Allstate 2015 Annual Report Download - page 139

Download and view the complete annual report

Please find page 139 of the 2015 Allstate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The Allstate Corporation 2015 Annual Report 133

For further discussion of realized capital gains and losses, see the Investments section of the MD&A.

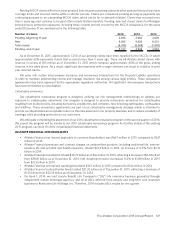

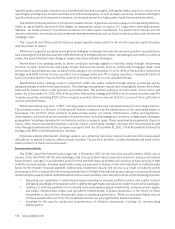

Analysis of costs and expenses Total costs and expenses decreased 3.3% or $114 million in 2015 compared to 2014.

Excluding results of the LBL business for first quarter 2014 of $168 million, total costs and expenses increased $54 million

in 2015 compared to 2014, primarily due to higher life and annuity contract benefits, partially offset by lower interest

credited to contractholder funds. Total costs and expenses decreased 16.7% or $683 million in 2014 compared to 2013.

Excluding results of the LBL business for second through fourth quarter 2013 of $475 million, total costs and expenses

decreased $208 million in 2014 compared to 2013, primarily due to lower interest credited to contractholder funds, lower

operating costs and expenses and lower amortization of DAC, partially offset by higher life and annuity contract benefits.

Life and annuity contract benefits increased 2.2% or $38 million in 2015 compared to 2014. Excluding results of the

LBL business for first quarter 2014 of $65 million, life and annuity contract benefits increased $103 million in 2015

compared to 2014, primarily due to unfavorable life insurance mortality experience and growth at Allstate Benefits. Our

2015 annual review of assumptions resulted in a $4 million increase in reserves primarily for secondary guarantees on

interest-sensitive life insurance due to higher than anticipated retention on guaranteed interest-sensitive life business.

Life and annuity contract benefits decreased 7.9% or $152 million in 2014 compared to 2013. Excluding results of

the LBL business for second through fourth quarter 2013 of $173 million, life and annuity contract benefits increased $21

million in 2014 compared to 2013, primarily due to worse mortality experience on life insurance and growth at Allstate

Benefits. Our 2014 annual review of assumptions resulted in an $11 million increase in reserves primarily for secondary

guarantees on interest-sensitive life insurance due to increased projected exposure to secondary guarantees.

We analyze our mortality and morbidity results using the difference between premiums and contract charges earned

for the cost of insurance and life and annuity contract benefits excluding the portion related to the implied interest on

immediate annuities with life contingencies (“benefit spread”). This implied interest totaled $511 million, $521 million

and $527 million in 2015, 2014 and 2013, respectively.

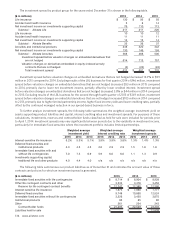

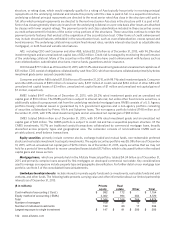

The benefit spread by product group for the years ended December 31 is disclosed in the following table.

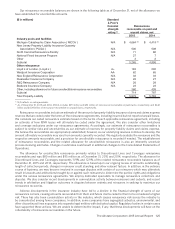

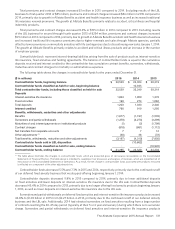

($ in millions) 2015 2014 2013

Life insurance $ 250 $ 287 $ 301

Accident and health insurance (10) (8) (18)

Subtotal — Allstate Life 240 279 283

Life insurance 24 17 21

Accident and health insurance 396 397 356

Subtotal — Allstate Benefits 420 414 377

Allstate Annuities (80) (85) (77)

Total benefit spread $ 580 $ 608 $ 583

Benefit spread decreased 4.6% or $28 million in 2015 compared to 2014. Excluding results of the LBL business

for first quarter 2014 of $(1) million, benefit spread decreased $29 million in 2015 compared to 2014, primarily due to

unfavorable life insurance mortality experience, partially offset by higher life insurance premiums.

Benefit spread increased 4.3% or $25 million in 2014 compared to 2013. Excluding results of the LBL business for

second through fourth quarter 2013 of $11 million, benefit spread increased $36 million in 2014 compared to 2013,

primarily due to growth in Allstate Benefits accident and health insurance and higher premiums and cost of insurance

contract charges on life insurance, partially offset by worse mortality experience on life insurance and immediate

annuities.

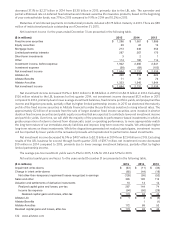

Interest credited to contractholder funds decreased 17.2% or $158 million in 2015 compared to 2014. Excluding results of

the LBL business for first quarter 2014 of $90 million, interest credited to contractholder funds decreased 8.2% or $68 million

in 2015 compared to 2014, primarily due to lower average contractholder funds and lower interest crediting rates. Interest

credited to contractholder funds decreased 28.1% or $359 million in 2014 compared to 2013. Excluding results of the LBL

business for second through fourth quarter 2013 of $270 million, interest credited to contractholder funds decreased $89

million in 2014 compared to 2013, primarily due to lower average contractholder funds and lower interest crediting rates.

Valuation changes on derivatives embedded in equity-indexed annuity contracts that are not hedged increased interest

credited to contractholder funds by $2 million in 2015 compared to $22 million in 2014 and $24 million in 2013.

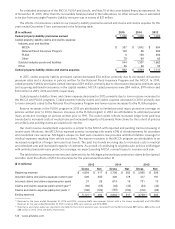

In order to analyze the impact of net investment income and interest credited to contractholders on net income, we

monitor the difference between net investment income and the sum of interest credited to contractholder funds and the

implied interest on immediate annuities with life contingencies, which is included as a component of life and annuity

contract benefits on the Consolidated Statements of Operations (“investment spread”).