Chevron 2007 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2007 Chevron annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

58 58

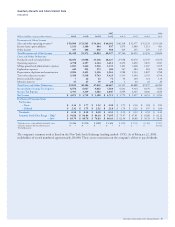

Consolidated Statement of Stockholders’ Equity

2007 2006 2005

Shares Amount Shares Amount Shares Amount

Preferred Stock – $ – – $ – – $ –

Common Stock

Balance at January 1 2,442,677 $ 1,832 2,442,677 $ 1,832 2,274,032 $ 1,706

Shares issued for Unocal acquisition – – – – 168,645 126

Balance at December 31 2,442,677 $ 1,832 2,442,677 $ 1,832 2,442,677 $ 1,832

Capital in Excess of Par

Balance at January 1 $ 14,126 $ 13,894 $ 4,160

Shares issued for Unocal acquisition – – 9,585

Treasury stock transactions 163 232 149

Balance at December 31 $ 14,289 $ 14,126 $ 13,894

Retained Earnings

Balance at January 1 $ 68,464 $ 55,738 $ 45,414

Net income 18,688 17,138 14,099

Cash dividends on common stock (4,791) (4,396) (3,778)

Adoption of EITF 04-6, “Accounting for Stripping Costs

Incurred during Production in the Mining Industry” – (19) –

Adoption of FIN 48, “Accounting for Uncertainty in Income Taxes” (35) – –

Tax benefit from dividends paid on

unallocated ESOP shares and other 3 3 3

Balance at December 31 $ 82,329 $ 68,464 $ 55,738

Notes Receivable – Key Employees $ (1) $ (2) $ (3)

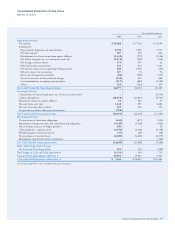

Accumulated Other Comprehensive Loss

Currency translation adjustment

Balance at January 1 $ (90) $ (145) $ (140)

Change during year 31 55 (5)

Balance at December 31 $ (59) $ (90) $ (145)

Pension and other postretirement benefit plans

Balance at January 1 $ (2,585) $ (344) $ (402)

Change to defined benefit plans during year 685 (38) 58

Adoption of FAS 158, “Employers’ Accounting for

Defined Benefit Pension and Other Postretirement Plans” (108) (2,203) –

Balance at December 31 $ (2,008) $ (2,585) $ (344)

Unrealized net holding gain on securities

Balance at January 1 $ – $ 88 $ 120

Change during year 19 (88) (32)

Balance at December 31 $ 19 $ – $ 88

Net derivatives gain (loss) on hedge transactions

Balance at January 1 $ 39 $ (28) $ 103

Change during year (6) 67 (131)

Balance at December 31 $ 33 $ 39 $ (28)

Balance at December 31 $ (2,015) $ (2,636) $ (429)

Deferred Compensation and Benefit Plan Trust

Deferred Compensation

Balance at January 1 $ (214) $ (246) $ (367)

Net reduction of ESOP debt and other – 32 121

Balance at December 31 (214) (214) (246)

Benefit Plan Trust (Common Stock) 14,168 (240) 14,168 (240) 14,168 (240)

Balance at December 31 14,168 $ (454) 14,168 $ (454) 14,168 $ (486)

Treasury Stock at Cost

Balance at January 1 278,118 $ (12,395) 209,990 $ (7,870) 166,912 $ (5,124)

Purchases 85,429 (7,036) 80,369 (5,033) 52,013 (3,029)

Issuances – mainly employee benefit plans (11,304) 539 (12,241) 508 (8,935) 283

Balance at December 31 352,243 $ (18,892) 278,118 $ (12,395) 209,990 $ (7,870)

Total Stockholders’ Equity at December 31 $ 77,088 $ 68,935 $ 62,676

See accompanying Notes to the Consolidated Financial Statements.