Allstate 2015 Annual Report Download - page 142

Download and view the complete annual report

Please find page 142 of the 2015 Allstate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

136 www.allstate.com

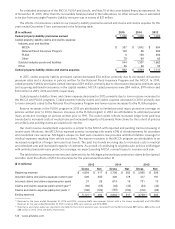

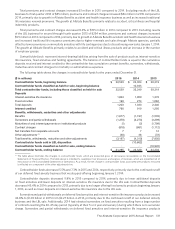

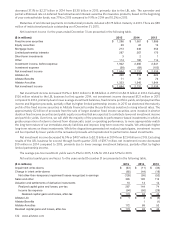

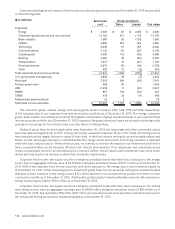

The changes in DAC for the years ended December 31 are detailed in the following table.

($ in millions) Traditional life

and accident

and health

Interest-sensitive

life insurance

Fixed

annuities Total

2015 2014 2015 2014 2015 2014 2015 2014

Balance, beginning of year $ 753 $ 711 $ 905 $ 991 $ 47 $ 45 $ 1,705 $ 1,747

Classified as held for sale, beginning balance — 13 — 700 — 30 — 743

Total, including those classified as held for sale 753 724 905 1,691 47 75 1,705 2,490

Acquisition costs deferred 178 167 107 113 — — 285 280

Amortization of DAC before amortization relating

to realized capital gains and losses, valuation

changes on embedded derivatives that are not

hedged and changes in assumptions (1) (139) (125) (111) (130) (6) (8) (256) (263)

Amortization relating to realized capital gains and

losses and valuation changes on embedded

derivatives that are not hedged (1) — — (6) (8) 1 3 (5) (5)

Amortization (acceleration) deceleration for changes

in assumptions (“DAC unlocking”) (1) — — (1) 10 — (2) (1) 8

Effect of unrealized capital gains and losses (2) — — 99 (97) 5 (1) 104 (98)

Sold in LBL disposition — (13) — (674) — (20) — (707)

Ending balance $ 792 $ 753 $ 993 $ 905 $ 47 $ 47 $ 1,832 $ 1,705

(1) Included as a component of amortization of DAC on the Consolidated Statements of Operations.

(2) Represents the change in the DAC adjustment for unrealized capital gains and losses. The DAC adjustment represents the amount by which the

amortization of DAC would increase or decrease if the unrealized gains and losses in the respective product portfolios were realized.

Operating costs and expenses increased 1.3% or $6 million in 2015 compared to 2014. Excluding results of the LBL

business for first quarter 2014 of $8 million, operating costs and expenses increased $14 million in 2015 compared to

2014. Operating costs and expenses decreased 17.5% or $99 million in 2014 compared to 2013. Excluding results of the

LBL business for second through fourth quarter 2013 of $31 million, operating costs and expenses decreased $68 million

in 2014 compared to 2013.

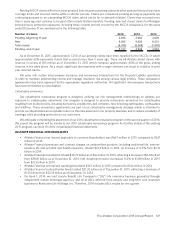

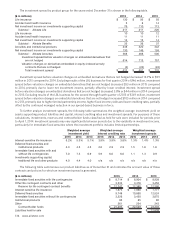

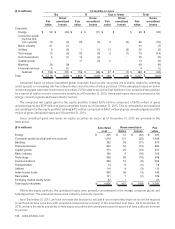

The following table summarizes operating costs and expenses for the years ended December 31.

($ in millions) 2015 2014 2013

Non‑deferrable commissions $ 95 $ 99 $ 103

General and administrative expenses 325 314 398

Taxes and licenses 52 53 64

Total operating costs and expenses $ 472 $ 466 $ 565

Restructuring and related charges $ — $ 2 $ 7

Allstate Life $ 212 $ 232 $ 282

Allstate Benefits 222 206 199

Allstate Annuities 38 28 84

Total operating costs and expenses $ 472 $ 466 $ 565

General and administrative expenses increased 3.5% or $11 million in 2015 compared to 2014, primarily due to

increased expenses at Allstate Benefits relating to employee costs, reinsurance expense allowances paid to LBL for

business reinsured to Allstate Life Insurance Company (“ALIC”) after the sale, and a guaranty fund accrual release in the

prior year period, partially offset by lower technology costs.

General and administrative expenses decreased 21.1% or $84 million in 2014 compared to 2013, primarily due to

actions to improve strategic focus and modernize the operating model. This included the sale of LBL, exiting the master

brokerage agency distribution channel, discontinuing sales of proprietary annuity products, and other rightsizing and

profitability actions.

Income tax expense included $17 million related to our adoption of new accounting guidance for investments in

qualified affordable housing projects in first quarter 2015.

Reinsurance ceded In the normal course of business, we seek to limit aggregate and single exposure to losses on

large risks by purchasing reinsurance. In addition, Allstate Financial has used reinsurance to effect the disposition of

certain blocks of business. We retain primary liability as a direct insurer for all risks ceded to reinsurers. As of December

31, 2015 and 2014, 21% and 23%, respectively, of our face amount of life insurance in force was reinsured. Additionally,

we ceded substantially all of the risk associated with our variable annuity business.