Allstate 2015 Annual Report Download - page 205

Download and view the complete annual report

Please find page 205 of the 2015 Allstate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The Allstate Corporation 2015 Annual Report 199

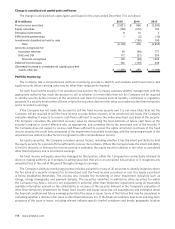

and implications of rating agency actions and offering prices; 2) the specific reasons that a security is in an unrealized

loss position, including overall market conditions which could affect liquidity; and 3) the length of time and extent to

which the fair value has been less than amortized cost or cost.

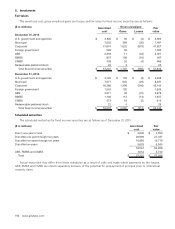

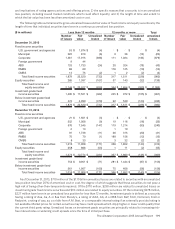

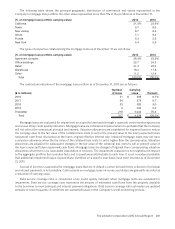

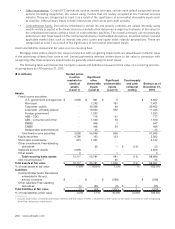

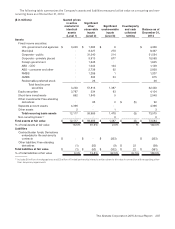

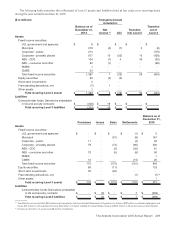

The following table summarizes the gross unrealized losses and fair value of fixed income and equity securities by the

length of time that individual securities have been in a continuous unrealized loss position.

($ in millions) Less than 12 months 12 months or more Total

unrealized

losses

Number

of issues

Fair

value

Unrealized

losses

Number

of issues

Fair

value

Unrealized

losses

December 31, 2015

Fixed income securities

U.S. government and agencies 53 $ 1,874 $ (4) — $ — $ — $ (4)

Municipal 222 810 (6) 9 36 (14) (20)

Corporate 1,361 17,915 (696) 111 1,024 (183) (879)

Foreign government 9 44 — — — — —

ABS 133 1,733 (24) 20 324 (19) (43)

RMBS 88 69 — 176 125 (10) (10)

CMBS 13 75 (2) 1 2 (2) (4)

Total fixed income securities 1,879 22,520 (732) 317 1,511 (228) (960)

Equity securities 265 1,397 (107) 37 143 (32) (139)

Total fixed income and

equity securities 2,144 $ 23,917 $ (839) 354 $ 1,654 $ (260) $ (1,099)

Investment grade fixed

income securities 1,405 $ 17,521 $ (362) 225 $ 972 $ (105) $ (467)

Below investment grade fixed

income securities 474 4,999 (370) 92 539 (123) (493)

Total fixed income securities 1,879 $ 22,520 $ (732) 317 $ 1,511 $ (228) $ (960)

December 31, 2014

Fixed income securities

U.S. government and agencies 21 $ 1,501 $ (3) — $ — $ — $ (3)

Municipal 252 1,008 (9) 19 116 (16) (25)

Corporate 576 7,545 (147) 119 1,214 (93) (240)

Foreign government 2 13 — 1 19 — —

ABS 81 1,738 (11) 26 315 (20) (31)

RMBS 75 70 (1) 188 156 (12) (13)

CMBS 8 33 — 3 32 (2) (2)

Total fixed income securities 1,015 11,908 (171) 356 1,852 (143) (314)

Equity securities 258 866 (53) 1 11 (2) (55)

Total fixed income and

equity securities 1,273 $ 12,774 $ (224) 357 $ 1,863 $ (145) $ (369)

Investment grade fixed

income securities 754 $ 9,951 $ (71) 281 $ 1,444 $ (87) $ (158)

Below investment grade fixed

income securities 261 1,957 (100) 75 408 (56) (156)

Total fixed income securities 1,015 $ 11,908 $ (171) 356 $ 1,852 $ (143) $ (314)

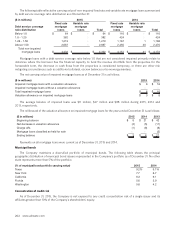

As of December 31, 2015, $710 million of the $1.10 billion unrealized losses are related to securities with an unrealized

loss position less than 20% of amortized cost or cost, the degree of which suggests that these securities do not pose a

high risk of being other-than-temporarily impaired. Of the $710 million, $338 million are related to unrealized losses on

investment grade fixed income securities and $94 million are related to equity securities. Of the remaining $278 million,

$227 million have been in an unrealized loss position for less than 12 months. Investment grade is defined as a security

having a rating of Aaa, Aa, A or Baa from Moody’s, a rating of AAA, AA, A or BBB from S&P, Fitch, Dominion, Kroll or

Realpoint, a rating of aaa, aa, a or bbb from A.M. Best, or a comparable internal rating if an externally provided rating is

not available. Market prices for certain securities may have credit spreads which imply higher or lower credit quality than

the current third party rating. Unrealized losses on investment grade securities are principally related to increasing risk-

free interest rates or widening credit spreads since the time of initial purchase.