Allstate 2015 Annual Report Download - page 235

Download and view the complete annual report

Please find page 235 of the 2015 Allstate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The Allstate Corporation 2015 Annual Report 229

Allstate Financial

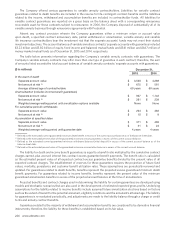

The Company’s Allstate Financial segment reinsures certain of its risks to other insurers primarily under yearly

renewable term, coinsurance, modified coinsurance and coinsurance with funds withheld agreements. These agreements

result in a passing of the agreed-upon percentage of risk to the reinsurer in exchange for negotiated reinsurance premium

payments. Modified coinsurance and coinsurance with funds withheld are similar to coinsurance, except that the cash and

investments that support the liability for contract benefits are not transferred to the assuming company and settlements

are made on a net basis between the companies.

For certain term life insurance policies issued prior to October 2009, Allstate Financial ceded up to 90% of the

mortality risk depending on the year of policy issuance under coinsurance agreements to a pool of fourteen unaffiliated

reinsurers. Effective October 2009, mortality risk on term business is ceded under yearly renewable term agreements

under which Allstate Financial cedes mortality in excess of its retention, which is consistent with how Allstate Financial

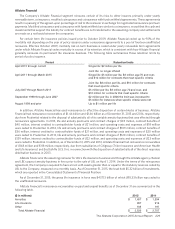

generally reinsures its permanent life insurance business. The following table summarizes those retention limits by

period of policy issuance.

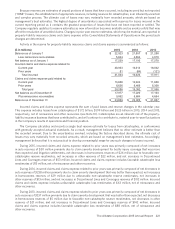

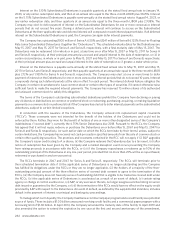

Period Retention limits

April 2015 through current Single life: $2 million per life

Joint life: no longer offered

April 2011 through March 2015 Single life: $5 million per life, $3 million age 70 and over,

and $10 million for contracts that meet specific criteria

Joint life: $8 million per life, and $10 million for contracts

that meet specific criteria

July 2007 through March 2011 $5 million per life, $3 million age 70 and over, and

$10 million for contracts that meet specific criteria

September 1998 through June 2007 $2 million per life, in 2006 the limit was increased to

$5 million for instances when specific criteria were met

August 1998 and prior Up to $1 million per life

In addition, Allstate Financial has used reinsurance to effect the disposition of certain blocks of business. Allstate

Financial had reinsurance recoverables of $1.44 billion and $1.46 billion as of December31, 2015 and 2014, respectively,

due from Prudential related to the disposal of substantially all of its variable annuity business that was effected through

reinsurance agreements. In 2015, life and annuity premiums and contract charges of $94 million, contract benefits of

$40 million, interest credited to contractholder funds of $21 million, and operating costs and expenses of $18 million

were ceded to Prudential. In 2014, life and annuity premiums and contract charges of $109 million, contract benefits of

$36 million, interest credited to contractholder funds of $21 million, and operating costs and expenses of $20 million

were ceded to Prudential. In 2013, life and annuity premiums and contract charges of $120 million, contract benefits of

$139 million, interest credited to contractholder funds of $22 million, and operating costs and expenses of $23 million

were ceded to Prudential. In addition, as of December31, 2015 and 2014, Allstate Financial had reinsurance recoverables

of $148 million and $118 million, respectively, due from subsidiaries of Citigroup (Triton Insurance and American Health

and Life Insurance) and Scottish Re (U.S.)Inc. in connection with the disposition of substantially all of the direct response

distribution business in 2003.

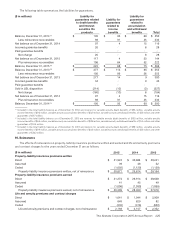

Allstate Financial is the assuming reinsurer for LBL’s life insurance business sold through the Allstate agency channel

and LBL’s payout annuity business in force prior to the sale of LBL on April 1, 2014. Under the terms of the reinsurance

agreement, the Company is required to have a trust with assets greater than or equal to the statutory reserves ceded by

LBL to the Company, measured on a monthly basis. As of December31, 2015, the trust held $5.32 billion of investments,

which are reported in the Consolidated Statement of Financial Position.

As of December31, 2015, the gross life insurance in force was $437.13 billion of which $93.33 billion was ceded to

the unaffiliated reinsurers.

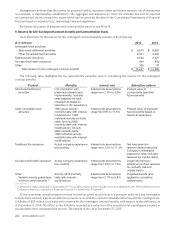

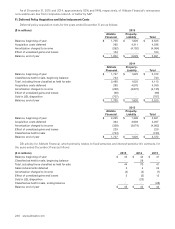

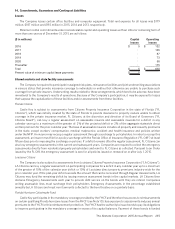

Allstate Financial’s reinsurance recoverables on paid and unpaid benefits as of December31 are summarized in the

following table.

($ in millions) 2015 2014

Annuities $ 1,457 $ 1,594

Life insurance 897 916

Other 185 197

Total Allstate Financial $ 2,539 $ 2,707