Allstate 2015 Annual Report Download - page 112

Download and view the complete annual report

Please find page 112 of the 2015 Allstate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

106 www.allstate.com

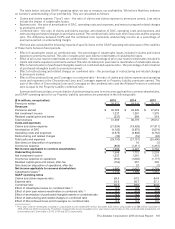

Auto premiums written totaled $20.66 billion in 2015, a 5.1% increase from $19.67 billion in 2014, following a 5.2%

increase in 2014 from $18.70 billion in 2013.

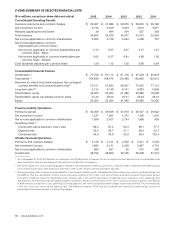

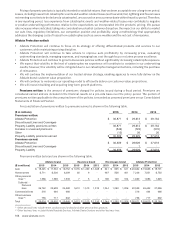

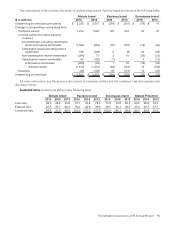

Allstate brand Esurance brand Encompass brand

2015 2014 2013 2015 2014 2013 2015 2014 2013

PIF (thousands) 20,326 19,916 19,362 1,415 1,424 1,286 723 790 774

Average premium (1) $ 492 $ 479 $ 468 $ 516 $ 499 $ 485 $ 945 $ 895 $ 880

Renewal ratio (%) 88.6 88.9 88.6 79.5 79.5 80.7 77.3 79.7 78.7

Approved rate changes (2):

# of locations 50 (6) 46 (6) 39 37 38 31 30 29 29

Total brand (%) (3) 5.3 2.3 1.9 7.1 6.0 4.8 9.4 6.6 5.9

Location specific (%) (4)(5) 7.6 3.2 3.2 9.3 6.9 6.5 11.1 7.9 7.0

(1) Policy term is six months for Allstate and Esurance brands and twelve months for Encompass brand.

(2) Rate changes that are indicated based on loss trend analysis to achieve a targeted return will continue to be pursued. Rate changes do not include

rating plan enhancements, including the introduction of discounts and surcharges that result in no change in the overall rate level in the state. These

rate changes do not reflect initial rates filed for insurance subsidiaries initially writing business in a state. Rate changes for Allstate brand for the 2013

period exclude Canada and specialty auto.

(3) Represents the impact in the states and Canadian provinces where rate changes were approved during the period as a percentage of total brand prior

year-end premiums written.

(4) Represents the impact in the states and Canadian provinces where rate changes were approved during the period as a percentage of its respective

total prior year-end premiums written in those same locations.

(5) Allstate brand operates in 50 states, the District of Columbia, and 5 Canadian provinces. Esurance brand operates in 43 states and 1 Canadian

province. Encompass brand operates in 40 states and the District of Columbia. Based on historical premiums written in those states and Canadian

provinces, rate changes approved for auto totaled $1.11 billion, $520million and $379million in 2015, 2014 and 2013, respectively.

(6) 2015 and 2014 includes 5 and 4 Canadian provinces, respectively, and the District of Columbia.

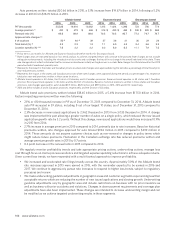

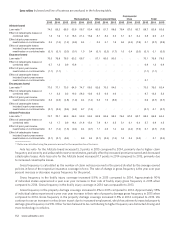

Allstate brand auto premiums written totaled $18.45 billion in 2015, a 5.4% increase from $17.50 billion in 2014.

Factors impacting premiums written were the following:

• 2.1% or 410 thousand increase in PIF as of December 31, 2015 compared to December 31, 2014. Allstate brand

auto PIF increased in 39 states, including 8 out of our largest 10 states, as of December 31, 2015 compared to

December 31, 2014.

• 2.3% decrease in new issued applications to 2,962 thousand in 2015 from 3,033thousand in 2014. A change

was implemented this year allowing a greater number of autos on a single policy, which reduced the new issued

application growth rate by 3.2 points. Without this change, new issued applications would have increased 0.9%

in 2015 from 2014.

• 2.7% increase in average premium in 2015 compared to 2014, primarily due to rate increases. Based on historical

premiums written, rate changes approved for auto totaled $942 million in 2015 compared to $399 million in

2014. These amounts do not assume customer choices such as non-renewal or changes in policy terms which

might reduce future premiums. Fluctuation in the Canadian exchange rate has reduced premiums written and

average premium growth rates in 2015 by 0.7 points.

• 0.3 point decrease in the renewal ratio in 2015 compared to 2014.

We regularly monitor profitability trends and take appropriate pricing actions, underwriting actions, manage loss

cost through focus on claims process excellence and targeted expense spending reductions to achieve adequate returns.

Given current loss trends, we have responded with a multi-faceted approach to improve profitability.

• We increased and accelerated rate filings broadly across the country. Approximately 30% of the Allstate brand

rate increases approved in 2015 were earned in 2015, with the remainder expected to be earned in 2016 and

2017. We continue to aggressively pursue rate increases to respond to higher loss trends, subject to regulatory

processes and review.

• We made underwriting guideline adjustments in geographic areas and customer segments experiencing less than

acceptable returns which are reducing the number of new issued applications and slowing growth. Underwriting

guideline adjustments vary by geographic area and include restrictions on business with no prior insurance as

well as business with prior accidents and violations. Changes in down payment requirements and coverage plan

adjustments have also been implemented. These changes are intended to increase underwriting margin and can

be modified as we achieve targeted underwriting results in these segments.