Chevron 2007 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2007 Chevron annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Management’s Discussion and Analysis of

Financial Condition and Results of Operations

42

remediation costs up to a maximum obligation of $200 mil-

lion, which had not been reached as of December 31, 2007.

Securitization During 2007, the company completed the

sale of its U.S. proprietary consumer credit card business and

related receivables. This transaction included terminating

the qualifying Special Purpose Entity (SPE) that was used to

securitize associated retail accounts receivable.

Through the use of another qualifying SPE, the

company had $675 million of securitized trade accounts

receivable related to its downstream business as of December

31, 2007. This arrangement has the effect of accelerating

Chevron’s collection of the securitized amounts. Chevron’s

total estimated financial exposure under this securitization at

December 31, 2007, was $65 million. In the event that the

SPE experiences major defaults in the collection of receiv-

ables, Chevron believes that it would have no additional loss

exposure connected with third-party investments in this

securitization.

Minority Interests The company has commitments of

$204 million related to minority interests in subsidiary

companies.

Long-Term Unconditional Purchase Obligations and

Commitments, Including Throughput and Take-or-Pay Agree-

ments The company and its subsidiaries have certain other

contingent liabilities relating to long-term unconditional

purchase obligations and commitments, including throughput

and take-or-pay agreements, some of which relate to suppliers’

financing arrangements. The agreements typically provide

goods and services, such as pipeline and storage capacity,

drilling rigs, utilities, and petroleum products, to be used or

sold in the ordinary course of the company’s business. The

aggregate approximate amounts of required payments under

these various commitments are: 2008 – $4.7 billion;

2009 – $3.3 billion; 2010 – $3.3 billion; 2011 – $1.9 billion;

2012 – $1.3 billion; 2013 and after – $4.9 billion. A portion

of these commitments may ultimately be shared with project

partners. Total payments under the agreements were approxi-

mately $3.7 billion in 2007, $3.0 billion in 2006 and $2.1

billion in 2005.

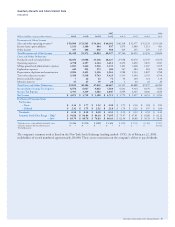

The following table summarizes the company’s significant

contractual obligations:

Contractual Obligations

Millions of dollars Payments Due by Period

2009– After

Total 2008 2011 2012 2012

On Balance Sheet:1

Short-Term Debt2 $ 1,162 $ 1,162 $ – $ – $ –

Long-Term Debt2 5,664 – 4,926 33 705

Noncancelable Capital

Lease Obligations 406 – 193 61 152

Interest 3,950 360 899 292 2,399

Off-Balance-Sheet:

Noncancelable Operating

Lease Obligations 3,167 513 1,255 293 1,106

Throughput and

Take-or-Pay Agreements 13,118 3,699 4,783 618 4,018

Other Unconditional

Purchase Obligations3 6,300 988 3,779 653 880

1 Does not include amounts related to the company’s income tax liabilities associated with

uncertain tax positions. The company is unable to make reasonable estimates for the

periods in which these liabilities may become due. The company does not expect settle-

ment of such liabilities will have a material effect on its results of operations, consolidated

financial position or liquidity in any single period.

2 $4.4. billion of short-term debt that the company expects to refinance is included in

long-term debt. The repayment schedule above reflects the projected repayment of the

entire amounts in the 2009–2011 period.

3 Does not include obligations to purchase the company’s share of natural gas liquids and

regasified natural gas associated with operations of the 36.4 percent-owned Angola LNG

affiliate. The LNG plant is expected to commence operations in 2012 and is designed to

produce 5.2 million metric tons of liquefied natural gas and related natural gas liquids

per year. Volumes and prices associated with these purchase obligations are neither fixed

nor determinable.

No material change in market risk occurred between 2006

and 2007 for the financial and derivative instruments dis-

cussed below. The hypothetical variances used in this section

were selected for illustrative purposes only and do not repre-

sent the company’s estimation of market changes. The actual

impact of future market changes could differ materially due

to factors discussed elsewhere in this report, including those

set forth under the heading “Risk Factors” in Part I, Item 1A,

of the company’s 2007 Annual Report on Form 10-K.

Commodity Derivative Instruments Chevron is exposed to

market risks related to the price volatility of crude oil, refined

products, natural gas, natural gas liquids, liquefied natural gas

and refinery feedstocks.

The company uses derivative commodity instruments to

manage these exposures on a portion of its activity, including

firm commitments and anticipated transactions for the pur-

chase, sale and storage of crude oil, refined products, natural

gas, natural gas liquids and feedstock for company refineries.

The company also uses derivative commodity instruments for

limited trading purposes. The results of this activity were not

material to the company’s financial position, net income or

cash flows in 2007.