Chevron 2007 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2007 Chevron annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

73

specific agreements may be based on the London Interbank

Offered Rate or bank prime rate. No amounts were outstand-

ing under these credit agreements during 2007 or at year-end.

At December 31, 2007 and 2006, the company classi-

fied $4,382 and $4,450, respectively, of short-term debt as

long-term. Settlement of these obligations is not expected to

require the use of working capital in 2008, as the company

has both the intent and the ability to refinance this debt on

a long-term basis.

Total long-term debt, excluding capital leases, at Decem-

ber 31, 2007, was $5,664. The company’s long-term debt

outstanding at year-end 2007 and 2006 was as follows:

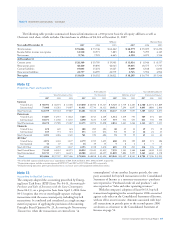

At December 31

2007 2006

3.375% notes due 2008 $ 749 $ 738

5.5% notes due 2009 405 401

7.327% amortizing notes due 20141 213 213

8.625% debentures due 2032 161 199

8.625% debentures due 2031 108 199

7.5% debentures due 2043 85 198

8% debentures due 2032 81 148

9.75% debentures due 2020 57 250

8.875% debentures due 2021 46 150

8.625% debentures due 2010 30 150

3.85% notes due 2008 30 –

3.5% notes due 2007 – 1,996

7.09% notes due 2007 – 144

Medium-term notes, maturing from

2021 to 2038 (6.2%)2 64 210

Fixed interest rate notes, maturing from

2008 to 2011 (8.2%)2 27 46

Other foreign currency obligations (0.5%)2 17 23

Other long-term debt (7.4%)2 59 66

Total including debt due within one year 2,132 5,131

Debt due within one year (850) (2,176)

Reclassified from short-term debt 4,382 4,450

Total long-term debt $ 5,664 $ 7,405

1 Guarantee of ESOP debt.

2 Weighted-average interest rate at December 31, 2007.

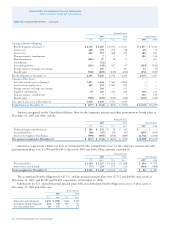

Long-term debt of $2,132 matures as follows: 2008 – $850;

2009 – $431; 2010 – $65; 2011 – $48; 2012 – $33; and after

2012 – $705.

In 2007, $2,000 of Chevron Canada Funding Company

bonds matured. The company also redeemed early $874 of

Texaco Capital Inc. bonds, at an after-tax loss of approxi-

mately $175. In 2006, $510 in bonds were retired at maturity

and $1,700 of Unocal debt was redeemed early at a $92

before-tax gain.

FASB Statement No. 157, Fair Value Measurements (FAS 157)

In September 2006, the FASB issued FAS 157, which

became effective for the company on January 1, 2008. This

standard defines fair value, establishes a framework for mea-

suring fair value and expands disclosures about fair value

measurements. FAS 157 does not require any new fair value

measurements but applies to assets and liabilities that are

required to be recorded at fair value under other account-

ing standards. The implementation of FAS 157 did not have

a material effect on the company’s results of operations or

consolidated financial position.

FASB Staff Position FAS No. 157-1, Application of FASB

Statement No. 157 to FASB Statement No. 13 and Its Related

Interpretive Accounting Pronouncements That Address Leas-

ing Transactions (FSP 157-1) In February 2008, the FASB

issued FSP 157-1, which became effective for the company

on January 1, 2008. This FSP excludes FASB Statement

No. 13, Accounting for Leases, and its related interpretive

accounting pronouncements from the provisions of FAS 157.

Implementation of this standard did not have a material

effect on the company’s results of operations or consolidated

financial position.

FASB Staff Position FAS No. 157-2, Effective Date of FASB

Statement No. 157 (FSP 157-2) In February 2008, the FASB

issued FSP 157-2, which delays the company’s January 1,

2008, effective date of FAS 157 for all nonfinancial assets and

nonfinancial liabilities, except those recognized or disclosed

at fair value in the financial statements on a recurring basis

(at least annually), until January 1, 2009. Implementation of

this standard did not have a material effect on the company’s

results of operations or consolidated financial position.

FASB Statement No. 159, The Fair Value Option for Financial

Assets and Financial Liabilities − Including an amendment of

FASB Statement No. 115 (FAS 159) In February 2007, the

FASB issued FAS 159, which became effective for the com-

pany on January 1, 2008. This standard permits companies

to choose to measure many financial instruments and certain

other items at fair value and report unrealized gains and losses

in earnings. Such accounting is optional and is generally to

be applied instrument by instrument. The implementation

of FAS 159 did not have a material effect on the company’s

results of operations or consolidated financial position.

FASB Statement No. 141 (revised 2007), Business Combina-

tions (FAS 141-R) In December 2007, the FASB issued FAS

141-R, which will become effective for business combination

transactions having an acquisition date on or after January 1,

2009. This standard requires the acquiring entity in a business