Allstate 2015 Annual Report Download - page 118

Download and view the complete annual report

Please find page 118 of the 2015 Allstate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

112 www.allstate.com

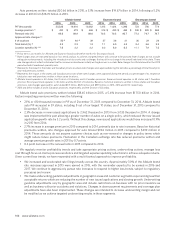

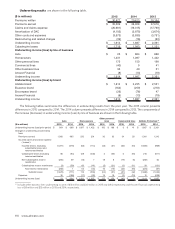

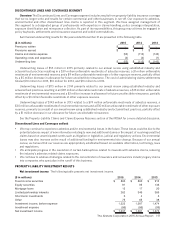

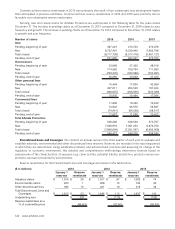

Loss ratios by brand and line of business are analyzed in the following table.

Auto Homeowners Other personal lines

Commercial

lines Total

2015 2014 2013 2015 2014 2013 2015 2014 2013 2015 2014 2013 2015 2014 2013

Allstate brand

Loss ratio (1) 74.5 69.2 68.5 55.6 58.7 53.4 60.9 61.7 58.6 78.4 67.0 60.7 68.7 65.8 63.6

Effect of catastrophe losses on

combined ratio 1.3 1.6 1.0 18.3 21.4 15.6 8.1 8.2 3.5 5.1 6.1 0.4 5.8 6.9 4.7

Effect of prior year reserve

reestimates on combined ratio 0.2 (1.2) (1.2) (0.3) 0.4 — 0.5 2.1 1.8 0.4 (4.2) (7.9) 0.1 (0.7) (0.9)

Effect of catastrophe losses

included in prior year reserve

reestimates on combined ratio (0.1) (0.1) (0.3) (0.1) 1.0 0.4 (0.1) (0.2) (1.7) 1.0 0.4 (2.0) (0.1) 0.1 (0.3)

Esurance brand

Loss ratio (1) 75.3 76.8 78.5 63.2 66.7 — 57.1 60.0 50.0 — — — 75.1 76.8 78.5

Effect of catastrophe losses on

combined ratio 0.7 1.3 0.9 15.8 — — — — — — — — 0.9 1.3 0.9

Effect of prior year reserve

reestimates on combined ratio (1.1) (1.1) — — — — — — — — — — (1.1) (1.1) —

Effect of catastrophe losses

included in prior year reserve

reestimates on combined ratio — — — — — — — — — — — — 0.1 — —

Encompass brand

Loss ratio (1) 77.0 77.1 73.5 64.9 74.7 56.3 92.6 75.5 54.0 — — — 73.5 76.0 65.4

Effect of catastrophe losses on

combined ratio 1.1 3.2 0.3 19.3 28.2 12.6 6.5 6.6 4.0 — — — 8.7 13.2 5.2

Effect of prior year reserve

reestimates on combined ratio 0.3 (2.0) (4.8) (1.0) 0.4 (1.2) 9.3 1.9 (8.0) — — — 0.6 (0.7) (3.7)

Effect of catastrophe losses

included in prior year reserve

reestimates on combined ratio (0.1) (0.2) (0.5) (0.2) 0.7 (1.3) — — — — — — (0.1) 0.1 (0.7)

Allstate Protection

Loss ratio (1) 74.7 70.1 69.3 56.3 59.9 53.5 62.9 62.6 58.2 78.4 67.0 60.7 69.2 66.8 64.4

Effect of catastrophe losses on

combined ratio 1.2 1.7 0.9 18.4 21.8 15.4 7.9 8.1 3.5 5.1 6.1 0.4 5.7 6.9 4.5

Effect of prior year reserve

reestimates on combined ratio 0.1 (1.2) (1.3) (0.4) 0.4 (0.1) 1.1 2.0 1.2 0.4 (4.2) (7.9) 0.1 (0.7) (1.0)

Effect of catastrophe losses

included in prior year reserve

reestimates on combined ratio (0.1) (0.1) (0.4) — 0.9 0.3 (0.1) (0.3) (1.5) 1.0 0.4 (2.0) — 0.1 (0.3)

(1) Ratios are calculated using the premiums earned for the respective line of business.

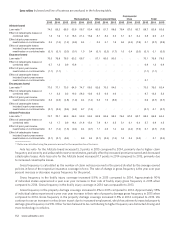

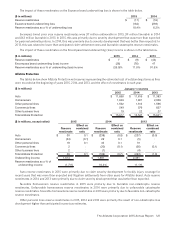

Auto loss ratio for the Allstate brand increased 5.3 points in 2015 compared to 2014, primarily due to higher claim

frequency and severity and unfavorable reserve reestimates, partially offset by increased premiums earned and decreased

catastrophe losses. Auto loss ratio for the Allstate brand increased 0.7 points in 2014 compared to 2013, primarily due

to increased catastrophe losses.

Gross frequency is calculated as the number of claim notices received in the period divided by the average earned

policies in force of the respective insurance coverage in force. The rate of change in gross frequency is the year over year

percent increase or decrease in gross frequency for the period.

Gross frequency in the bodily injury coverage increased 5.9% in 2015 compared to 2014. Approximately 90%

of individual states experienced a year over year increase in their rate of bodily injury gross frequency in 2015 when

compared to 2014. Gross frequency in the bodily injury coverage in 2014 was comparable to 2013.

Gross frequency in the property damage coverage increased 6.3% in 2015 compared to 2014. Approximately 95%

of individual states experienced a year over year increase in their rate of property damage gross frequency in 2015 when

compared to 2014. Gross frequency in the property damage coverage increased 0.5% in 2014 compared to 2013. We

continue to see an increase in miles driven in part due to increased employment, which has adversely impacted property

damage gross frequency in 2015. Other factors believed to be contributing to higher frequency are distracted driving and

more technology in vehicles.