Zynga 2011 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2011 Zynga annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

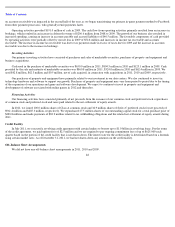

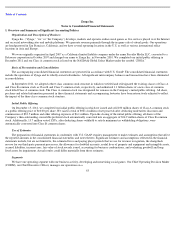

Foreign Currency Exchange Risk

Our sales transactions are primarily denominated in U.S. dollars and therefore substantially all of our revenue is not subject to foreign

currency risk. However, certain of our operating expenses are incurred outside the United States and are denominated in foreign currencies and

are subject to fluctuations due to changes in foreign currency exchange rates, particularly changes in the Euro, Chinese Yuan, Japanese Yen,

British Pound, Canadian Dollar and Indian Rupee. The volatility of exchange rates depends on many factors that we cannot forecast with reliable

accuracy. Although we have experienced and will continue to experience fluctuations in our net income (loss) as a result of transaction gains

(losses) related to revaluing certain cash balances, trade accounts receivable, trade accounts payable, current liabilities and intercompany

balances that are denominated in currencies other than the U.S. dollar, we believe such a change would not have a material impact on our results

of operations.

Inflation Risk

We do not believe that inflation has had a material effect on our business, financial condition or results of operations. If our costs were to

become subject to significant inflationary pressures, we may not be able to fully offset such higher costs through price increases. Our inability or

failure to do so could harm our business, financial condition and results of operations.

54