Allstate 2015 Annual Report Download - page 150

Download and view the complete annual report

Please find page 150 of the 2015 Allstate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

144 www.allstate.com

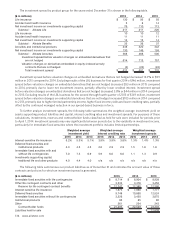

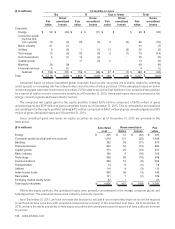

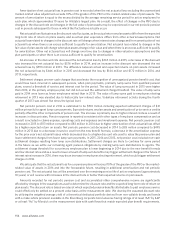

Gross unrealized gains and losses on fixed income securities by type and sector as of December 31, 2015 are provided

in the following table.

($ in millions) Amortized

cost

Gross unrealized

Fair valueGains Losses

Corporate:

Energy $ 4,549 $ 52 $ (345) $ 4,256

Consumer goods (cyclical and non‑cyclical) 12,103 210 (119) 12,194

Basic industry 1,880 28 (103) 1,805

Utilities 4,605 323 (64) 4,864

Technology 3,040 37 (57) 3,020

Communications 3,132 64 (57) 3,139

Capital goods 4,023 112 (46) 4,089

Banking 3,462 39 (42) 3,459

Transportation 1,677 73 (27) 1,723

Financial services 2,673 63 (16) 2,720

Other 530 31 (3) 558

Total corporate fixed income portfolio 41,674 1,032 (879) 41,827

U.S. government and agencies 3,836 90 (4) 3,922

Municipal 7,032 389 (20) 7,401

Foreign government 983 50 — 1,033

ABS 2,359 11 (43) 2,327

RMBS 857 100 (10) 947

CMBS 438 32 (4) 466

Redeemable preferred stock 22 3 — 25

Total fixed income securities $ 57,201 $ 1,707 $ (960) $ 57,948

The consumer goods, utilities, energy and capital goods sectors comprise 29%, 12%, 10% and 10%, respectively,

of the carrying value of our corporate fixed income securities portfolio as of December 31, 2015. The energy, consumer

goods, basic industry and utilities sectors had the highest concentration of gross unrealized losses in our corporate fixed

income securities portfolio as of December 31, 2015. In general, the gross unrealized losses are related to widening credit

spreads or increasing risk-free interest rates since the time of initial purchase.

Global oil prices have declined significantly since September 30, 2014 and natural gas and other commodity values

have also declined significantly in 2015. Among commodity exposed companies, those in the metal and mining sectors

have experienced the largest decline in values of their debt. In the fixed income and equity securities tables above and

below, oil and natural gas exposure is reflected within the energy sector and metals and mining exposure is reflected

within the basic industry sector. Within these sectors, we continue to monitor the impact to our investment portfolio for

those companies that may be adversely affected, both directly and indirectly. If oil, natural gas and commodity prices

remain at depressed levels for an extended period or decline further, certain issuers and investments may come under

duress and may result in an increase in other-than-temporary impairments.

Corporate fixed income and equity securities with gross unrealized losses that have direct exposure to the energy

sector, have an aggregate carrying value of $3.15 billion and gross unrealized losses of $377 million as of December 31,

2015. 83% of the corporate fixed income securities with direct exposure to the energy sector were investment grade as

of December 31, 2015. Of the remaining below investment grade fixed income securities with gross unrealized losses

that have a direct exposure to the energy sector, $35 million had been in an unrealized loss position for twelve or more

consecutive months as of December 31, 2015. Additionally, private equity limited partnership interests with exposure to

energy totaled approximately $350 million as of December 31, 2015.

Corporate fixed income and equity securities with gross unrealized losses that have direct exposure to the metals

and mining sectors, have an aggregate carrying value of $468 million and gross unrealized losses of $81 million as of

December 31, 2015. Approximately 55% of the $437 million of corporate fixed income securities with direct exposure to

the metals and mining sectors were investment grade as of December 31, 2015.