Allstate 2015 Annual Report Download - page 133

Download and view the complete annual report

Please find page 133 of the 2015 Allstate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The Allstate Corporation 2015 Annual Report 127

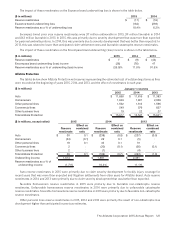

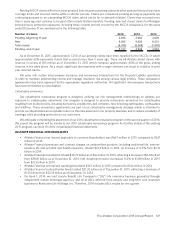

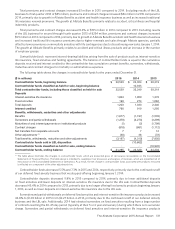

Pending MCCA claims differ from most personal lines insurance pending claims as other personal lines policies have

coverage limits and incurred claims settle in shorter periods. Claims are considered pending as long as payments are

continuing pursuant to an outstanding MCCA claim, which can be for a claimant’s lifetime. Claims that occurred more

than 5 years ago and continue to be paid often include lifetime benefits. Pending, new and closed claims for Michigan

personal injury protection exposures, including those covered and not covered by the MCCA reinsurance, for the years

ended December 31 are summarized in the following table.

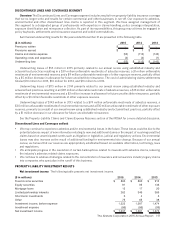

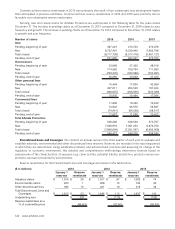

Number of claims 2015 2014 2013

Pending, beginning of year 4,936 4,684 4,029

New 8,956 8,620 8,531

Total closed (8,765) (8,368) (7,876)

Pending, end of year 5,127 4,936 4,684

As of December 31, 2015, approximately 1,250 of our pending claims have been reported to the MCCA, of which

approximately 65% represents claims that occurred more than 5 years ago. There are 68 Allstate brand claims with

reserves in excess of $15 million as of December 31, 2015 which comprise approximately 40% of the gross ending

reserves in the table above. As a result, significant developments with a single claimant can result in volatility in prior

year incurred claims.

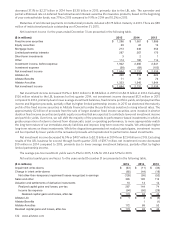

We enter into certain intercompany insurance and reinsurance transactions for the Property-Liability operations

in order to maintain underwriting control and manage insurance risk among various legal entities. These reinsurance

agreements have been approved by the appropriate regulatory authorities. All significant intercompany transactions

have been eliminated in consolidation.

Catastrophe reinsurance

Our catastrophe reinsurance program is designed, utilizing our risk management methodology, to address our

exposure to catastrophes nationwide. Our program is designed to provide reinsurance protection for catastrophes

resulting from multiple perils including hurricanes, windstorms, hail, tornados, fires following earthquakes, earthquakes

and wildfires. These reinsurance agreements are part of our catastrophe management strategy, which is intended to

provide our shareholders an acceptable return on the risks assumed in our property business, and to reduce variability of

earnings, while providing protection to our customers.

We anticipate completing the placement of our 2016 catastrophe reinsurance program in the second quarter of 2016.

We expect the program will be similar to our 2015 catastrophe reinsurance program. For further details of the existing

2015 program, see Note 10 of the consolidated financial statements.

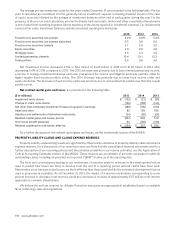

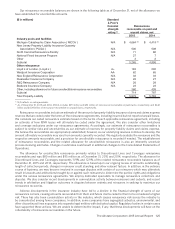

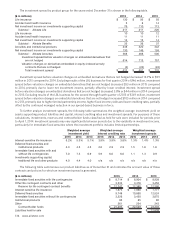

ALLSTATE FINANCIAL 2015 HIGHLIGHTS

• Allstate Financial net income applicable to common shareholders was $663 million in 2015 compared to $631

million in 2014.

• Allstate Financial premiums and contract charges on underwritten products, including traditional life, interest-

sensitive life and accident and health insurance, totaled $2.14 billion in 2015, an increase of 0.5% from $2.13

billion in 2014.

• Allstate Financial investments totaled $36.79 billion as of December 31, 2015, reflecting a decrease of $2.02 billion

from $38.81 billion as of December 31, 2014. Net investment income decreased 11.6% to $1.88 billion in 2015

from $2.13 billion in 2014.

• Allstate Financial net realized capital gains totaled $267 million in 2015 compared to $144 million in 2014.

• Allstate Financial contractholder funds totaled $21.30 billion as of December 31, 2015, reflecting a decrease of

$1.23 billion from $22.53 billion as of December 31, 2014.

• On April 1, 2014, we sold Lincoln Benefit Life Company’s (“LBL”) life insurance business generated through

independent master brokerage agencies, and all of LBL’s deferred fixed annuity and long-term care insurance

business to Resolution Life Holdings, Inc. Therefore, 2014 includes LBL’s results for one quarter.