Chevron 2007 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2007 Chevron annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

74

combination to recognize the assets acquired, the liabilities

assumed, and any noncontrolling interest in the acquiree at

the acquisition date to be measured at their respective fair

values. The Statement requires acquisition-related costs, as

well as restructuring costs the acquirer expects to incur for

which it is not obligated at acquisition date, to be recorded

against income rather than included in purchase-price

determination. It also requires recognition of contingent

arrangements at their acquisition-date fair values, with subse-

quent changes in fair value generally reflected in income.

FASB Statement No. 160, Noncontrolling Interests in Consoli-

dated Financial Statements, an amendment of ARB No. 51

(FAS 160) The FASB issued FAS 160 in December 2007,

which will become effective for the company January 1,

2009, with retroactive adoption of the Statement’s presen-

tation and disclosure requirements for existing minority

interests. This standard will require ownership interests

in subsidiaries held by parties other than the parent to be

presented within the equity section of the consolidated state-

ment of financial position but separate from the parent’s

equity. It will also require the amount of consolidated net

income attributable to the parent and the noncontrolling

interest to be clearly identified and presented on the face of

the consolidated income statement. Certain changes in a

parent’s ownership interest are to be accounted for as equity

transactions and when a subsidiary is deconsolidated, any

noncontrolling equity investment in the former subsidiary is

to be initially measured at fair value. The company does not

anticipate the implementation of FAS 160 will significantly

change the presentation of its consolidated income statement

or consolidated balance sheet.

The company accounts for the cost of exploratory wells in

accordance with FASB Statement No. 19, Financial and Report-

ing by Oil and Gas Producing Companies (FAS 19), as amended

by FASB Staff Position (FSP) FAS 19-1, Accounting for Sus-

pended Well Costs, which provides that exploratory well costs

continue to be capitalized after the completion of drilling when

(a) the well has found a sufficient quantity of reserves to justify

completion as a producing well and (b) the enterprise is making

sufficient progress assessing the reserves and the economic and

operating viability of the project. If either condition is not met

or if an enterprise obtains information that raises substantial

doubt about the economic or operational viability of the proj-

ect, the exploratory well would be assumed to be impaired, and

its costs, net of any salvage value, would be charged to expense.

FAS 19 provides a number of indicators that can assist an entity

to demonstrate sufficient progress is being made in assessing

the reserves and economic viability of the project.

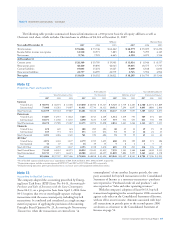

The following table indicates the changes to the com-

pany’s suspended exploratory well costs for the three years

ended December 31, 2007. No capitalized exploratory well

costs were charged to expense upon the 2005 adoption of

FSP FAS 19-1.

2007 2006 2005

Beginning balance at January 1 $ 1,239 $ 1,109 $ 671

Additions associated with the

acquisition of Unocal – – 317

Additions to capitalized exploratory

well costs pending the

determination of proved reserves 486 446 290

Reclassifications to wells, facilities

and equipment based on the

determination of proved reserves (23) (171) (140)

Capitalized exploratory well costs

charged to expense (42) (121) (6)

Other reductions* – (24) (23)

Ending balance at December 31 $ 1,660 $ 1,239 $ 1,109

* Represent property sales and exchanges.

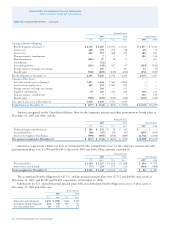

The following table provides an aging of capitalized well

costs and the number of projects for which exploratory well

costs have been capitalized for a period greater than one year

since the completion of drilling. The aging of the former

Unocal wells is based on the date the drilling was completed,

rather than the date of Chevron’s acquisition of Unocal in 2005.

At December 31

2007 2006 2005

Exploratory well costs capitalized

for a period of one year or less $ 449 $ 332 $ 259

Exploratory well costs capitalized

for a period greater than one year 1,211 907 850

Balance at December 31 $ 1,660 $ 1,239 $ 1,109

Number of projects with exploratory

well costs that have been capitalized

for a period greater than one year* 54 44 40

* Certain projects have multiple wells or fields or both.

Of the $1,211 of exploratory well costs capitalized for

more than one year at December 31, 2007, $750 (32 projects)

is related to projects that had drilling activities under way or

firmly planned for the near future. An additional $8 (three

projects) is related to projects that had drilling activity during

2007. The $453 balance related to 19 projects in areas requir-

ing a major capital expenditure before production could begin

and for which additional drilling efforts were not under way

or firmly planned for the near future. Additional drilling was

not deemed necessary because the presence of hydrocarbons

had already been established, and other activities were in

process to enable a future decision on project development.

The projects for the $453 referenced above had the fol-

lowing activities associated with assessing the reserves and the

Notes to the Consolidated Financial Statements