Zynga 2011 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2011 Zynga annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

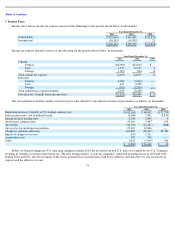

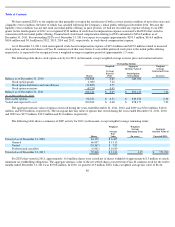

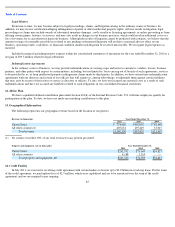

The following weighted-

average employee equity awards were excluded from the calculation of diluted net income (loss) per share and pro

forma diluted net income per share attributable to common stockholders because their effect would have been anti-dilutive for the periods

presented (in thousands):

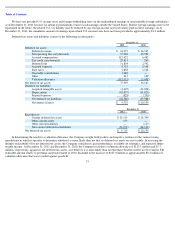

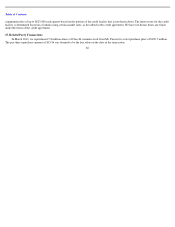

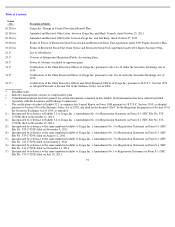

11. Commitments and Contingencies

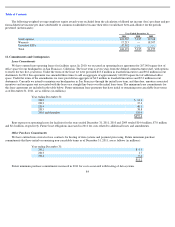

Lease Commitments

We have entered into operating leases for facilities space. In 2010, we executed an operating lease agreement for 267,000 square feet of

office space for our headquarters in San Francisco, California. The lease term is seven years from the defined commencement date, with options

to renew for two five-year terms. Under the terms of the lease we were provided $13.6 million in leasehold incentives and $9.8 million in rent

abatements. In 2011 this agreement was amended three times to add an aggregate of approximately 140,000 square feet of additional office

space. Under the terms of the amendments we were provided an aggregate of $4.9 million in leasehold incentives and $5.2 million in rent

abatements. Currently we intend to maintain our headquarters in San Francisco through the initial lease term, and therefore, amortize associated

incentives and recognize rent associated with the lease on a straight line basis over the initial lease term. The minimum lease commitments for

this lease agreement are included in the table below. Future minimum lease payments that have initial or remaining non-cancelable lease terms

as of December 31, 2011, are as follows (in millions):

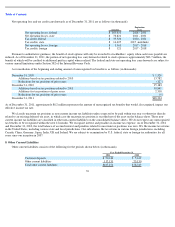

Rent expense on operating leases for facilities for the years ended December 31, 2011, 2010 and 2009 totaled $14.4 million, $7.0 million

and $2.2 million, respectively. Future lease obligations increased in 2011 for costs related to additional leases and amendments.

Other Purchase Commitments

We have entered into several service contracts for hosting of data systems and payment processing. Future minimum purchase

commitments that have initial or remaining non-cancelable terms as of December 31, 2011, are as follows (in millions):

Future minimum purchase commitments increased in 2011 for costs associated with hosting of data systems.

84

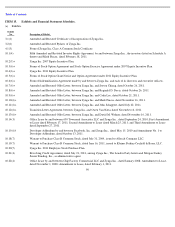

Year Ended December 31,

2011

2010

2009

Stock options

103,565

5,235

12,768

Warrants

17,215

—

18,507

Unvested ZSUs

47,392

—

—

Total

168,172

5,235

31,275

Year ending December 31:

2012

$

31.1

2013

37.3

2014

40.1

2015

38.8

2016 and thereafter

110.0

$

257.3

Year ending December 31:

2012

$

9.3

2013

1.7

2014

0.2

$

11.2