Allstate 2015 Annual Report Download - page 225

Download and view the complete annual report

Please find page 225 of the 2015 Allstate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The Allstate Corporation 2015 Annual Report 219

level. Credit-risk-contingent cross-default provisions allow the counterparties to terminate the derivative agreement if

the Company defaults by pre-determined threshold amounts on certain debt instruments. Credit-risk-contingent credit

support annex agreements specify the amount of collateral the Company must post to counterparties based on AIC’s,

ALIC’s or ALNY’s financial strength credit ratings by Moody’s or S&P, or in the event AIC, ALIC or ALNY are no longer

rated by either Moody’s or S&P.

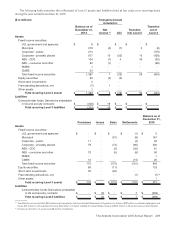

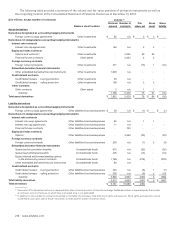

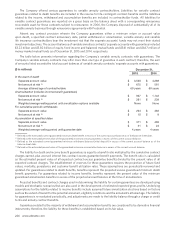

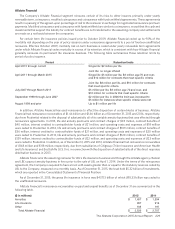

The following summarizes the fair value of derivative instruments with termination, cross-default or collateral credit-

risk-contingent features that are in a liability position as of December31, as well as the fair value of assets and collateral

that are netted against the liability in accordance with provisions within legally enforceable MNAs.

($ in millions) 2015 2014

Gross liability fair value of contracts containing credit‑risk‑contingent features $ 21 $ 16

Gross asset fair value of contracts containing credit‑risk‑contingent features

and subject to MNAs (3) (4)

Collateral posted under MNAs for contracts containing credit‑risk‑contingent features (13) (7)

Maximum amount of additional exposure for contracts with credit‑risk‑contingent features if all

features were triggered concurrently $ 5 $ 5

Credit derivatives– selling protection

Free-standing credit default swaps (“CDS”) are utilized for selling credit protection against a specified credit event.

A credit default swap is a derivative instrument, representing an agreement between two parties to exchange the credit

risk of a specified entity (or a group of entities), or an index based on the credit risk of a group of entities (all commonly

referred to as the “reference entity” or a portfolio of “reference entities”), in return for a periodic premium. In selling

protection, CDS are used to replicate fixed income securities and to complement the cash market when credit exposure

to certain issuers is not available or when the derivative alternative is less expensive than the cash market alternative.

CDS typically have a five-year term.

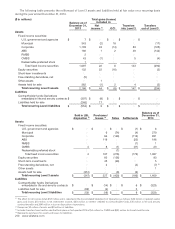

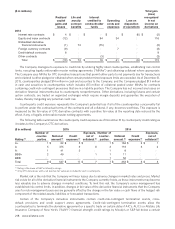

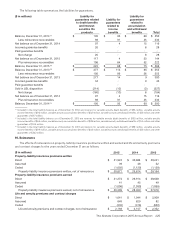

The following table shows the CDS notional amounts by credit rating and fair value of protection sold.

($ in millions) Notional amount

AA A BBB

BB and

lower Total

Fair

value

December 31, 2015

Single name

Corporate debt $ 20 $ 10 $ 45 $ — $ 75 $ 1

First-to-default Basket

Municipal — — 100 — 100 (8)

Index

Corporate debt 1 20 52 7 80 1

Total $21 $ 30 $ 197 $ 7 $ 255 $ (6)

December 31, 2014

Single name

Corporate debt $ 20 $ 15 $ 90 $ — $ 125 $ 1

First-to-default Basket

Municipal — 100 — — 100 (9)

Index

Corporate debt — 22 52 6 80 2

Total $20 $ 137 $ 142 $ 6 $ 305 $ (6)

In selling protection with CDS, the Company sells credit protection on an identified single name, a basket of names

in a first-to-default (“FTD”) structure or credit derivative index (“CDX”) that is generally investment grade, and in return

receives periodic premiums through expiration or termination of the agreement. With single name CDS, this premium

or credit spread generally corresponds to the difference between the yield on the reference entity’s public fixed maturity

cash instruments and swap rates at the time the agreement is executed. With a FTD basket, because of the additional

credit risk inherent in a basket of named reference entities, the premium generally corresponds to a high proportion of

the sum of the credit spreads of the names in the basket and the correlation between the names. CDX is utilized to take

a position on multiple (generally 125) reference entities. Credit events are typically defined as bankruptcy, failure to pay,