Chevron 2007 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2007 Chevron annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

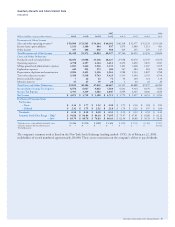

41

Direct Guarantee

Millions of dollars Commitment Expiration by Period

2009– After

Total 2008 2011 2012 2012

Guarantee of non-

consolidated affiliate or

joint-venture obligation $ 613 $ – $ – $ 38 $ 575

The company’s guarantee of approximately $600 mil-

lion is associated with certain payments under a terminal use

agreement entered into by a company affiliate. The terminal

is expected to be operational by 2012. Over the approximate

16-year term of the guarantee, the maximum guarantee

amount will reduce over time as certain fees are paid by the

affiliate. There are numerous cross-indemnity agreements

with the affiliate and the other partners to permit recovery of

any amounts paid under the guarantee. Chevron carries no

liability for its obligation under this guarantee.

Indemnifications The company provided certain indem-

nities of contingent liabilities of Equilon and Motiva to Shell

and Saudi Refining, Inc., in connection with the February

2002 sale of the company’s interests in those investments.

The company would be required to perform if the indemni-

fied liabilities become actual losses. Were that to occur, the

company could be required to make future payments up to

$300 million. Through the end of 2007, the company had

paid $48 million under these indemnities and continues to

be obligated for possible additional indemnification payments

in the future.

The company has also provided indemnities relating to

contingent environmental liabilities related to assets origi-

nally contributed by Texaco to the Equilon and Motiva joint

ventures and environmental conditions that existed prior to

the formation of Equilon and Motiva or that occurred dur-

ing the period of Texaco’s ownership interest in the joint

ventures. In general, the environmental conditions or events

that are subject to these indemnities must have arisen prior

to December 2001. Claims must be asserted no later than

February 2009 for Equilon indemnities and no later than

February 2012 for Motiva indemnities. Under the terms of

these indemnities, there is no maximum limit on the amount

of potential future payments. The company has not recorded

any liabilities for possible claims under these indemnities.

The company posts no assets as collateral and has made no

payments under the indemnities.

The amounts payable for the indemnities described above

are to be net of amounts recovered from insurance carriers

and others and net of liabilities recorded by Equilon or Motiva

prior to September 30, 2001, for any applicable incident.

In the acquisition of Unocal, the company assumed

certain indemnities relating to contingent environmental

liabilities associated with assets that were sold in 1997. Under

the indemnification agreement, the company’s liability

is unlimited until April 2022, when the indemnifica-

tion expires. The acquirer shares in certain environmental

Pension Obligations In 2007, the company’s pension plan

contributions were $317 million (approximately $78 million

to the U.S. plans). The company estimates contributions in

2008 will be approximately $500 million. Actual contribu-

tion amounts are dependent upon plan-investment results,

changes in pension obligations, regulatory requirements and

other economic factors. Additional funding may be required

if investment returns are insufficient to offset increases in

plan obligations. Refer also to the discussion of pension

accounting in “Critical Accounting Estimates and Assump-

tions,” beginning on page 46.

Financial Ratios

At December 31

2007 2006 2005

Current Ratio 1.2 1.3 1.4

Interest Coverage Ratio 69.2 53.5 47.5

Total Debt/Total Debt-Plus-Equity 8.6% 12.5% 17.0%

Current Ratio – current assets divided by current liabili-

ties. The current ratio in all periods was adversely affected by

the fact that Chevron’s inventories are valued on a Last-In,

First-Out basis. At year-end 2007, the book value of inventory

was lower than replacement costs, based on average acquisi-

tion costs during the year, by approximately $7 billion.

Interest Coverage Ratio – income before income tax

expense, plus interest and debt expense and amortization of

capitalized interest, divided

by before-tax interest costs.

The company’s interest

coverage ratio was higher

between 2007 and 2006 and

between 2006 and 2005,

primarily due to higher

before-tax income and lower

average debt balances in each

of the subsequent years.

