Allstate 2015 Annual Report Download - page 134

Download and view the complete annual report

Please find page 134 of the 2015 Allstate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.128 www.allstate.com

ALLSTATE FINANCIAL SEGMENT

Overview and strategy The Allstate Financial segment sells traditional, interest-sensitive and variable life insurance

and voluntary accident and health insurance products. We serve our customers through Allstate exclusive agencies and

exclusive financial specialists, and workplace enrolling independent agents. We previously offered and continue to have in

force fixed annuities such as deferred and immediate annuities, and institutional products consisting of funding agreements

sold to unaffiliated trusts that use them to back medium-term notes. Allstate exclusive agencies and exclusive financial

specialists have a portfolio of non-proprietary products to sell, including mutual funds, fixed and variable annuities, disability

insurance and long-term care insurance, to help meet customer needs.

Allstate Financial brings value to The Allstate Corporation in three principal ways: through improving the economics of

the Protection business through increased customer loyalty and deepened customer relationships based on cross selling

Allstate Financial products to existing customers, bringing new customers to Allstate, and profitable growth. Allstate

Financial’s strategy is focused on expanding Allstate customer relationships, growing the number of products delivered to

customers through Allstate exclusive agencies and Allstate Benefits (our workplace distribution business), managing the

run-off of our in-force annuity products while taking actions to improve returns, and emphasizing capital efficiency and

shareholder returns.

The strategy for our life insurance business centers on the continuation of efforts to fully integrate the business into

the Allstate brand customer value proposition and modernizing our operating model. The life insurance product portfolio

and sales process are being redesigned with a focus on clear and distinct positioning to meet the varied needs of Allstate

customers. Our product positioning will provide solutions to help meet customer needs during various life stages ranging

from basic mortality protection to more complex mortality and financial planning solutions. Basic mortality protection

solutions will be provided through less complex products, such as term and whole life insurance, sold through exclusive

agents and licensed sales professionals to deepen customer relationships. More advanced mortality and financial planning

solutions will be provided primarily through exclusive financial specialists with an emphasis on our more complex offerings,

such as universal life insurance products. Sales producer education and technology improvements are being made to ensure

agencies have the tools and information needed to help customers meet their needs and build personal relationships

as trusted advisors. Additionally, tools will be made available to consumers to help them understand their needs and

encourage interaction with their local agencies.

Our employer relationships through Allstate Benefits also afford opportunities to offer Allstate products to more

customers and grow our business. Allstate Benefits is an industry leader in the voluntary benefits market, offering a broad

range of products, including critical illness, accident, cancer, hospital indemnity, disability and universal life. Allstate

Benefits differentiates itself by offering a broad product portfolio, flexible enrollment solutions and technology (including

significant presence on private exchanges), and its strong national accounts team, as well as the well-recognized Allstate

brand. We are investing in new generation enrollment and administrative technology to improve our customer experience

and modernize our operating model.

Market trends for voluntary benefits are favorable as the market has nearly doubled in size since 2006, driven by the

ability of voluntary benefits to fill gaps from employers seeking to contain rising health care costs, by providing lower cost

benefits, and shifting costs to employees. Allstate Benefits has introduced new products and enhanced existing products

to address these gaps by providing protection for catastrophic events such as a critical illness, accident or hospital stay.

We are expanding our group life capabilities to broaden our product portfolio. Originally a provider of voluntary benefits to

small and mid-sized businesses, Allstate Benefits now provides benefit solutions to companies of all sizes and industries

including the large account voluntary benefits marketplace.

Allstate Benefits is partnering with other Allstate Protection Emerging Businesses to expand our small business presence

and enhance small business enrollment capabilities and technology. Additionally, we are increasing Allstate exclusive

agency engagement to drive cross selling of voluntary benefits products, and developing opportunities for revenue growth

through new product and fee income offerings. The Allstate Benefits strategy for growth also includes expansion in the

national accounts market by increasing the number of sales, enrollment technology and account management personnel

and expanding independent agent distribution in targeted geographic locations for increased new sales. Allstate Benefits

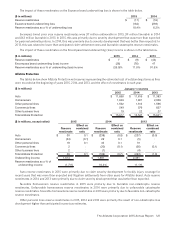

new business written premiums increased 6.0% and 5.0% in 2015 and 2014, respectively. Allstate Benefits also expanded

into the Canadian market in 2015.

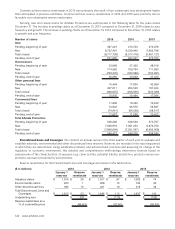

Our in force deferred and immediate annuity business has been adversely impacted by the historically low interest

rate environment. Our immediate annuity business has also been impacted by medical advancements that have resulted

in annuitants living longer than anticipated when many of these contracts were originated. We have initiated a mortality

study for our structured settlement annuities with life contingencies, which is expected to be completed in 2016, to update

our mortality assumptions concerning these trends. Allstate Financial focuses on the distinct risk and return profiles of