Chevron 2007 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2007 Chevron annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

43

The company’s market exposure positions are moni-

tored and managed on a daily basis by an internal Risk

Control group to ensure compliance with the company’s risk

management policies that have been approved by the Audit

Committee of the company’s Board of Directors.

The derivative instruments used in the company’s risk

management and trading activities consist mainly of futures,

options and swap contracts traded on the NYMEX (New

York Mercantile Exchange) and on electronic platforms of

ICE (Inter-Continental Exchange) and GLOBEX (Chicago

Mercantile Exchange). In addition, crude oil, natural gas

and refined-product swap contracts and option contracts are

entered into principally with major financial institutions and

other oil and gas companies in the “over-the-counter” markets.

Virtually all derivatives beyond those designated as nor-

mal purchase and normal sale contracts are recorded at fair

value on the Consolidated Balance Sheet with resulting gains

and losses reflected in income. Fair values are derived prin-

cipally from published market quotes and other independent

third-party quotes.

Effective with 2007 year-end reporting, the company

changed the model used to quantify information about

market risk for its commodity derivatives from a “sensitivity

analysis” approach to Value-at-Risk (VaR). The major reason

for the change is that VaR allows estimation of a portfolio’s

aggregate market risk exposure and takes into account cor-

relations between trading assets. Therefore, it reflects risk

reduction due to diversification or hedging activities. Most

of the company’s market positions are time and commodity

spreads, and the company believes that VaR is a more accu-

rate tool to measure this type of exposure than the sensitivity

analysis model. The company fully developed and tested its

VaR model during 2007.

VaR is the maximum loss not to be exceeded within a

given probability or confidence level over a given period of

time. The company’s VaR model uses the Monte Carlo simu-

lation method that involves generating hypothetical scenarios

from the specified probability distribution and constructing a

full distribution of a potential portfolio’s values.

The VaR model utilizes an exponentially weighted

moving average for computing historical volatilities and cor-

relations, a 95 percent confidence level, and one-day holding

period. That is, the company’s 95 percent, one-day VaR cor-

responds to the unrealized loss in portfolio value that would

not be exceeded on average more than one in every 20 trad-

ing days, if the portfolio were held constant for one day.

The one-day holding period is based on the assump-

tion that market-risk positions can be liquidated or hedged

within one day. For hedging and risk management, the com-

pany uses conventional exchange-traded instruments such as

futures and options, as well as nonexchange-traded swaps,

most of which can be liquidated or hedged effectively within

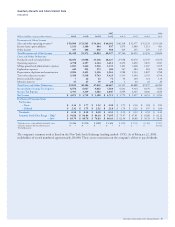

one day. The table below presents 95 percent/one-day VaR

for each of the company’s primary risk exposures in the area

of commodity derivative instruments at December 31, 2007:

Millions of dollars 2007

Crude Oil $ 29

Natural Gas 3

Refined Products 23

Sensitivity analysis for the company’s open commodity

derivative instruments at December 31, 2007, and Decem-

ber 31, 2006, based on a hypothetical 10 percent increase in

commodity prices, is provided in the following table:

Incremental Increase (Decrease) in Fair Value of Open Commodity

Derivative Contracts Assuming a Hypothetical Increase in

Year-End Commodity Prices of 10 Percent

Millions of dollars 2007 2006

Crude Oil $ (113) $ 4

Natural Gas 14 10

Refined Products (96) (30)

The same hypothetical decrease in prices of these com-

modities would result in approximately the same opposite effects

on the fair values of the contracts. The hypothetical effect on

these contracts was estimated by calculating the fair value of the

contracts as the difference between the hypothetical and current

market prices multiplied by the contract amounts.

The change in the amounts between years in the table

above for crude oil and refined products is associated with an

increase in commodity prices, volumes hedged and the use of

longer-term contracts.

Foreign Currency The company enters into forward

exchange contracts, generally with terms of 180 days or less,

to manage some of its foreign currency exposures. These expo-

sures include revenue and anticipated purchase transactions,

including foreign currency capital expenditures and lease com-

mitments, forecasted to occur within 180 days. The forward

exchange contracts are recorded at fair value on the balance

sheet with resulting gains and losses reflected in income.

The aggregate effect of a hypothetical 10 percent increase

in the value of the U.S. dollar at year-end 2007 would be a

reduction in the fair value of the foreign exchange contracts of

approximately $75 million. The effect would be the opposite

for a hypothetical 10 percent decrease in the value of the U.S.

dollar at year-end 2007.

Interest Rates The company enters into interest rate

swaps as part of its overall strategy to manage the interest

rate risk on its debt. Under the terms of the swaps, net cash

settlements are based on the difference between fixed-rate

and floating-rate interest amounts calculated by reference to

agreed notional principal amounts. Interest rate swaps related

to a portion of the company’s fixed-rate debt are accounted

for as fair value hedges. Interest rate swaps related to floating-

rate debt are recorded at fair value on the balance sheet with

resulting gains and losses reflected in income. At year-end

2007, the company had no interest-rate swaps on floating-

rate debt. At year-end 2007, the weighted average maturity

of “receive fixed” interest rate swaps was less than one year.

A hypothetical increase or decrease of 10 basis points in fixed

interest rates would have a de minimis impact on the fair

value of the “receive fixed” swaps.

Chevron enters into a number of business arrangements

with related parties, principally its equity affiliates. These

arrangements include long-term supply or offtake agree-

ments. Long-term purchase agreements are in place with the