

Risk-free interest rate based on

zero coupon U.S. treasury note – – 3.9%

Dividend yield – – 3.4%

Weighted-average fair value per

option granted – – $ 21.48

1 Expected term is based on historical exercise and post-vesting cancellation data.

2 Volatility rate is based on historical stock prices over an appropriate period,

generally equal to the expected term.

3 Represent options converted at the acquisition date.

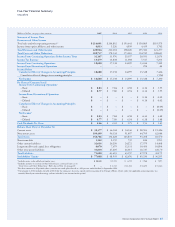

A summary of option activity during 2007 is presented

below:

Weighted-

Weighted- Average

Average Remaining Aggregate

Shares Exercise Contractual Intrinsic

(Thousands) Price Term Value

Outstanding at

January 1, 2007 55,945 $ 47.91

Granted 12,848 $ 74.08

Exercised (14,340) $ 51.92

Restored 3,458 $ 80.45

Forfeited (554) $ 72.36

Outstanding at

December 31, 2007 57,357 $ 54.50 6.3 yrs. $ 2,227

Exercisable at

December 31, 2007 35,540 $ 45.93 5.1 yrs. $ 1,685

The total intrinsic value (i.e., the difference between the

exercise price and the market price) of options exercised during

2007, 2006 and 2005 was $423, $281 and $258, respectively.

Upon adoption of FAS 123R, the company elected to

amortize newly issued graded awards on a straight-line basis

over the requisite service period. In accordance with FAS 123R

implementation guidance issued by the staff of the Securities

and Exchange Commission, the company accelerates the vest-

ing period for retirement-eligible employees in accordance with