Chevron 2007 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2007 Chevron annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

64

The trade receivable balances, reflecting the company’s

diver sified sources of revenue, are dispersed among the

company’s broad customer base worldwide. As a consequence,

the company believes concentrations of credit risk are limited.

The company routinely assesses the financial strength of its

customers. When the financial strength of a customer is not

considered sufficient, requiring Letters of Credit is a principal

method used to support sales to customers.

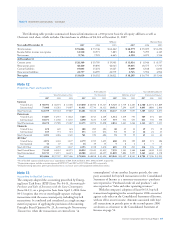

Although each subsidiary of Chevron is responsible for its

own affairs, Chevron Corporation manages its investments

in these subsidiaries and their affiliates. For this purpose,

the investments are grouped as follows: upstream – explora-

tion and production; downstream – refining, marketing and

transportation; chemicals; and all other. The first three of

these groupings represent the company’s “reportable segments”

and “operating segments” as defined in Financial Accounting

Standards Board (FASB) Statement No. 131, Disclosures About

Segments of an Enterprise and Related Information (FAS 131).

The segments are separately managed for investment

purposes under a structure that includes “segment managers”

who report to the company’s “chief operating decision maker”

(CODM) (terms as defined in FAS 131). The CODM is

the company’s Executive Committee, a committee of senior

officers that includes the Chief Executive Officer and that, in

turn, reports to the Board of Directors of Chevron Corporation.

The operating segments represent components of the

company as described in FAS 131 terms that engage in activi-

ties (a) from which revenues are earned and expenses are

incurred; (b) whose operating results are regularly reviewed

by the CODM, which makes decisions about resources to be

allocated to the segments and to assess their performance;

and (c) for which discrete financial information is available.

Segment managers for the reportable segments are

accountable directly to and maintain regular contact with the

company’s CODM to discuss the segment’s operating activities

and financial performance. The CODM approves annual

capital and exploratory budgets at the reportable segment level,

as well as reviews capital and exploratory funding for major

projects and approves major changes to the annual capital and

exploratory budgets. However, business-unit managers within

the operating segments are directly responsible for decisions

relating to project implementation and all other matters con-

nected with daily operations. Company officers who are

members of the Executive Committee also have individual

management responsibilities and participate in other commit-

tees for purposes other than acting as the CODM.

“All Other” activities include the company’s interest in

Dynegy (through May 2007, when Chevron sold its interest),

mining operations, power generation businesses, worldwide

The fair values of the outstanding contracts are reported

on the Consolidated Balance Sheet as “Accounts and notes

receivable” or “Accounts payable,” with gains and losses

reported as “Other income.”

Interest Rates The company enters into interest rate swaps as

part of its overall strategy to manage the interest rate risk on

its debt. Under the terms of the swaps, net cash settlements are

based on the difference between fixed-rate and floating-rate

interest amounts calculated by reference to agreed notional prin-

cipal amounts. Interest rate swaps related to a portion of the

company’s fixed-rate debt are accounted for as fair value hedges.

Fair values of the interest rate swaps are reported on the

Consolidated Balance Sheet as “Accounts and notes receiv-

able” or “Accounts payable.”

Fair Value Fair values are derived from quoted market prices,

other independent third-party quotes or, if not available, the

present value of the expected cash flows. The fair values reflect

the cash that would have been received or paid if the instru-

ments were settled at year-end.

Long-term debt of $2,132 and $5,131 had estimated

fair values of $2,325 and $5,621 at December 31, 2007 and

2006, respectively.

The company holds cash equivalents and marketable

securities in U.S. and non-U.S. portfolios. Eurodollar bonds,

floating-rate notes, time deposits and commercial paper are the

primary instruments held. Cash equivalents and marketable

securities had carrying/fair values of $5,427 and $9,200 at

Decem ber 31, 2007 and 2006, respectively. Of these balances,

$4,695 and $8,247 at the respective year-ends were classified as

cash equiv alents that had average maturities under 90 days.

The remainder, classified as marketable securities, had average

maturities of approximately one year. At December 31, 2007,

restricted cash with a carrying/fair value of $799 that is related

to capital-investment projects at the company’s Pascagoula,

Mississippi, refinery and Angola liquefied natural gas project

was reclassified from cash equivalents to a long-term deferred

asset on the Consolidated Balance Sheet. This restricted cash

was invested in short-term marketable securities.

Fair values of other financial and derivative instruments

at the end of 2007 and 2006 were not material.

Concentrations of Credit Risk The company’s financial instru-

ments that are exposed to concentrations of credit risk consist

primarily of its cash equivalents, marketable securities,

derivative financial instruments and trade receivables. The

company’s short-term investments are placed with a wide

array of financial institutions with high credit ratings. This

diversified investment policy limits the company’s exposure

both to credit risk and to concentrations of credit risk. Similar

standards of diversity and creditworthiness are applied to the

company’s counterparties in derivative instruments.

Notes to the Consolidated Financial Statements