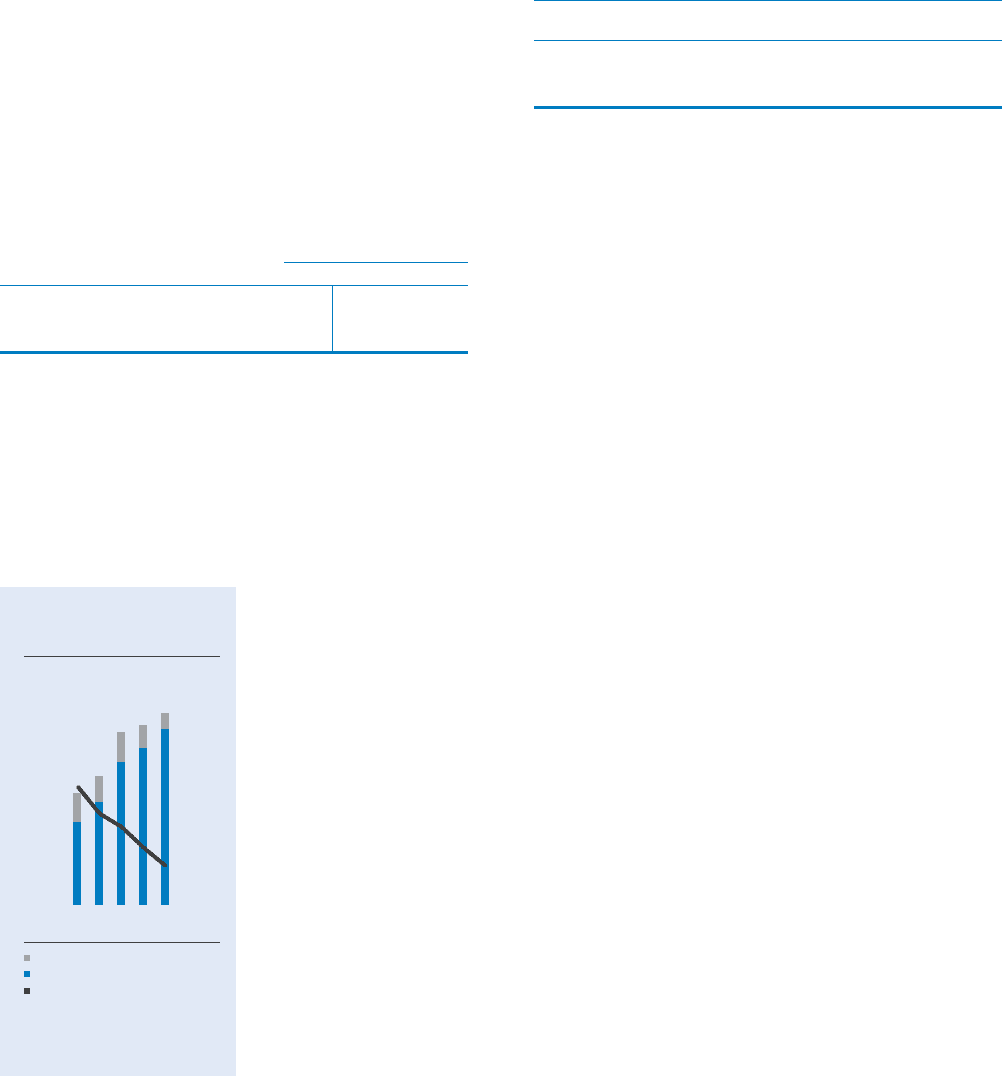

Debt Ratio – total debt

as a percentage of total debt

plus equity. The progressive

decrease between 2005 and

2007, was due to lower aver-

age debt levels and higher

stockholders’ equity balances.

'%'

(''%'

)'%'

-'%'

/'%'

+'%'

'

,'

+'

*'

)'

('

024 – Total Debt to Debt Plus

Equity Ratio – v2

Total Debt to Total

Debt-Plus-Equity Ratio

'+'* ', '- '.

/+%*