Chevron 2007 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2007 Chevron annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

71

operations …” was primarily due to the impact of asset sales

and to lower effective tax rates in certain non-U.S. opera-

tions. The 1 percent decrease in “Other” primarily relates to

the effects of asset sales in 2007.

The company records its deferred taxes on a tax-

jurisdiction basis and classifies those net amounts as current

or noncurrent based on the balance sheet classification of the

related assets or liabilities. The reported deferred tax balances

are composed of the following:

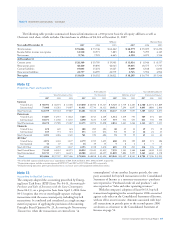

At December 31

2007 2006

Deferred tax liabilities

Properties, plant and equipment $ 17,310 $ 16,054

Investments and other 1,837 2,137

Total deferred tax liabilities 19,147 18,191

Deferred tax assets

Abandonment/environmental reserves (3,587) (2,925)

Employee benefits (2,148) (2,707)

Tax loss carryforwards (1,603) (1,509)

Capital losses – (246)

Deferred credits (1,689) (1,670)

Foreign tax credits (3,138) (1,916)

Inventory (608) (378)

Other accrued liabilities (477) (375)

Miscellaneous (1,528) (1,144)

Total deferred tax assets (14,778) (12,870)

Deferred tax assets valuation allowance 5,949 4,391

Total deferred taxes, net $ 10,318 $ 9,712

In 2007, deferred tax liabilities increased by approxi-

mately $1,000 from the amount reported in 2006. The

increase was primarily related to increased temporary differ-

ences for properties, plant and equipment.

Deferred tax assets increased by approximately $1,900

in 2007. The increase related primarily to additional foreign

tax credits arising from earnings in high-tax-rate international

jurisdictions. This increase was substantially offset by valua-

tion allowances.

The overall valuation allowance relates to foreign tax

credit carry forwards, tax loss carryforwards and temporary

differences for which no benefit is expected to be realized. Tax

loss carry forwards exist in many international jurisdictions.

Whereas some of these tax loss carry forwards do not have

an expiration date, others expire at various times from 2008

through 2029. Foreign tax credit carryforwards of $3,138

will expire between 2008 and 2017.

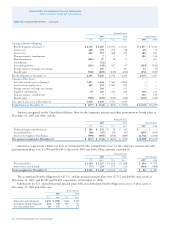

At December 31, 2007 and 2006, deferred taxes were

classified in the Consolidated Balance Sheet as follows:

At December 31

2007 2006

Prepaid expenses and other current assets $ (1,234) $ (1,167)

Deferred charges and other assets (812) (844)

Federal and other taxes on income 194 76

Noncurrent deferred income taxes 12,170 11,647

Total deferred income taxes, net $ 10,318 $ 9,712

Income taxes are not accrued for unremitted earnings

of international operations that have been or are intended

to be reinvested indefinitely. Undistributed earnings of inter-

national consolidated subsidiaries and affiliates for which

no deferred income tax provision has been made for possible

future remittances totaled $20,557 at December 31, 2007.

This amount represents earnings reinvested as part of the

company’s ongoing international business. It is not practica-

ble to estimate the amount of taxes that might be payable on

the eventual remittance of earnings that are intended to be

reinvested indefinitely. At the end of 2007, deferred income

taxes were recorded for the undistributed earnings of certain

international operations for which the company no longer

intends to indefinitely reinvest the earnings. The company

does not anticipate incurring significant additional taxes on

remittances of earnings that are not indefinitely reinvested.

Uncertain Income Tax Positions Effective January 1, 2007, the

company implemented Financial Accounting Standards Board

(FASB) Interpretation No. 48, Accounting for Uncertainty in

Income Taxes – An Interpretation of FASB Statement No. 109

(FIN 48), which clarifies the accounting for income tax benefits

that are uncertain in nature. This interpretation was intended

by the standard-setters to address the diversity in practice that

existed in this area of accounting for income taxes.

Under FIN 48, a company recognizes a tax benefit in

the financial statements for an uncertain tax position only if

management’s assessment is that the position is “more likely

than not” (i.e., a likelihood greater than 50 percent) to be

allowed by the tax jurisdiction based solely on the technical

merits of the position. The term “tax position” in FIN 48

refers to a position in a previously filed tax return or a

position expected to be taken in a future tax return that is

reflected in measuring current or deferred income tax assets

and liabilities for interim or annual periods. The accounting

interpretation also provides guidance on measurement meth-

odology, derecognition thresholds, financial statement

classification and disclosures, recognition of interest and

penalties, and accounting for the cumulative-effect adjust-

ment at the date of adoption. Upon adoption of FIN 48 on

January 1, 2007, the company recorded a cumulative-effect

adjustment that reduced retained earnings by $35.