Allstate 2015 Annual Report Download - page 121

Download and view the complete annual report

Please find page 121 of the 2015 Allstate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The Allstate Corporation 2015 Annual Report 115

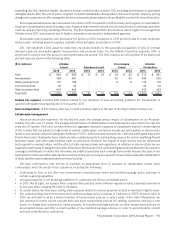

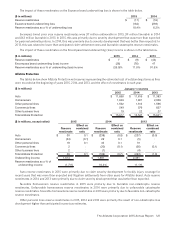

expanding into the Canadian market. Esurance’s annual combined ratio is below 100, excluding amortization of purchased

intangible assets, after the year of policy inception (in which substantially all acquisition costs are incurred), driven by pricing

changes and customer mix. We manage the direct to consumer business based on its profitability over the life-time of the policy.

Encompass brand expense ratio decreased 1.6 points in 2015 compared to 2014 primarily due to agency compensation,

employee compensation and technology costs. Expense improvement actions include reductions in technology and other

costs, as well as improving operating efficiency. The Encompass brand DAC amortization rate is higher on average than

Allstate brand DAC amortization due to higher commission rates paid to independent agencies.

Encompass brand expense ratio decreased 0.4 points in 2014 compared to 2013 primarily due to lower employee

related costs, including pension expense, partially offset by higher amortization of DAC.

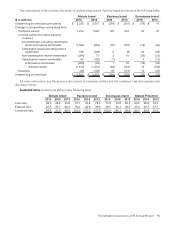

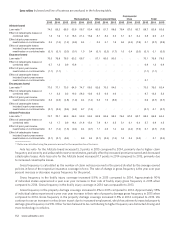

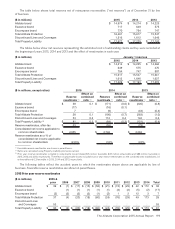

DAC We establish a DAC asset for costs that are related directly to the successful acquisition of new or renewal

insurance policies, principally agents’ remuneration and premium taxes. For the Allstate Protection business, DAC is

amortized to income over the period in which premiums are earned. The DAC balance as of December31 by brand and

product type are shown in the following table.

($ in millions) Allstate

brand Esurance brand

Encompass

brand

Allstate

Protection

2015 2014 2015 2014 2015 2014 2015 2014

Auto $ 644 $ 609 $ 10 $ 10 $ 59 $ 62 $ 713 $ 681

Homeowners 504 491 — — 42 43 546 534

Other personal lines 110 109 — — 8 9 118 118

Commercial lines 33 34 — — — — 33 34

Other business lines 619 453 — — — — 619 453

Total DAC $ 1,910 $ 1,696 $ 10 $ 10 $ 109 $ 114 $ 2,029 $ 1,820

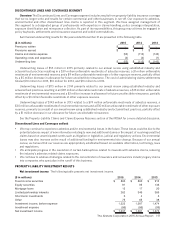

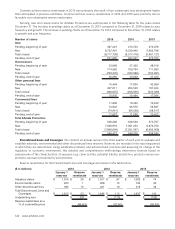

Income tax expense included $28 million related to our adoption of new accounting guidance for investments in

qualified affordable housing projects in first quarter 2015.

Gain on disposition of $37million, after-tax, in 2014 primarily relates to the sale of Sterling Collision Centers,Inc.

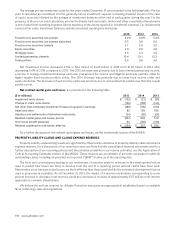

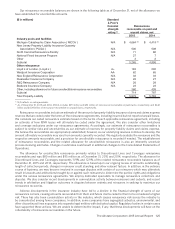

Catastrophe management

Historical catastrophe experience For the last ten years, the average annual impact of catastrophes on our Property-

Liability loss ratio was 7.7 points. The average annual impact of catastrophes on the homeowners loss ratio for the last ten

years was 31.1 points. Over time, we have limited our aggregate insurance exposure to catastrophe losses in certain regions

of the country that are subject to high levels of natural catastrophes. Limitations include our participation in various state

facilities, such as the California Earthquake Authority (“CEA”), which provides insurance for California earthquake losses; the

Florida Hurricane Catastrophe Fund, which provides reimbursements to participating insurers for certain qualifying Florida

hurricane losses; and other state facilities, such as wind pools. However, the impact of these actions may be diminished

by the growth in insured values, and the effect of state insurance laws and regulations. In addition, in various states we are

required to participate in assigned risk plans, reinsurance facilities and joint underwriting associations that provide insurance

coverage to individuals or entities that otherwise are unable to purchase such coverage from private insurers. Because of our

participation in these and other state facilities such as wind pools, we may be exposed to losses that surpass the capitalization

of these facilities and to assessments from these facilities.

We have continued to take actions to maintain an appropriate level of exposure to catastrophic events while

continuing to meet the needs of our customers, including the following:

• Continuing to limit or not offer new homeowners, manufactured home and landlord package policy business in

certain coastal geographies.

• Increased capacity in our brokerage platform for customers not offered an Allstate policy.

• In 2015, North Light, our surplus lines company that operates under different regulatory rules, expanded operations

to one new state, bringing the total to 43 states.

• In certain states, we have been ceding wind exposure related to insured property located in wind pool eligible areas.

• We ceased writing new homeowners and landlord package policy business in California in 2007; however, later in

2016 we will start to write a limited number of homeowners policies in select areas of the state. Meanwhile, we

will continue to renew current policyholders and allow replacement policies for existing customers who buy a new

home, or change their residence to rental property. For landlord package policies we allow replacement policies on

an exception basis, and offer a small number of new landlord package policies in order to accommodate current

personal umbrella policy customers.