Chevron 2007 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2007 Chevron annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

55 55

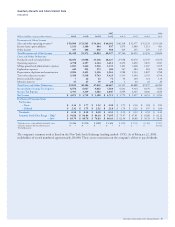

Consolidated Statement of Comprehensive Income

Year ended December 31

2007 2006 2005

Net Income $ 18,688 $ 17,138 $ 14,099

Currency translation adjustment

Unrealized net change arising during period 31 55 (5)

Unrealized holding gain (loss) on securities

Net gain (loss) arising during period 17 (88) (32)

Reclassification to net income of net realized loss 2 – –

T o t a l 19 (88) (32)

Derivatives

Net derivatives (loss) gain on hedge transactions (10) 2 (242)

Reclassification to net income of net realized loss 7 95 34

Income taxes on derivatives transactions (3) (30) 77

T o t a l (6) 67 (131)

Defined benefit plans

Minimum pension liability adjustment – (88) 89

Actuarial loss

Amortization to net income of net actuarial loss 356 – –

Actuarial gain arising during period 530 – –

Prior service cost

Amortization to net income of net prior service credits (15) – –

Prior service cost arising during period 204 – –

Nonsponsored defined benefit plans 19 – –

Income taxes on defined benefit plans (409) 50 (31)

T o t a l 685 (38) 58

Other Comprehensive Gain (Loss), Net of Tax 729 (4) (110)

Comprehensive Income $ 19,417 $ 17,134 $ 13,989

See accompanying Notes to the Consolidated Financial Statements.