Allstate 2015 Annual Report Download - page 137

Download and view the complete annual report

Please find page 137 of the 2015 Allstate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The Allstate Corporation 2015 Annual Report 131

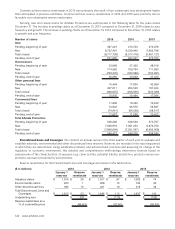

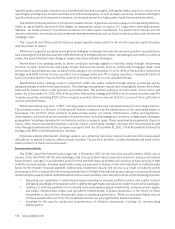

Total premiums and contract charges increased $1 million in 2015 compared to 2014. Excluding results of the LBL

business for first quarter 2014 of $85 million, premiums and contract charges increased $86 million in 2015 compared to

2014, primarily due to growth in Allstate Benefits accident and health insurance business as well as increased traditional

life insurance renewal premiums. The growth at Allstate Benefits primarily relates to accident, critical illness and hospital

indemnity products.

Total premiums and contract charges decreased 8.3% or $195 million in 2014 compared to 2013. Excluding results

of the LBL business for second through fourth quarter 2013 of $254 million, premiums and contract charges increased

$59 million in 2014 compared to 2013, primarily due to growth in Allstate Benefits accident and health insurance business

and increased traditional life insurance premiums due to higher renewals and sales through Allstate agencies, partially

offset by lower premiums on immediate annuities with life contingencies due to discontinuing new sales January 1, 2014.

The growth at Allstate Benefits primarily relates to accident and critical illness products and an increase in the number

of employer groups.

Contractholder funds represent interest-bearing liabilities arising from the sale of products such as interest-sensitive

life insurance, fixed annuities and funding agreements. The balance of contractholder funds is equal to the cumulative

deposits received and interest credited to the contractholder less cumulative contract benefits, surrenders, withdrawals,

maturities and contract charges for mortality or administrative expenses.

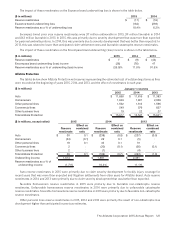

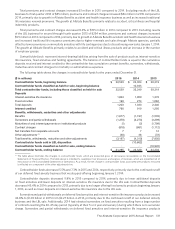

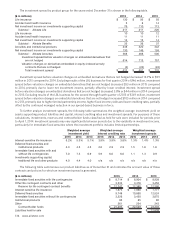

The following table shows the changes in contractholder funds for the years ended December 31.

($ in millions) 2015 2014 2013

Contractholder funds, beginning balance $ 22,529 $ 24,304 $ 39,319

Contractholder funds classified as held for sale, beginning balance — 10,945 —

Total contractholder funds, including those classified as held for sale 22,529 35,249 39,319

Deposits

Interest‑sensitive life insurance 1,004 1,059 1,378

Fixed annuities 199 274 1,062

Total deposits 1,203 1,333 2,440

Interest credited 760 919 1,295

Benefits, withdrawals, maturities and other adjustments

Benefits (1,077) (1,197) (1,535)

Surrenders and partial withdrawals (1,278) (2,273) (3,299)

Maturities of and interest payments on institutional products (1) (2) (1,799)

Contract charges (818) (881) (1,112)

Net transfers from separate accounts 7 7 12

Other adjustments (1) (30) 36 (72)

Total benefits, withdrawals, maturities and other adjustments (3,197) (4,310) (7,805)

Contractholder funds sold in LBL disposition — (10,662) —

Contractholder funds classified as held for sale, ending balance — — (10,945)

Contractholder funds, ending balance $ 21,295 $ 22,529 $ 24,304

(1) The table above illustrates the changes in contractholder funds, which are presented gross of reinsurance recoverables on the Consolidated

Statements of Financial Position. The table above is intended to supplement our discussion and analysis of revenues, which are presented net of

reinsurance on the Consolidated Statements of Operations. As a result, the net change in contractholder funds associated with products reinsured

is reflected as a component of the other adjustments line.

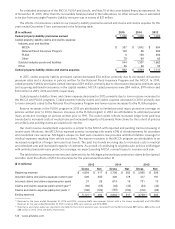

Contractholder funds decreased 5.5% and 7.3% in 2015 and 2014, respectively, primarily due to the continued runoff

of our deferred fixed annuity business that we stopped offering beginning January 1, 2014.

Contractholder deposits decreased 9.8% in 2015 compared to 2014, primarily due to lower additional deposits

on fixed annuities and lower deposits on interest-sensitive life insurance due to the LBL sale. Contractholder deposits

decreased 45.4% in 2014 compared to 2013, primarily due to no longer offering fixed annuity products beginning January

1, 2014, as well as lower deposits on interest-sensitive life insurance due to the LBL sale.

Surrenders and partial withdrawals on deferred fixed annuities and interest-sensitive life insurance products decreased

43.8% to $1.28 billion in 2015 from $2.27 billion in 2014, primarily due to the continued runoff of our deferred annuity

business and the LBL sale. Additionally, 2014 had elevated surrenders on fixed annuities resulting from a large number

of contracts reaching the 30-45 day period (typically at their 5 or 6 year anniversary) during which there is no surrender

charge. Surrenders and partial withdrawals on deferred fixed annuities and interest-sensitive life insurance products