Allstate 2015 Annual Report Download - page 239

Download and view the complete annual report

Please find page 239 of the 2015 Allstate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The Allstate Corporation 2015 Annual Report 233

upon approval of existing or replacement lenders. This facility contains an increase provision that would allow up to an

additional $500 million of borrowing. This facility has a financial covenant requiring the Company not to exceed a 37.5%

debt to capitalization ratio as defined in the agreement. Although the right to borrow under the facility is not subject to a

minimum rating requirement, the costs of maintaining the facility and borrowing under it are based on the ratings of the

Company’s senior unsecured, unguaranteed long-term debt. The total amount outstanding at any point in time under the

combination of the commercial paper program and the credit facility cannot exceed the amount that can be borrowed

under the credit facility. No amounts were outstanding under the credit facility as of December31, 2015 or 2014. The

Company had no commercial paper outstanding as of December31, 2015 or 2014.

The Company paid $289 million, $332 million and $361 million of interest on debt in 2015, 2014 and 2013, respectively.

The Company has $107 million of investment-related debt that is reported in other liabilities and accrued expenses

as of December 31, 2015, including a commitment to fund a limited partnership of $89 million and $18 million of debt

related to other investments. The Company has an outstanding line of credit to fund the limited partnership.

During 2015, the Company filed a universal shelf registration statement with the Securities and Exchange Commission

(“SEC”) that expires in 2018. The registration statement covers an unspecified amount of securities and can be used

to issue debt securities, common stock, preferred stock, depositary shares, warrants, stock purchase contracts, stock

purchase units and securities of trust subsidiaries.

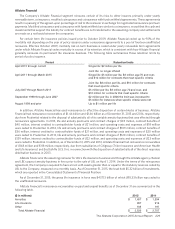

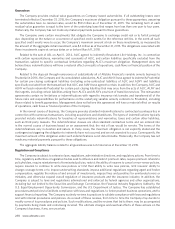

Common stock

The Company had 900 million shares of issued common stock of which 381 million shares were outstanding and 519

million shares were held in treasury as of December31, 2015. In 2015, the Company reacquired 43 million shares at an

average cost of $65.55 and reissued 6 million net shares under equity incentive plans.

Preferred stock

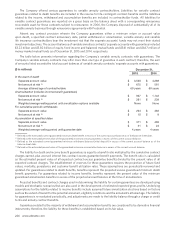

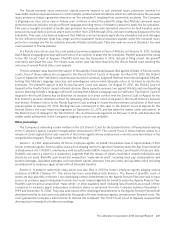

The following table summarizes the Company’s outstanding preferred stock as of December31, 2015. All represent

noncumulative perpetual preferred stock with a $1.00 par value per share and a liquidation preference of $25,000

per share.

($ in millions, except

per share data) Dividend Per Share

Aggregate Dividend

Payment

Shares

Aggregate

liquidation

preference

Dividend

rate 2015 2014 2013 2015 2014 2013

Series A 11,500 $ 287.5 5.625%$ 1.41 $ 1.41 $ 0.83 $ 16 $ 16 $ 9

Series C 15,400 385.0 6.750%1.69 1.69 0.49 26 26 8

Series D 5,400 135.0 6.625%1.66 1.79 — 9 10 —

Series E 29,900 747.5 6.625%1.66 1.44 — 49 43 —

Series F 10,000 250.0 6.250%1.56 0.92 — 16 9 —

Total 72,200 $ 1,805 $ 116 $ 104 $ 17

In March 2014, the Company issued 29,900 shares of 6.625% Noncumulative Perpetual Preferred Stock, SeriesE, for

gross proceeds of $747.5 million. In June 2014, the Company issued 10,000 shares of 6.25% Noncumulative Perpetual

Preferred Stock, SeriesF, for gross proceeds of $250 million. The proceeds of both issuances were used for general

corporate purposes.

The preferred stock ranks senior to the Company’s common stock with respect to the payment of dividends and

liquidation rights. The Company will pay dividends on the preferred stock on a noncumulative basis only when, as and

if declared by the Company’s board of directors (or a duly authorized committee of the board) and to the extent that

the Company has legally available funds to pay dividends. If dividends are declared on the preferred stock, they will be

payable quarterly in arrears at an annual fixed rate. Dividends on the preferred stock are not cumulative. Accordingly,

in the event dividends are not declared on the preferred stock for payment on any dividend payment date, then those

dividends will cease to be payable. If the Company has not declared a dividend before the dividend payment date for any

dividend period, the Company has no obligation to pay dividends for that dividend period, whether or not dividends are

declared for any future dividend period. No dividends may be paid or declared on the Company’s common stock and no

shares of the Company’s common stock may be repurchased unless the full dividends for the latest completed dividend

period on the preferred stock have been declared and paid or provided for.