Allstate 2015 Annual Report Download - page 232

Download and view the complete annual report

Please find page 232 of the 2015 Allstate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.226 www.allstate.com

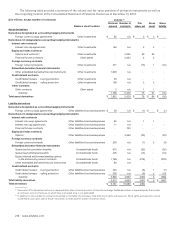

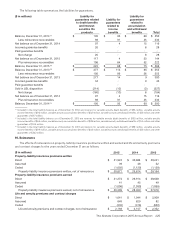

Property-Liability

The Company purchases reinsurance after evaluating the financial condition of the reinsurer, as well as the terms

and price of coverage. Developments in the insurance and reinsurance industries have fostered a movement to segregate

asbestos, environmental and other discontinued lines exposures into separate legal entities with dedicated capital.

Regulatory bodies in certain cases have supported these actions. The Company is unable to determine the impact, if any,

that these developments will have on the collectability of reinsurance recoverables in the future.

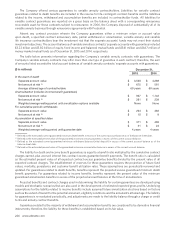

Property-Liability reinsurance recoverable

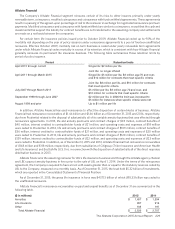

Total amounts recoverable from reinsurers as of December31, 2015 and 2014 were $5.98 billion and $5.78 billion,

respectively, including $86 million and $89 million, respectively, related to property-liability losses paid by the Company

and billed to reinsurers, and $5.89 billion and $5.69 billion, respectively, estimated by the Company with respect to

ceded unpaid losses (including IBNR), which are not billable until the losses are paid.

With the exception of the recoverable balances from the Michigan Catastrophic Claims Association (“MCCA”),

Lloyd’s of London, New Jersey Property-Liability Insurance Guaranty Association (“PLIGA”) and other industry pools and

facilities, the largest reinsurance recoverable balance the Company had outstanding was $62 million and $65 million from

Westport Insurance Corporation as of December31, 2015 and 2014, respectively. No other amount due or estimated to

be due from any single property-liability reinsurer was in excess of $32 million and $34 million as of December31, 2015

and 2014, respectively.

The allowance for uncollectible reinsurance was $80 million and $95 million as of December31, 2015 and 2014,

respectively, and is primarily related to the Company’s Discontinued Lines and Coverages segment.

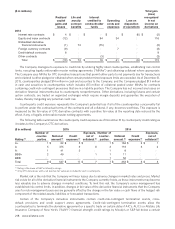

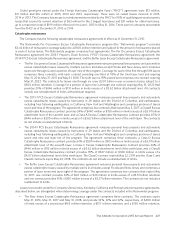

Industry pools and facilities

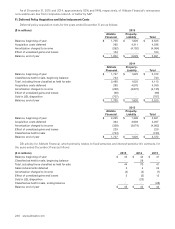

Reinsurance recoverable on paid and unpaid claims including IBNR as of December31, 2015 and 2014 includes $4.66

billion and $4.42 billion, respectively, from the MCCA. The MCCA is a mandatory insurance coverage and reinsurance

indemnification mechanism for personal injury protection losses that provides indemnification for losses over a retention

level that increases every other MCCA fiscal year. The retention level is $545 thousand per claim for the fiscal two-years

ending June30, 2017 compared to $530 thousand per claim for the fiscal two-years ending June 30, 2015. The MCCA

is obligated to fund the ultimate liability for participating member companies qualifying claims and claims expenses.

The MCCA operates similar to a reinsurance program and is funded by participating member companies through a

per vehicle annual assessment. The MCCA has been legally authorized to assess participating member companies

pursuant to enabling legislation that provides for annual determination and assessment. This assessment is included

in the premiums charged to the Company’s customers and when collected, the Company remits the assessment to the

MCCA. These assessments provide funds for the indemnification for losses described above. The MCCA is required

to assess an amount each year sufficient to cover lifetime claims of all persons catastrophically injured in that year,

its operating expenses, and adjustments for the amount of excesses or deficiencies in prior assessments. The MCCA

prepares statutory-basis financial statements in conformity with accounting practices prescribed or permitted by the

State of Michigan Department of Insurance and Financial Services (“MI DOI”). The MI DOI has granted the MCCA a

statutory permitted practice that expires in June of 2016 to discount its liabilities for loss and loss adjustment expense.

As of June30, 2015, the date of its most recent annual financial report, the permitted practice reduced the MCCA’s

accumulated deficit by $50.64 billion to $691 million.

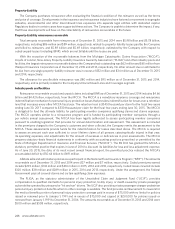

Allstate sells and administers policies as a participant in the National Flood Insurance Program (“NFIP”). The amounts

recoverable as of December31, 2015 and 2014 were $27 million and $7 million, respectively. Ceded premiums earned

include $293 million, $312 million and $316 million in 2015, 2014 and 2013, respectively. Ceded losses incurred include

$120 million, $38 million and $289 million in 2015, 2014 and 2013, respectively. Under the arrangement, the Federal

Government pays all covered claims and certain qualifying claim expenses.

The PLIGA, as the statutory administrator of the Unsatisfied Claim and Judgment Fund (“UCJF”), provides

compensation to qualified claimants for personal injury protection, bodily injury, or death caused by private passenger

automobiles operated by uninsured or “hit and run” drivers. The UCJF also provides private passenger stranger pedestrian

personal injury protection benefits when no other coverage is available. The fund provides reimbursement to insurers for

the medical benefits portion of personal injury protection coverage paid in excess of $75,000 with no limits for policies

issued or renewed prior to January1, 1991 and in excess of $75,000 and capped at $250,000 for policies issued or

renewed from January1, 1991 to December31, 2004. The amounts recoverable as of December31, 2015 and 2014 were

$500 million and $508 million, respectively.