Chevron 2007 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2007 Chevron annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Management’s Discussion and Analysis of

Financial Condition and Results of Operations

50

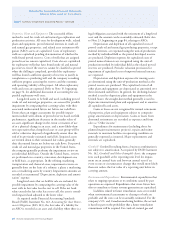

and nonfinancial liabilities, except those recognized or

disclosed at fair value in the financial statements on a recurring

basis (at least annually), until January 1, 2009. Implementation

of this standard did not have a material effect on the company’s

results of operations or consolidated financial position.

FASB Statement No. 159, The Fair Value Option for Finan-

cial Assets and Financial Liabilities − Including an amendment

of FASB Statement No. 115 (FAS 159) In February 2007,

the FASB issued FAS 159, which became effective for the

company on January 1, 2008. This standard permits com-

panies to choose to measure many financial instruments

and certain other items at fair value and report unrealized

gains and losses in earnings. Such accounting is optional

and is generally to be applied instrument by instrument.

The implementation of FAS 159 did not have a material

effect on the company’s results of operations or consolidated

financial position.

FASB Statement No. 141 (revised 2007), Business Combi-

nations (FAS 141-R) In December 2007, the FASB issued FAS

141-R, which will become effective for business combination

transactions having an acquisition date on or after January 1,

2009. This standard requires the acquiring entity in a business

combination to recognize the assets acquired, the liabilities

assumed, and any noncontrolling interest in the acquiree at

the acquisition date to be measured at their respective fair val-

ues. The Statement requires acquisition-related costs, as well

as restructuring costs the acquirer expects to incur for which

it is not obligated at acquisition date, to be recorded against

income rather than included in purchase-price determination.

It also requires recognition of contingent arrangements at their

acquisition-date fair values, with subsequent changes in fair

value generally reflected in income.

FASB Statement No. 160, Noncontrolling Interests in

Consolidated Financial Statements, an amendment of ARB

No. 51 (FAS 160) The FASB issued FAS 160 in December

2007, which will become effective for the company Janu-

ary 1, 2009, with retroactive adoption of the Statement’s

presentation and disclosure requirements for existing minor-

ity interests. This standard will require ownership interests

in subsidiaries held by parties other than the parent to be

presented within the equity section of the consolidated state-

ment of financial position but separate from the parent’s

equity. It will also require the amount of consolidated net

income attributable to the parent and the noncontrolling

interest to be clearly identified and presented on the face of

the consolidated income statement. Certain changes in a

parent’s ownership interest are to be accounted for as equity

transactions and when a subsidiary is deconsolidated, any

noncontrolling equity investment in the former subsidiary is

to be initially measured at fair value. The company does not

anticipate the implementation of FAS 160 will significantly

change the presentation of its consolidated income statement

or consolidated balance sheet.