Chevron 2007 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2007 Chevron annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.2

To Our Stockholders

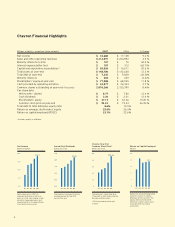

2007 was a year of significant achievement for our company. We reported record

earnings, led our peer group in total stockholder return and advanced our robust

queue of major capital projects, which are creating a strong foundation for

long-term growth. Most important, the people of Chevron performed superbly,

demonstrating the values and ingenuity that distinguish our company.

Net income of $18.7 billion represented a fourth

consecutive year of record earnings. Capital

and exploratory expenditures for the year were

$20 billion, and return on capital employed was

23.1 percent. We increased the annual dividend for

the 20th consecutive year and achieved a total

stockholder return of 30.5 percent, approximately

25 percentage points higher than the return

delivered by the S&P 500. We continued to return

cash to our stockholders through stock buyback

programs, purchasing $7 billion of our common

shares during 2007. In September, we initiated a

new program to acquire up to $15 billion of our

common shares over a period of up to three

years. We are committed to the capital discipline

necessary to create sustainable, long-term value

for our stockholders.

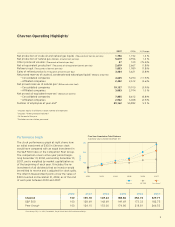

Achieving Milestones

In the upstream, we executed our strategy of man-

aging our base business profitably while advancing

new projects for future growth and returns. Our

base business, which is our daily crude oil and

natural gas production activities around the world,

generates the cash to fund our long-term growth.

We manage these assets with a strong focus on

world-class reservoir management, improved

recovery rates and continual innovation. Nowhere

is this more evident than in California’s San Joaquin

Valley, where the Kern River Field celebrated its

2 billionth barrel of production in late 2007. Kern

River began production in 1899 and through the

consistent application of innovative technology

continues to be a world-class asset.

Our exploration program, which is centered on

high-impact prospects in key basins, had a highly

successful year. We posted a 41 percent success

rate, adding approximately 1 billion barrels of poten-

tially recoverable oil and natural gas resources.

Major capital projects in the upstream reached

several milestones. The Agbami floating production,

storage and offloading vessel was completed and

was positioned in the deep water off Nigeria in early

2008. In 2007, the Bibiyana gas field in Bangladesh

began production, and we launched commercial

production from the 110-megawatt Darajat III geo-

thermal plant in Indonesia.

Chevron’s track record as a successful partner

helped us achieve a 10-year extension for produc-

ing natural gas in the Gulf of Thailand, which will

help realize our goal of increasing production

from this area to more than 1 billion cubic feet per

day. Our expertise in producing sour gas at the

Tengizchevroil project in Kazakhstan was a key

factor in our selection as a partner by the China

National Petroleum Corporation for the develop-

ment of the Chuandongbei natural gas area in

central China.

Our global downstream operations continue to

focus on increasing refinery flexibility, improving

reliability and creating new business opportunities.

We completed projects to increase the flexibil-

ity and capacity of two major refineries — in El

Segundo, California, and at our 50 percent-owned

Yeosu refinery complex in South Korea. The

downstream business also enhanced its focus on

profitable growth through the divestiture of sev-

eral nonstrategic assets.

Our 2007 safety performance showed signifi-

cant improvement, but we will never be satisfied

until we have reduced the number of safety-related

incidents to zero. We are absolutely committed to

achieving this goal.

Enhancing Technology and Capability

In the current business environment, companies

with superior ability to source and deploy technol-

ogy will build a sustainable competitive advantage.