Allstate 2015 Annual Report Download - page 110

Download and view the complete annual report

Please find page 110 of the 2015 Allstate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

104 www.allstate.com

Pricing of property products is typically intended to establish returns that we deem acceptable over a long-term period.

Losses, including losses from catastrophic events and weather-related losses (such as wind, hail, lightning and freeze losses

not meeting our criteria to be declared a catastrophe), are accrued on an occurrence basis within the policy period. Therefore,

in any reporting period, loss experience from catastrophic events and weather-related losses may contribute to negative

or positive underwriting performance relative to the expectations we incorporated into the products’ pricing. We pursue

rate increases where indicated, taking into consideration potential customer disruption, the impact on our ability to market

our auto lines, regulatory limitations, our competitive position and profitability, using a methodology that appropriately

addresses the changing costs of losses from catastrophes such as severe weather and the net cost of reinsurance.

Allstate Protection outlook

• Allstate Protection will continue to focus on its strategy of offering differentiated products and services to our

customers while maintaining pricing discipline.

• Allstate Protection will continue to take actions to improve auto profitability by increasing prices, evaluating

underwriting standards, managing expenses, and managing loss cost through focus on claims process excellence.

• Allstate Protection will continue to grow homeowners policies without significantly increasing catastrophe exposure.

• We expect that volatility in the level of catastrophes we experience will contribute to variation in our underwriting

results; however, this volatility will be mitigated due to our catastrophe management actions, including the purchase

of reinsurance.

• We will continue the implementation of our trusted advisor strategy, enabling agencies to more fully deliver on the

Allstate brand customer value proposition.

• We will continue to modernize our operating model to efficiently deliver our customer value propositions.

• We will invest in building and acquiring long-term growth platforms.

Premiums written is the amount of premiums charged for policies issued during a fiscal period. Premiums are

considered earned and are included in the financial results on a pro-rata basis over the policy period. The portion of

premiums written applicable to the unexpired term of the policies is recorded as unearned premiums on our Consolidated

Statements of Financial Position.

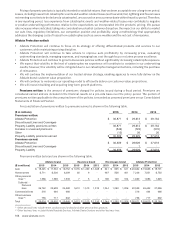

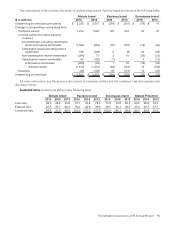

A reconciliation of premiums written to premiums earned is shown in the following table.

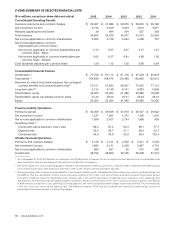

($ in millions) 2015 2014 2013

Premiums written:

Allstate Protection $ 30,871 $ 29,613 $ 28,164

Discontinued Lines and Coverages — 1 —

Property‑Liability premiums written 30,871 29,614 $ 28,164

Increase in unearned premiums (549) (723) (572)

Other (13) 38 26

Property‑Liability premiums earned $ 30,309 $ 28,929 $ 27,618

Premiums earned:

Allstate Protection $ 30,309 $ 28,928 $ 27,618

Discontinued Lines and Coverages — 1 —

Property‑Liability $ 30,309 $ 28,929 $ 27,618

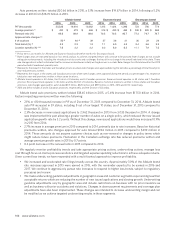

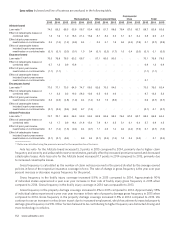

Premiums written by brand are shown in the following table.

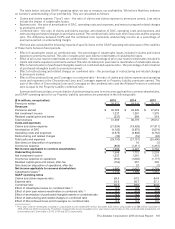

Allstate brand Esurance brand Encompass brand Allstate Protection

($ in millions) 2015 2014 2013 2015 2014 2013 2015 2014 2013 2015 2014 2013

Auto $ 18,445 $ 17,504 $ 16,752 $ 1,576 $ 1,499 $ 1,308 $ 641 $ 665 $ 641 $ 20,662 $ 19,668 $ 18,701

Homeowners 6,711 6,536 6,289 30 9 — 497 506 461 7,238 7,051 6,750

Other personal

lines (1) 1,586 1,569 1,539 7 5 2 106 109 104 1,699 1,683 1,645

Subtotal –

Personal

lines 26,742 25,609 24,580 1,613 1,513 1,310 1,244 1,280 1,206 29,599 28,402 27,096

Commercial lines 516 494 466 — — — — — — 516 494 466

Other business

lines (2) 756 717 602 — — — — — — 756 717 602

Total $ 28,014 $ 26,820 $ 25,648 $ 1,613 $ 1,513 $ 1,310 $ 1,244 $ 1,280 $ 1,206 $ 30,871 $ 29,613 $ 28,164

(1) Other personal lines include renter, condominium, landlord and other personal lines products.

(2) Other business lines include Allstate Roadside Services, Allstate Dealer Services and other business lines.