Chevron 2007 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2007 Chevron annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

80

Benefit Plan Trusts Texaco established a benefit plan trust

for funding obligations under some of its benefit plans. At

year-end 2007, the trust contained 14.2 million shares of

Chevron treasury stock. The company intends to continue to

pay its obligations under the benefit plans. The trust will sell

the shares or use the dividends from the shares to pay ben-

efits only to the extent that the company does not pay such

benefits. The trustee will vote the shares held in the trust as

instructed by the trust’s beneficiaries. The shares held in the

trust are not considered outstanding for earnings-per-share

purposes until distributed or sold by the trust in payment of

benefit obligations.

Unocal established various grantor trusts to fund obliga-

tions under some of its benefit plans, including the deferred

compensation and supplemental retirement plans. At Decem-

ber 31, 2007 and 2006, trust assets of $69 and $98, respec-

tively, were invested primarily in interest-earning accounts.

Employee Incentive Plans Chevron has two incentive plans,

the Management Incentive Plan (MIP) and the Long-Term

Incentive Plan (LTIP), for officers and other regular salaried

employees of the company and its subsidiaries who hold

positions of significant responsibility. MIP is an annual cash

incentive plan that links awards to performance results of the

prior year. The cash awards may be deferred by the recipients

by conversion to stock units or other investment fund alter-

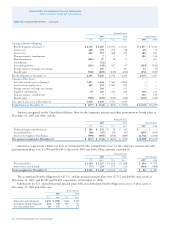

natives. Aggregate charges to expense for MIP were $184,

$180 and $155 in 2007, 2006 and 2005, respectively. Awards

under LTIP consist of stock options and other share-based

compensation that are described in Note 21 below.

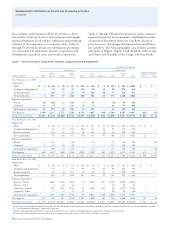

Through 2007 the company had a program that pro-

vided eligible employees, other than those covered by MIP

and LTIP, with an annual cash bonus if the company

achieves certain financial and safety goals. Charges for the

program were $431, $329 and $324 in 2007, 2006 and 2005,

respectively. Effective in 2008, this program was modified

to mirror the design of MIP and both were combined into a

single plan named the Chevron Incentive Plan (CIP).

Effective July 1, 2005, the company adopted the provisions of

Financial Accounting Standards Board (FASB) Statement No.

123R, Share-Based Payment (FAS 123R), for its share-based

compensation plans. The company previously accounted for

these plans under the recognition and measurement principles

of Accounting Principles Board Opinion No. 25, Accounting for

Stock Issued to Employees, and related interpretations and dis-

closure requirements established by FASB Statement No. 123,

Accounting for Stock-Based Compensation.

The company adopted FAS 123R using the modified pro-

spective method, and accordingly, results for prior periods were

not restated. Refer to Note 1, beginning on page 59, for the

pro forma effect on net income and earnings per share as if the

company had applied the fair-value recognition provisions of

FAS 123R for the full year 2005.

For 2007, 2006 and 2005, compensation expense for

stock options was $146 ($95 after tax), $125 ($81 after tax)

and $65 ($42 after tax), respectively. In addition, compensa-

tion expense for stock appreciation rights, performance units

and restricted stock units was $205 ($133 after tax), $113

($73 after tax) and $59 ($39 after tax) for 2007, 2006 and

2005, respectively. There were no significant stock-based

compensation costs that were capitalized at December 31,

2007 and 2006.

Cash received in payment for option exercises under all

share-based payment arrangements for 2007, 2006 and 2005

was $445, $444 and $297, respectively. Actual tax benefits

realized for the tax deductions from option exercises were

$94, $91 and $71 for 2007, 2006 and 2005, respectively.

Cash paid to settle performance units and stock apprecia-

tion rights was $88, $68 and $110 for 2007, 2006 and 2005,

respectively. Cash paid in 2005 included $73 for Unocal awards

paid under change-in-control plan provisions.

The company presents the tax benefits of deductions

from the exercise of stock options as financing cash inflows

in the Consolidated Statement of Cash Flows. In 2006, the

company implemented the transition method of FASB Staff

Position FAS 123R-3, Transition Election Related to Account-

ing for the Tax Effects of Share-Based Payment Awards, for

calculating the beginning balance of the pool of excess tax

benefits related to employee compensation and determining

the subsequent impact on the pool of employee awards that

were fully vested and outstanding upon the adoption of

FAS 123R. The company’s reported tax expense for the

period subsequent to the implementation of FAS 123R was

not affected by this election. Refer to Note 3, on page 62, for

information on excess tax benefits reported on the company’s

Statement of Cash Flows.

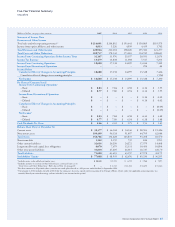

Chevron Long-Term Incentive Plan (LTIP) Awards under the

LTIP may take the form of, but are not limited to, stock

options, restricted stock, restricted stock units, stock appre-

ciation rights, performance units and nonstock grants. From

April 2004 through January 2014, no more than 160 mil-

lion shares may be issued under the LTIP, and no more than

64 million of those shares may be in a form other than a stock

option, stock appreciation right or award requiring full payment

for shares by the award recipient.

Stock options and stock appreciation rights granted

under the LTIP extend for 10 years from grant date. Effective

with options granted in June 2002, one-third of each award

vests on the first, second and third anniversaries of the date

of grant. Prior to this change, options vested one year after

Notes to the Consolidated Financial Statements