Chevron 2007 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2007 Chevron annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

62

market purchases totaled $7,036, $5,033 and $3,029 in 2007,

2006 and 2005, respectively.

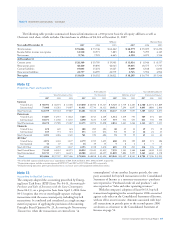

The major components of “Capital expenditures” and

the reconciliation of this amount to the reported capital and

exploratory expenditures, including equity affiliates, presented

in Management’s Discussion and Analysis, beginning on

page 30, are presented in the following table:

Year ended December 31

2007 2006 2005

Additions to properties, plant

and equipment* $ 16,127 $ 12,800 $ 8,154

Additions to investments 881 880 459

Current-year dry hole expenditures 418 400 198

Payments for other liabilities

and assets, net (748) (267) (110)

Capital expenditures 16,678 13,813 8,701

Expensed exploration expenditures 816 844 517

Assets acquired through capital

lease obligations and other

financing obligations 196 35 164

Capital and exploratory expenditures,

excluding equity affiliates 17,690 14,692 9,382

Equity in affiliates’ expenditures 2,336 1,919 1,681

Capital and exploratory expenditures,

including equity affiliates $ 20,026 $ 16,611 $ 11,063

*

Net of noncash additions of $3,560 in 2007, $440 in 2006 and $435 in 2005.

Chevron U.S.A. Inc. (CUSA) is a major subsidiary of

Chevron Corporation. CUSA and its subsidiaries manage

and operate most of Chevron’s U.S. businesses. Assets include

those related to the exploration and production of crude oil,

natural gas and natural gas liquids and those associated with

the refining, marketing, supply and distribution of products

derived from petroleum, other than natural gas liquids,

excluding most of the regulated pipeline operations of

Chevron. CUSA also holds Chevron’s investment in the

Chevron Phillips Chemical Company LLC (CPChem) joint

venture, which is accounted for using the equity method.

During 2007, Chevron implemented legal reorganizations

in which certain Chevron subsidiaries transferred assets to

or under CUSA. The summarized financial information for

CUSA and its consolidated subsidiaries presented in the table

on the following page gives retroactive effect to the reorganiza-

tions as if they had occurred on January 1, 2005. However, the

financial information on the following page may not reflect

the financial position and operating results in the periods pre-

sented if the reorganization actually had occurred on that date.

Year ended December 31

2007 2006 2005

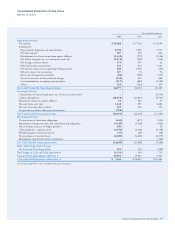

Net decrease (increase) in operating working

capital was composed of the following:

(Increase) decrease in accounts and

notes receivable $ (3,867) $ 17 $ (3,164)

Increase in inventories (749) (536) (968)

Increase in prepaid expenses and

other current assets (370) (31) (54)

Increase in accounts payable and

accrued liabilities 4,930 1,246 3,851

Increase in income and other

taxes payable 741 348 281

Net decrease (increase) in operating

working capital $ 685 $ 1,044 $ (54)

Net cash provided by operating

activities includes the following

cash payments for interest and

income taxes:

Interest paid on debt

(net of capitalized interest) $ 203 $ 470 $ 455

Income taxes $ 12,340 $ 13,806 $ 8,875

Net (purchases) sales of

marketable securities consisted

of the following gross amounts:

Marketable securities purchased $ (1,975) $ (1,271) $ (918)

Marketable securities sold 2,160 1,413 1,254

Net sales (purchases) of

marketable securities $ 185 $ 142 $ 336

The Consolidated Statement of Cash Flows does not

include noncash financing and investing activities. Refer to

Note 23, starting on page 84, for a discussion of revisions

to the company’s asset retirement obligations that did not

involve cash receipts or payments in 2007.

In accordance with the cash-flow classification require-

ments of FAS 123R, Share-Based Payment, the “Net decrease

(increase) in operating working capital” includes reductions

of $96 and $94 for excess income tax benefits associated with

stock options exercised during 2007 and 2006, respectively.

These amounts are offset by “Net purchases of treasury shares.”

The 2007 “Net purchases of other short-term investments”

consist of $799 in restricted cash associated with capital-

investment projects at the company’s Pascagoula, Mississippi,

refinery and Angola liquefied natural gas project that was

invested in short-term marketable securities and reclassified

from cash equivalents to a long-term deferred asset on the

Consolidated Balance Sheet. In December 2007, the company

issued a $650 tax exempt Mississippi Gulf Opportunity Zone

Bond as a source of funds for the Pascagoula Refinery project.

The “Net purchases of treasury shares” represents the cost

of common shares acquired in the open market less the cost

of shares issued for share-based compensation plans. Open-

Notes to the Consolidated Financial Statements