Allstate 2015 Annual Report Download - page 160

Download and view the complete annual report

Please find page 160 of the 2015 Allstate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.154 www.allstate.com

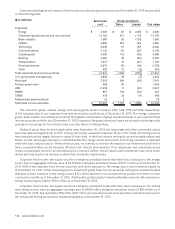

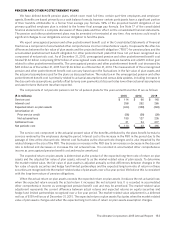

Amortization of net actuarial loss in pension cost is recorded when the net actuarial loss excluding the unamortized

market-related value adjustment exceeds 10% of the greater of the PBO or the market-related value of plan assets. The

amount of amortization is equal to the excess divided by the average remaining service period for active employees for

each plan, which approximates 10 years for Allstate’s largest plan. As a result, the effect of changes in the PBO due to

changes in the discount rate and changes in the fair value of plan assets may be experienced in our net periodic pension

cost in periods subsequent to those in which the fluctuations actually occur.

Net actuarial loss fluctuates as the discount rate fluctuates, as the actual return on plan assets differ from the expected

long-term rate of return on plans assets, and as actual plan experience differs from other actuarial assumptions. Net

actuarial loss related to changes in the discount rate will change when interest rates change and from amortization of net

actuarial loss when there is an excess sufficient to qualify for amortization. Net actuarial loss related to changes in the

fair value of plan assets will change when plan assets change in fair value and when there is an excess sufficient to qualify

for amortization. Other net actuarial loss will change over time due to changes in other valuation assumptions and the

plan participants or when there is an excess sufficient to qualify for amortization.

An increase in the discount rate decreased the net actuarial loss by $465 million in 2015, a decrease in the discount

rate increased the net actuarial loss by $576 million in 2014, and an increase in the discount rate decreased the net

actuarial loss by $593 million in 2013. The difference between actual and expected returns on plan assets increased

the net actuarial loss by $466 million in 2015 and decreased the loss by $144 million and $172 million in 2014, and

2013, respectively.

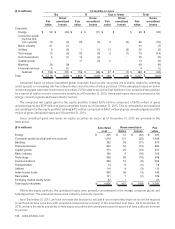

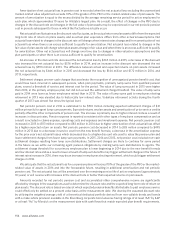

Settlement charges are non-cash charges that accelerate the recognition of unrecognized pension benefit cost, that

would have been incurred in subsequent periods, when plan payments, primarily lump sums from qualified pension

plans, exceed a threshold of service and interest cost for the period. The value of lump sums paid in 2015 were higher

than 2014, in the primary employee plan, but did not exceed the settlement charge threshold. The value of lump sums

paid in 2014 were lower as fewer employees retired than in 2013. The value of lump sums paid to employees electing

retirement in 2013 was elevated due to historically low interest rates. Voluntary retirement activity during the fourth

quarter of 2013 was almost five times the typical level.

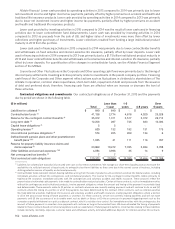

Net periodic pension cost in 2016 is estimated to be $150 million including expected settlement charges of $31

million primarily for agent lump sum payments. Expected returns on plan assets and amortization of prior service credits

partially offset the other components of pension cost. The increase is primarily due to higher interest costs as a result of

increases in discount rates. Pension expense is reported consistent with other types of employee compensation and as

a result is included in claims expense, operating costs and expenses and investment expense. Net periodic pension cost

increased in 2015 to $113 million compared to $83 million in 2014 due to higher amortization of net actuarial loss offset

by a higher expected return on assets. Net periodic pension cost decreased in 2014 to $83 million compared to $495

million in 2013 due to a decrease in service cost from the new benefit formula, a decrease in the amortization expense

for the prior year’s net actuarial losses which decreased due to a higher discount rate used to value the pension plan and

lower settlement charges from fewer lump sum payments. In 2015, 2014 and 2013, net pension cost included non-cash

settlement charges resulting from lump sum distributions. Settlement charges are likely to continue for some period

in the future as we settle our remaining agent pension obligations by making lump sum distributions to agents. The

settlement charge threshold for our primary employee plan is lower beginning in 2014 due to the new benefit formula

and low interest rates and as a result a lower amount of lump sum benefits may trigger settlement charges in the future. If

interest rates increase in 2016, there may be an increase in employees electing retirement, which could trigger settlement

charges in 2016.

We anticipate that the net actuarial loss for our pension plans will exceed 10% of the greater of the PBO or the market-

related value of assets in 2016 and into the foreseeable future, resulting in additional amortization and net periodic

pension cost. The net actuarial loss will be amortized over the remaining service life of active employees (approximately

10 years) or will reverse with increases in the discount rate or better than expected returns on plan assets.

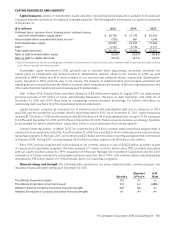

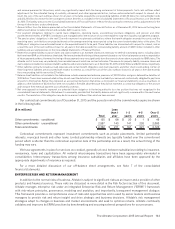

Amounts recorded for net periodic pension cost and accumulated other comprehensive income are significantly

affected by changes in the assumptions used to determine the discount rate and the expected long-term rate of return on

plan assets. The discount rate is based on rates at which expected pension benefits attributable to past employee service

could effectively be settled on a present value basis at the measurement date. We develop the assumed discount rate

by utilizing the weighted average yield of a theoretical dedicated portfolio derived from non-callable bonds and bonds

with a make-whole provision available in the Bloomberg corporate bond universe having ratings of at least “AA” by S&P

or at least “Aa” by Moody’s on the measurement date with cash flows that match expected plan benefit requirements.