Chevron 2007 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2007 Chevron annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

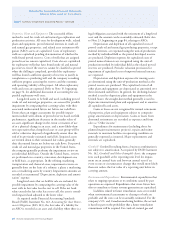

68

Colonial Pipeline Company Chevron owns an approximate

23 percent equity interest in the Colonial Pipeline Company.

The Colonial Pipeline system runs from Texas to New Jersey

and transports petroleum products in a 13-state market. At

December 31, 2007, the company’s carrying value of its invest-

ment in Colonial Pipeline was approximately $580 higher

than the amount of underlying equity in Colonial Pipeline

net assets.

Chevron Phillips Chemical Company LLC Chevron owns

50 percent of Chevron Phillips Chemical Company LLC

(CPChem), with the other half owned by Conoco Phillips Cor-

poration. At December 31, 2007, the company’s carrying value

of its investment in CPChem was approximately $60 lower

than the amount of underlying equity in CPChem net assets.

Dynegy Inc. In May 2007, Chevron sold its 19 percent com-

mon stock investment in Dynegy Inc., a provider of electricity

to markets and customers throughout the United States, for

approximately $940, resulting in a gain of $680.

Other Information “Sales and other operating revenues” on

the Consolidated Statement of Income includes $11,555,

$9,582 and $8,824 with affiliated companies for 2007, 2006

and 2005, respectively. “Purchased crude oil and products”

includes $5,464, $4,222 and $3,219 with affiliated companies

for 2007, 2006 and 2005, respectively.

“Accounts and notes receivable” on the Consolidated

Balance Sheet includes $1,722 and $1,297 due from affiliated

companies at December 31, 2007 and 2006, respectively.

“Accounts payable” includes $374 and $262 due to affiliated

companies at December 31, 2007 and 2006, respectively.

Petroboscan Chevron has a 39 percent interest in Petroboscan,

a joint stock company formed in 2006 to operate the Boscan

Field in Venezuela until 2026. Chevron previously operated

the field under an operating service agreement. At December

31, 2007, the company’s carrying value of its investment in

Petroboscan was approximately $310 higher than the amount

of underlying equity in Petroboscan net assets.

Angola LNG Ltd. Chevron has a 36 percent interest in Angola

LNG, which will process and liquefy natural gas produced in

Angola for delivery to international markets.

GS Caltex Corporation Chevron owns 50 percent of GS

Caltex, a joint venture with GS Holdings. The joint venture,

originally formed in 1967 between the LG Group and Caltex,

imports, refines and markets petroleum products and petro-

chemicals predominantly in South Korea.

Caspian Pipeline Consortium Chevron has a 15 percent

interest in the Caspian Pipeline Consortium (CPC), which

provides the critical export route for crude oil from both

TCO and Karachaganak. At December 31, 2007, the com-

pany’s carrying value of its investment in CPC was about

$50 higher than the amount of underlying equity in CPC

net assets.

Star Petroleum Refining Company Ltd. Chevron has a 64 per-

cent equity ownership interest in Star Petroleum Refining

Company Limited (SPRC), which owns the Star Refinery

in Thailand. The Petroleum Authority of Thailand owns the

remaining 36 percent of SPRC.

Escravos Gas-to-Liquids Chevron Nigeria Limited (CNL) has

a 75 percent interest in Escravos Gas-to-Liquids (EGTL) with

the other 25 percent of the joint venture owned by Nigeria

National Petroleum Company. Sasol Ltd provides 50 percent

of the venture capital required by CNL as risk-based financing

(returns are based on project performance). This venture was

formed to convert natural gas produced from Chevron’s Niger-

ian operations into liquid products for sale in international

markets. At December 31, 2007, the company’s carrying value

of its investment in EGTL was about $25 lower than the

amount of underlying equity in EGTL net assets.

Caltex Australia Ltd Chevron has a 50 percent equity

owner ship interest in Caltex Australia Limited (CAL).

The remaining 50 percent of CAL is publicly owned. At

December 31, 2007, the fair value of Chevron’s share of

CAL common stock was approximately $2,294. The aggre-

gate carrying value of the company’s investment in CAL was

approximately $50 lower than the amount of underlying

equity in CAL net assets.

Notes to the Consolidated Financial Statements