Allstate 2015 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2015 Allstate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The Allstate Corporation 2016 Proxy Statement 81

APPENDICES

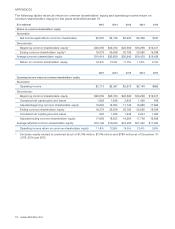

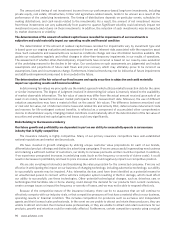

The following table reconciles the Property-Liability underlying combined ratio to the Property-Liability

combined ratio.

Twelve months ended

December 31,

2015 2014 2013 2012 2011

Combined ratio excluding the effect of catastrophes, prior

year reserve reestimates and amortization of purchased

intangible assets (“underlying combined ratio”) 88.7 87.2 87.3 87.2 89.3

Effect of catastrophe losses 5.7 6.9 4.5 8.8 14.7

Effect of prior year non‑catastrophe reserve reestimates 0.3 (0.4) (0.1) (1.0) (0.8)

Effect of amortization of purchased intangible assets 0.2 0.2 0.3 0.5 0.2

Combined ratio (“recorded combined ratio”) 94.9 93.9 92.0 95.5 103.4

Effect of prior year catastrophe reserve reestimates — 0.1 (0.3) (1.5) (0.5)

Underwriting margin is calculated as 100% minus the combined ratio.

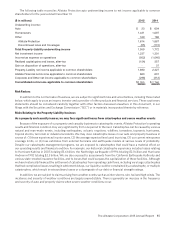

Operating income return on common shareholders’

equity is a ratio that uses a non-GAAP measure.

It is calculated by dividing the rolling 12-month

operating income by the average of common

shareholders’ equity at the beginning and at the

end of the 12-months, after excluding the effect of

unrealized net capital gains and losses. Return on

common shareholders’ equity is the most directly

comparable GAAP measure. We use operating

income as the numerator for the same reasons we

use operating income, as discussed above. We use

average common shareholders’ equity excluding

the effect of unrealized net capital gains and losses

for the denominator as a representation of common

shareholders’ equity primarily attributable to the

company’s earned and realized business operations

because it eliminates the effect of items that are

unrealized and vary significantly between periods

due to external economic developments such as

capital market conditions like changes in equity

prices and interest rates, the amount and timing of

which are unrelated to the insurance underwriting

process. We use it to supplement our evaluation of

net income applicable to common shareholders and

return on common shareholders’ equity because it

excludes the effect of items that tend to be highly

variable from period to period. We believe that this

measure is useful to investors and that it provides

a valuable tool for investors when considered

along with return on common shareholders’ equity

because it eliminates the after-tax effects of realized

and unrealized net capital gains and losses that

can fluctuate significantly from period to period

and that are driven by economic developments, the

magnitude and timing of which are generally not

influenced by management. In addition, it eliminates

non-recurring items that are not indicative of our

ongoing business or economic trends. A byproduct

of excluding the items noted above to determine

operating income return on common shareholders’

equity from return on common shareholders’ equity

is the transparency and understanding of their

significance to return on common shareholders’

equity variability and profitability while recognizing

these or similar items may recur in subsequent

periods. We use adjusted measures of operating

income return on common shareholders’ equity

in incentive compensation. Therefore, we believe

it is useful for investors to have operating income

return on common shareholders’ equity and return

on common shareholders’ equity when evaluating

our performance. We note that investors, financial

analysts, financial and business media organizations

and rating agencies utilize operating income

return on common shareholders’ equity results in

their evaluation of our and our industry’s financial

performance and in their investment decisions,

recommendations and communications as it

represents a reliable, representative and consistent

measurement of the industry and the company

and management’s utilization of capital. Operating

income return on common shareholders’ equity

should not be considered a substitute for return on

common shareholders’ equity and does not reflect

the overall profitability of our business.