Chevron 2007 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2007 Chevron annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

82

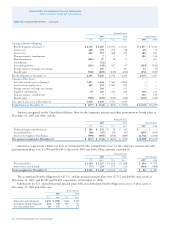

vesting provisions of the company’s share-based compensation

programs for awards issued after adoption of FAS 123R. As

of December 31, 2007, there was $160 of total unrecognized

before-tax compensation cost related to nonvested share-based

compensation arrangements granted or restored under the

plans. That cost is expected to be recognized over a weighted-

average period of two years.

At January 1, 2007, the number of LTIP performance

units outstanding was equivalent to 2,110,196 shares. Dur-

ing 2007, 931,200 units were granted, 784,364 units vested

with cash proceeds distributed to recipients and 32,017 units

were forfeited. At December 31, 2007, units outstanding

were 2,225,015, and the fair value of the liability recorded for

these instruments was $205. In addition, outstanding stock

appreciation rights and other awards that were granted under

various LTIP and former Texaco and Unocal programs totaled

approximately 1 million equivalent shares as of December 31,

2007. A liability of $38 was recorded for these awards.

Broad-Based Employee Stock Options In addition to the plans

described above, Chevron granted all eligible employees

stock options or equivalents in 1998. The options vested in

February 2000 and expired in February 2008. A total of

9,641,600 options were awarded with an exercise price of

$38.16 per share.

The fair value of each option on the date of grant was

estimated at $9.54 using the Black-Scholes model for the

preceding 10 years. The assumptions used in the model,

based on a 10-year average, were: a risk-free interest rate of

7 percent, a dividend yield of 4.2 percent, an expected life

of seven years and a volatility of 24.7 percent.

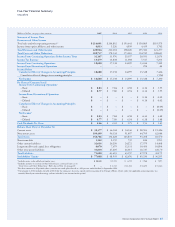

At January 1, 2007, the number of broad-based employee

stock options outstanding was 1,306,059. During 2007, exer-

cises of 637,044 shares and forfeitures of 16,300 shares reduced

outstanding options to 652,715. As of December 31, 2007,

these instruments had an aggregate intrinsic value of $36 and

the remaining contractual term of these options was 0.1 year.

The total intrinsic value of these options exercised during

2007, 2006 and 2005 was $30, $10 and $9, respectively.

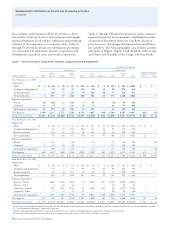

Income Taxes The company calculates its income tax expense

and liabilities quarterly. These liabilities generally are subject to

audit and are not finalized with the individual taxing authori-

ties until several years after the end of the annual period for

which income taxes have been calculated. Refer to Note 15

beginning on page 70 for a discussion of the periods for which

tax returns have been audited for the company’s major tax

jurisdictions and a discussion for all tax jurisdictions of the dif-

ferences between the amount of tax benefits recognized in the

financial statements and the amount taken or expected to be

taken in a tax return. The company does not expect settlement

of income tax liabilities associated with uncertain tax positions

will have a material effect on its results of operations, consoli-

dated financial position or liquidity.

Guarantees The company’s guarantee of approximately $600

is associated with certain payments under a terminal use

agreement entered into by a company affiliate. The terminal

is expected to be operational by 2012. Over the approximate

16-year term of the guarantee, the maximum guarantee

amount will reduce over time as certain fees are paid by the

affiliate. There are numerous cross-indemnity agreements

with the affiliate and the other partners to permit recovery of

any amounts paid under the guarantee. Chevron carries no

liability for its obligation under this guarantee.

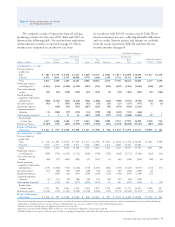

Indemnifications The company provided certain indemni-

ties of contingent liabilities of Equilon and Motiva to Shell

and Saudi Refining, Inc., in connection with the February

2002 sale of the company’s interests in those investments.

The company would be required to perform if the indemni-

fied liabilities become actual losses. Were that to occur, the

company could be required to make future payments up to

$300. Through the end of 2007, the company paid $48 under

these indemnities and continues to be obligated for possible

additional indemnification payments in the future.

The company has also provided indemnities relating to

contingent environmental liabilities related to assets origi-

nally contributed by Texaco to the Equilon and Motiva joint

ventures and environmental conditions that existed prior to

the formation of Equilon and Motiva or that occurred dur-

ing the period of Texaco’s ownership interest in the joint

ventures. In general, the environmental conditions or events

that are subject to these indemnities must have arisen prior

to December 2001. Claims must be asserted no later than

February 2009 for Equilon indemnities and no later than

February 2012 for Motiva indemnities. Under the terms of

these indemnities, there is no maximum limit on the amount

of potential future payments. The company has not recorded

any liabilities for possible claims under these indemnities.

The company posts no assets as collateral and has made no

payments under the indemnities.

The amounts payable for the indemnities described above

are to be net of amounts recovered from insurance carriers

and others and net of liabilities recorded by Equilon or Motiva

prior to September 30, 2001, for any applicable incident.

In the acquisition of Unocal, the company assumed

certain indemnities relating to contingent environmental

liabil ities associated with assets that were sold in 1997. Under

the indemnification agreement, the company’s liability

is unlimited until April 2022, when the indemnification

expires. The acquirer shares in certain environmental

remediation costs up to a maximum obligation of $200,

which had not been reached as of December 31, 2007.

Notes to the Consolidated Financial Statements