Chevron 2007 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2007 Chevron annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

70

liquidity or financial position. The terms of this agreement are

confidential, and subject to further negotiation and approval,

including by the courts.

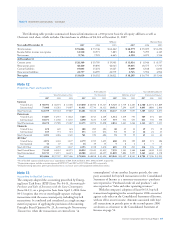

Income Taxes

Year ended December 31

2007 2006 2005

Taxes on income

U.S. Federal

Current $ 1,446 $ 2,828 $ 1,459

Deferred 225 200 567

State and local 338 581 409

Total United States 2,009 3,609 2,435

International

Current 11,416 11,030 7,837

Deferred 54 199 826

Total International 11,470 11,229 8,663

Total taxes on income $ 13,479 $ 14,838 $ 11,098

In 2007, before-tax income for U.S. operations,

including related corporate and other charges, was $7,794,

compared with before-tax income of $9,131 and $6,733 in

2006 and 2005, respectively. For international operations,

before-tax income was $24,373, $22,845 and $18,464 in

2007, 2006 and 2005, respectively. U.S. federal income tax

expense was reduced by $132, $116 and $289 in 2007, 2006

and 2005, respectively, for business tax credits.

The reconciliation between the U.S. statutory federal

income tax rate and the company’s effective income tax rate is

explained in the table below:

Year ended December 31

2007 2006 2005

U.S. statutory federal income tax rate 35.0% 35.0% 35.0%

Effect of income taxes from inter-

national operations at rates different

from the U.S. statutory rate 8.3 10.3 9.2

State and local taxes on income, net

of U.S. federal income tax benefit 0.8 1.0 1.0

Prior-year tax adjustments 0.3 0.9 0.1

Tax credits (0.4) (0.4) (1.1)

Effects of enacted changes in tax laws (0.3) 0.3 –

Other (1.8) (0.7) (0.1)

Effective tax rate 41.9% 46.4% 44.1%

The company’s effective tax rate decreased by 4.5 per-

cent in 2007 from the prior year. The 2 percent decrease

pertaining to the “Effect of income taxes from international

MTBE Chevron and many other companies in the petroleum

industry have used methyl tertiary butyl ether (MTBE) as

a gasoline additive. The company is a party to 88 lawsuits

and claims, the majority of which involve numerous other

petroleum marketers and refiners, related to the use of MTBE

in certain oxygenated gasolines and the alleged seepages of

MTBE into groundwater. Chevron has agreed in principle to

a tentative settlement of 60 pending lawsuits and claims. The

terms of this agreement, which must be approved by a num-

ber of parties, including the court, are confidential and not

material to the company’s results of operations, liquidity or

financial position.

Resolution of remaining lawsuits and claims may ulti-

mately require the company to correct or ameliorate the

alleged effects on the environment of prior release of MTBE

by the company or other parties. Additional lawsuits and

claims related to the use of MTBE, including personal-injury

claims, may be filed in the future. The tentative settlement of

the referenced 60 lawsuits did not set any precedents related

to standards of liability to be used to judge the merits of the

claims, corrective measures required or monetary damages to

be assessed for the remaining lawsuits and claims or future

lawsuits and claims. As a result, the company’s ultimate

exposure related to pending lawsuits and claims is not cur-

rently determinable, but could be material to net income in

any one period. The company no longer uses MTBE in the

manufacture of gasoline in the United States.

RFG Patent Fourteen purported class actions were brought

by consumers of reformulated gasoline (RFG) alleging that

Unocal misled the California Air Resources Board into

adopting standards for composition of RFG that overlapped

with Unocal’s undisclosed and pending patents. Eleven law-

suits were consolidated in U.S. District Court for the Central

District of California, where a class action has been certified,

and three were consolidated in a state court action. Unocal

is alleged to have monopolized, conspired and engaged in

unfair methods of competition, resulting in injury to con-

sumers of RFG. Plaintiffs in both consolidated actions seek

unspecified actual and punitive damages, attorneys’ fees, and

interest on behalf of an alleged class of consumers who pur-

chased “summertime” RFG in California from January 1995

through August 2005. The parties have reached a tentative

agreement to resolve all of the above matters in an amount

that is not material to the company’s results of operations,

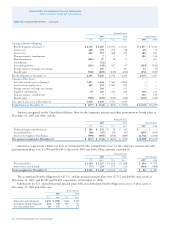

Notes to the Consolidated Financial Statements