Chevron 2007 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2007 Chevron annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

33

the crude-oil and product-supply functions and the economic

returns on invested capital. Profitability can also be affected

by the volatility of tanker charter rates for the company’s

shipping operations, which are driven by the industry’s

demand for crude oil and product tankers. Other factors

beyond the company’s control include the general level of

inflation and energy costs to operate the company’s refinery

and distribution network.

The company’s most significant marketing areas are the

West Coast of North America, the U.S. Gulf Coast, Latin

America, Asia, sub-Saharan Africa and the United Kingdom.

Chevron operates or has ownership interests in refineries

in each of these areas except Latin America. For the indus-

try, refined-product margins were generally higher in 2007

than in 2006. For the company, U.S. refined-product mar-

gins during 2007 were negatively affected by planned and

unplanned downtime at its three largest U.S. refineries.

Industry margins in the future may be volatile and

are influenced by changes in the price of crude oil used for

refinery feedstock and by changes in the supply and demand

for crude oil and refined products. The industry supply and

demand balance can be affected by disruptions at refineries

resulting from maintenance programs and unplanned out-

ages, including weather-related disruptions; refined-product

inventory levels; and geopolitical events.

Refer to pages 35 through 36 for additional discussion of

the company’s downstream operations.

Chemicals Earnings in the petrochemicals business are

closely tied to global chemical demand, industry inventory

levels and plant capacity utilization. Feedstock and fuel costs,

which tend to follow crude oil and natural gas price move-

ments, also influence earnings in this segment.

Refer to page 36 for

additional discussion of

chemicals earnings.

Key operating develop-

ments and other events

during 2007 and early 2008

included the following:

Upstream

Angola Discovered crude

oil at the 31 percent-owned

and operated Malange-1

well in offshore Block 14.

Additional drilling and

geologic and engineer-

ing studies are planned

to appraise the discovery.

The company and partners

also made the final invest-

ment decision to construct

a lique fied natural gas

(LNG) plant that will

be owned 36 percent by

Chevron. The plant will be

designed with a capacity to process 1 billion cubic feet of

natural gas per day and produce 5.2 million metric tons a

year of LNG and related gas liquids products.

Australia Received federal and state environmental

approvals for development of the 50 percent-owned and

operated Gorgon LNG project located off the northwest

coast. The approvals represented a significant milestone

toward the development of the company’s natural gas

resources offshore Australia.

Bangladesh Began production at the 98 percent-owned

Bibiyana natural gas field. The field’s total production is

expected to increase to a maximum of 500 million cubic feet

per day by 2010.

China Signed a 30-year production-sharing contract

with China National Petroleum Corporation to assume oper-

atorship and hold a 49 percent interest in the development of

the Chuandongbei natural gas area in central China. Design

input capacity of the proposed gas plants is expected to be

740 million cubic feet of natural gas per day.

Indonesia Began commercial operation of the 110-mega-

watt Darajat III geothermal power plant in Garut, West Java.

The plant increased Darajat’s total capacity to 259 megawatts.

Kazakhstan Initiated production from the first phase of

the Sour Gas Injection and Second Generation Plant expan-

sion projects at the 50 percent-owned Tengiz Field. This

phase increased production capacity by 90,000 barrels of

crude oil per day to approximately 400,000. Full facility

expansion is expected to occur during the second-half 2008,

increasing production capacity to 540,000 barrels per day.

Republic of the Congo Confirmed two crude oil discov-

eries in the offshore Moho-Bilondo permit. Evaluation and

development studies were undertaken to appraise the dis-

coveries, in which Chevron holds a 32 percent nonoperated

working interest.

Thailand Signed an agreement to increase sales of natural

gas from company-operated Blocks 10, 11, 12 and 13 in the

Gulf of Thailand to PTT Public Company Limited. Chevron

has ownership interests ranging from 60 percent to 80 percent

in the blocks, which received 10-year production-period exten-

sions to 2022. The company was also granted the concession

rights for a six-year period to four prospective offshore petro-

leum blocks, three of which it will operate.

Trinidad and Tobago Signed an agreement to sell natural

gas to the National Gas Company of Trinidad and Tobago

for 11 years with an option for a four-year extension. The gas

is expected to be sourced from Chevron’s 50 percent-owned

East Coast Marine Area.

United States Announced that first production from the

Tahiti project in the deepwater Gulf of Mexico is expected by

the third quarter 2009. The startup is approximately one year

later than originally planned due to metallurgical problems

with the mooring shackles for the floating production facility.

Downstream

Benelux Countries Sold the company’s 31 percent interest in the

Nerefco Refinery and related assets in the Netherlands, and the

company’s fuels marketing businesses in Belgium, Luxembourg

and the Netherlands, resulting in gains totaling $960 million.

'%'

()%'

-%'

0%'

*%'

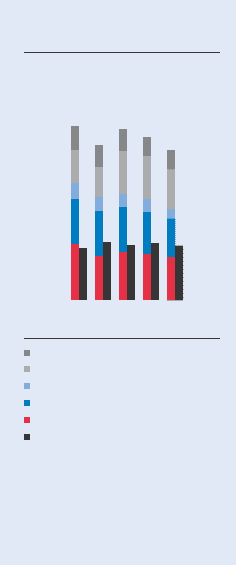

Net Proved Reserves

14A – Net Proved Reserves

front – v3

'+'* ', '- '.

.%0

)%0