Chevron 2007 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2007 Chevron annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

63

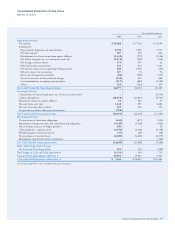

Year ended December 31

2007 2006 2005

Sales and other operating

revenues $ 153,574 $ 145,774 $ 137,866

Total costs and other deductions 147,510 137,765 131,809

Net income 5,203 5,668 4,775

At December 31

2007 2006

Current assets $ 32,803 $ 26,066

Other assets 27,401 23,538

Current liabilities 20,050 16,917

Other liabilities 11,447 9,037

Net equity 28,707 23,650

Memo: Total debt $ 4,433 $ 3,465

Chevron Transport Corporation Ltd. (CTC), incorporated in

Bermuda, is an indirect, wholly owned subsidiary of Chevron

Corporation. CTC is the principal operator of Chevron’s inter-

national tanker fleet and is engaged in the marine transportation

of crude oil and refined petroleum products. Most of CTC’s

shipping revenue is derived from providing transportation serv-

ices to other Chevron companies. Chevron Corporation has

fully and unconditionally guaranteed this subsidiary’s obliga-

tions in connection with certain debt securities issued by a third

party. Summarized financial information for CTC and its con-

solidated subsidiaries is presented in the following table:

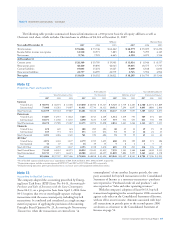

Year ended December 31

2007 2006 2005

Sales and other operating revenues $ 667 $ 692 $ 640

Total costs and other deductions 713 602 509

Net income (39) 119 113

At December 31

2007 2006

Current assets $ 335 $ 413

Other assets 337 345

Current liabilities 107 92

Other liabilities 188 250

Net equity 377 416

There were no restrictions on CTC’s ability to pay divi-

dends or make loans or advances at December 31, 2007.

Retained earnings at December 31, 2007 and 2006, included

approximately $7,284 and $5,580, respectively, for the com-

pany’s share of undistributed earnings of equity affiliates.

At December 31, 2007, about 120 million shares of

Chevron’s common stock remained available for issuance from

the 160 million shares that were reserved for issuance under

the Chevron Corporation Long-Term Incentive Plan (LTIP).

In addition, approximately 454,000 shares remain available

for issuance from the 800,000 shares of the company’s com-

mon stock that were reserved for awards under the Chevron

Corporation Non-Employee Directors’ Equity Compensation

and Deferral Plan (Non-Employee Directors’ Plan).

For the financial and derivative instruments discussed below,

no material change in market risk occurred relative to the

information presented in 2006.

Commodity Derivative Instruments Chevron is exposed

to market risks related to price volatility of crude oil, refined

products, natural gas, natural gas liquids, liquefied natural gas

and refinery feedstocks.

The company uses derivative commodity instruments to

manage these exposures on a portion of its activity, including

firm commitments and anticipated transactions for the pur-

chase, sale and storage of crude oil, refined products, natural

gas, natural gas liquids, and feedstock for company refineries.

The company also uses derivative commodity instruments for

limited trading purposes.

The company uses Inter national Swaps and Derivatives

Association agreements to govern derivative contracts with cer-

tain counterparties to mitigate credit risk. Depending on the

nature of the derivative transactions, bilateral collateral arrange-

ments may also be required. When the company is engaged

in more than one outstanding derivative transaction with the

same counterparty and also has a legally enforceable netting

agreement with that counterparty, the net marked-to-market

exposure represents the netting of the positive and negative

exposures with that counterparty and is a reasonable measure

of the company’s credit risk exposure. The company also uses

other netting agreements with certain counterparties with

which it conducts significant transactions to mitigate credit risk.

The fair values of the outstanding contracts are reported

on the Consolidated Balance Sheet as “Accounts and notes

receivable,” “Accounts payable,” “Long-term receivables –

net” and “Deferred credits and other noncurrent obligations.”

Gains and losses on the company’s risk management activities

are reported as either “Sales and other operating revenues” or

“Purchased crude oil and products,” whereas trading gains and

losses are reported as “Other income.”

Foreign Currency The company enters into forward exchange

contracts, generally with terms of 180 days or less, to man-

age some of its foreign currency exposures. These exposures

include revenue and anticipated purchase transactions,

including foreign currency capital expenditures and lease com-

mitments, forecasted to occur within 180 days. The forward

exchange contracts are recorded at fair value on the balance

sheet with resulting gains and losses reflected in income.