Allstate 2015 Annual Report Download - page 122

Download and view the complete annual report

Please find page 122 of the 2015 Allstate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.116 www.allstate.com

• North Light, began writing homeowners in California in February 2013.Any earthquake coverage provided under

these writings (other than fire following earthquakes) is currently ceded via quota share reinsurance.

• We ceased writing new homeowners business in Florida in 2011 beyond a modest stance for existing customers who

replace their currently-insured home with an acceptable property. The Encompass companies operating in Florida

withdrew from the property lines in 2009.

• Tropical cyclone deductibles are in place for a large portion of coastal insured properties.

• We have additional catastrophe exposure, beyond the property lines, for auto customers who have purchased

physical damage coverage. Auto physical damage coverage generally includes coverage for flood-related loss. We

manage this additional exposure through inclusion of auto losses in our nationwide reinsurance program (which

excludes New Jersey and Florida). New Jersey auto losses are included in our New Jersey reinsurance program.

• Designed a homeowners new business offering, Allstate House and Home, that provides options of coverage for roof

damage including graduated coverage and pricing based on roof type and age. Allstate House and Home is currently

available in 37 states.

Hurricanes

We consider the greatest areas of potential catastrophe losses due to hurricanes generally to be major metropolitan

centers in counties along the eastern and gulf coasts of the United States. Usually, the average premium on a property policy

near these coasts is greater than in other areas. However, average premiums are often not considered commensurate with

the inherent risk of loss. In addition and as explained in Note14 of the consolidated financial statements, in various states

Allstate is subject to assessments from assigned risk plans, reinsurance facilities and joint underwriting associations

providing insurance for wind related property losses.

We have addressed our risk of hurricane loss by, among other actions, purchasing reinsurance for specific states and

on a countrywide basis for our personal lines property insurance in areas most exposed to hurricanes, limiting personal

homeowners, landlord package policy and manufactured home new business writings in coastal areas in southern and

eastern states, implementing tropical cyclone deductibles where appropriate, and not offering continuing coverage on

certain policies in coastal counties in certain states. We continue to seek appropriate returns for the risks we write. This

may require further actions, similar to those already taken, in geographies where we are not getting appropriate returns.

However, we may maintain or opportunistically increase our presence in areas where we achieve adequate returns and

do not materially increase our hurricane risk.

Earthquakes

We do not offer earthquake coverage in most states and actions taken to reduce our exposure from earthquake

losses are complete. We purchased reinsurance in the state of Kentucky and entered into arrangements in many states

to make earthquake coverage available through non-proprietary insurers.

We retain approximately 30,000 PIF with earthquake coverage, primarily in Kentucky, due to regulatory and other

reasons. We continue to have exposure to earthquake risk on certain policies that do not specifically exclude coverage

for earthquake losses, including our auto policies, and to fires following earthquakes. Allstate policyholders in the state of

California are offered coverage through the CEA, a privately-financed, publicly-managed state agency created to provide

insurance coverage for earthquake damage. Allstate is subject to assessments from the CEA under certain circumstances

as explained in Note14 of the consolidated financial statements. While North Light writes property policies in California,

which can include earthquake coverage, this coverage is 100% ceded via quota share reinsurance.

Fires Following Earthquakes

Under a standard homeowners policy we cover fire losses, including those caused by an earthquake. Actions taken

related to our risk of loss from fires following earthquakes include restrictive underwriting guidelines in California for

new business writings, purchasing reinsurance for Kentucky personal lines property risks, and purchasing nationwide

occurrence reinsurance, excluding Florida and New Jersey.

Wildfires

Actions taken related to managing our risk of loss from wildfires include changing homeowners underwriting

requirements in certain states and purchasing nationwide occurrence reinsurance. We also have inspection programs to

identify homes that are susceptible to wildfires.

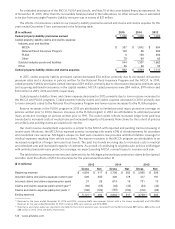

Reinsurance

A description of our current catastrophe reinsurance program appears in Note 10 of the consolidated financial

statements.