Allstate 2015 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2015 Allstate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

56 www.allstate.com

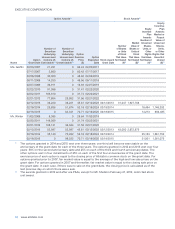

EXECUTIVE COMPENSATION

as required under the Internal Revenue Code. The

lump sum payment under the cash balance benefit

is generally equal to a participant’s account balance.

Payments from the SRIP are paid in the form of a

lump sum using the same interest rate and mortality

assumptions used under the ARP.

Timing of Payments

Eligible employees are vested in the normal ARP

and SRIP retirement benefits on the earlier of

the completion of three years of service or upon

reaching age 65.

Final average pay benefits are payable at age 65. A

participant with final average pay benefits may be

entitled to a reduced early retirement benefit on

or after age 55 if he or she terminates employment

after completing 20 or more years of vesting service.

A participant earning cash balance benefits who

terminates employment with at least three years

of vesting service is entitled to a lump sum benefit

equal to his or her cash balance account balance.

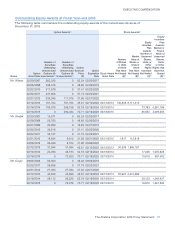

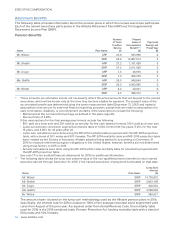

The following SRIP payment dates assume a

retirement or termination date of December 31, 2015:

• Ms. Greffin’s and Messrs. Shebik’s and Wilson’s

SRIP benefits earned prior to 2005 would become

payable as early as January 1, 2016. Benefits

earned after 2004 would be paid on July 1, 2016, or

following death.

• Mr. Civgin’s SRIP benefit would be paid on

January 1, 2017, or following death.

• Mr. Winter’s SRIP benefit would be paid on July 1,

2016, or following death.

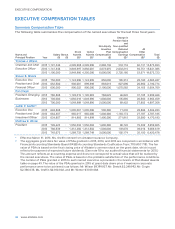

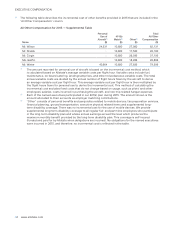

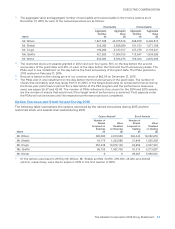

Non-Qualified Deferred Compensation at Fiscal Year-end 2015

The following table summarizes the non-qualified deferred compensation contributions, earnings, and

account balances of our named executives in 2015. All amounts relate to The Allstate Corporation Deferred

Compensation Plan.

Name

Executive

Contributions

in Last FY

($)

Registrant

Contributions

in Last FY

($)

Aggregate

Earnings

in Last FY

($)(1)

Aggregate

Withdrawals/

Distributions

in Last FY

($)

Aggregate

Balance

at Last FYE

($)(2)

Mr. Wilson 0 0 ‑16,436 0 759,904

Mr. Shebik 0 0 ‑4,450 0 135,332

Mr. Civgin 0 0 0 0 0

Ms. Greffin 0 0 ‑14,214 0 2,176,560

Mr. Winter 0 0 0 0 0

(1) Aggregate earnings were not included in the named executive’s compensation in the last completed fiscal

year in the Summary Compensation Table.

(2) There are no amounts reported in the Aggregate Balance at Last FYE column that previously were reported as

compensation in the Summary Compensation Table.

In order to remain competitive with other employers,

we allow the named executives and other employees

whose annual compensation exceeds the amount

specified in the Internal Revenue Code ($265,000

in 2015), to defer under the Deferred Compensation

Plan up to 80% of their salary and/or up to 100% of

their annual cash incentive award that exceeds the

Internal Revenue Code limit. Allstate does not match

participant deferrals and does not guarantee a

stated rate of return.

Deferrals under the Deferred Compensation Plan are

credited with earnings or debited for losses based

on the results of the notional investment option or

options selected by the participants. The notional

investment options available in 2015 under the

Deferred Compensation Plan are: stable value, S&P

500, international equity, Russell 2000, mid-cap,

and bond funds. Under the Deferred Compensation

Plan, deferrals are not actually invested in these

funds, but instead are credited with earnings or

debited for losses based on the funds’ investment

returns. Because the rate of return is based on

actual investment measures in our 401(k) plan, no

above-market earnings are credited, recorded, or

paid. Our Deferred Compensation Plan and 401(k)

plan allow participants to change their investment

elections daily.

The Deferred Compensation Plan is unfunded. This

means that Allstate does not set aside funds for the

plan in a trust or otherwise. Participants have only

the rights of general unsecured creditors and may

lose their balances in the event of the company’s

bankruptcy. Account balances are 100% vested at

all times.