Allstate 2015 Annual Report Download - page 102

Download and view the complete annual report

Please find page 102 of the 2015 Allstate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

96 www.allstate.com

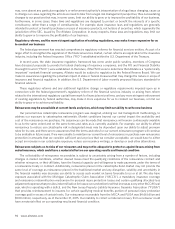

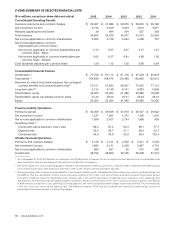

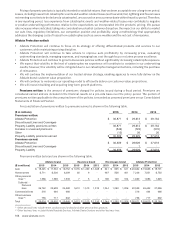

5-YEAR SUMMARY OF SELECTED FINANCIAL DATA

($ in millions, except per share data and ratios) 2015 2014 2013 2012 2011

Consolidated Operating Results

Insurance premiums and contract charges $ 32,467 $ 31,086 $ 29,970 $ 28,978 $ 28,180

Net investment income 3,156 3,459 3,943 4,010 3,971

Realized capital gains and losses 30 694 594 327 503

Total revenues 35,653 35,239 34,507 33,315 32,654

Net income applicable to common shareholders 2,055 2,746 2,263 2,306 787

Net income applicable to common

shareholders per common share:

Net income applicable to common shareholders per

common share ‑ Basic

5.12 6.37 4.87 4.71 1.51

Net income applicable to common shareholders per

common share ‑ Diluted

5.05 6.27 4.81 4.68 1.50

Cash dividends declared per common share 1.20 1.12 1.00 0.88 0.84

Consolidated Financial Position

Investments (1) $ 77,758 $ 81,113 $ 81,155 $ 97,278 $ 95,618

Total assets (2) 104,656 108,479 123,460 126,893 125,513

Reserves for claims and claims expense, life‑contingent

contract benefits and contractholder funds(1) 57,411 57,832 58,547 75,502 77,113

Long‑term debt (2) 5,124 5,140 6,141 6,003 5,858

Shareholders’ equity 20,025 22,304 21,480 20,580 18,298

Shareholders’ equity per diluted common share 47.34 48.24 45.31 42.39 36.18

Equity 20,025 22,304 21,480 20,580 18,326

Property-Liability Operations

Premiums earned $ 30,309 $ 28,929 $ 27,618 $ 26,737 $ 25,942

Net investment income 1,237 1,301 1,375 1,326 1,201

Net income applicable to common shareholders 1,690 2,427 2,754 1,968 403

Operating ratios (3)

Claims and claims expense (“loss”) ratio 69.4 67.2 64.9 69.1 77.7

Expense ratio 25.5 26.7 27.1 26.4 25.7

Combined ratio 94.9 93.9 92.0 95.5 103.4

Allstate Financial Operations

Premiums and contract charges $ 2,158 $ 2,157 $ 2,352 $ 2,241 $ 2,238

Net investment income 1,884 2,131 2,538 2,647 2,716

Net income applicable to common shareholders 663 631 95 541 590

Investments 36,792 38,809 39,105 56,999 57,373

(1) As of December31, 2013, $11.98 billion of investments and $12.84 billion of reserves for life-contingent contract benefits and contractholder funds

were classified as held for sale relating to the sale of Lincoln Benefit Life Company.

(2) Due to the adoption of new accounting guidance related to the presentation of debt issuance costs, long-term debt is reported net of debt issuance

costs. Debt issuance costs were previously reported in other assets. All prior periods have been adjusted.

(3) We use operating ratios to measure the profitability of our Property-Liability results. We believe that they enhance an investor’s understanding of our

profitability. They are calculated as follows: Claims and claims expense (“loss”) ratio is the ratio of claims and claims expense to premiums earned.

Loss ratios include the impact of catastrophe losses. Expense ratio is the ratio of amortization of deferred policy acquisition costs, operating costs

and expenses, and restructuring and related charges to premiums earned. Combined ratio is the ratio of claims and claims expense, amortization

of deferred policy acquisition costs, operating costs and expenses, and restructuring and related charges to premiums earned. The combined ratio

is the sum of the loss ratio and the expense ratio. The difference between 100% and the combined ratio represents underwriting income as a

percentage of premiums earned, or underwriting margin.