Chevron 2007 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2007 Chevron annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

99

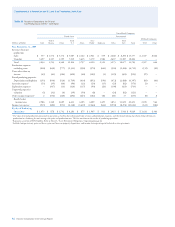

The standardized measure of discounted future net

cash flows, related to the preceding proved oil and gas

reserves, is calculated in accordance with the requirements

of FAS 69. Estimated future cash inflows from production

are computed by applying year-end prices for oil and gas to

year-end quantities of estimated net proved reserves. Future

price changes are limited to those provided by contractual

arrangements in existence at the end of each reporting year.

Future development and production costs are those estimated

future expenditures necessary to develop and produce year-end

estimated proved reserves based on year-end cost indices,

assuming continuation of year-end economic conditions,

and include estimated costs for asset retirement obligations.

Estimated future income taxes are calculated by applying

appropriate year-end statutory tax rates. These rates reflect

allowable deductions and tax credits and are applied to

estimated future pretax net cash flows, less the tax basis of

related assets. Discounted future net cash flows are calculated

using 10 percent midperiod discount factors. Discounting

requires a year-by-year estimate of when future expenditures

will be incurred and when reserves will be produced.

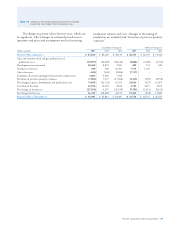

The information provided does not represent manage-

ment’s estimate of the company’s expected future cash flows

or value of proved oil and gas reserves. Estimates of proved-

reserve quantities are imprecise and change over time as

new information becomes available. Moreover, probable and

possible reserves, which may become proved in the future,

are excluded from the calculations. The arbitrary valuation

prescribed under FAS 69 requires assumptions as to the timing

and amount of future development and production costs. The

calculations are made as of December 31 each year and should

not be relied upon as an indication of the company’s future

cash flows or value of its oil and gas reserves. In the following

table, “Standardized Measure Net Cash Flows” refers to the

standardized measure of discounted future net cash flows.