Zynga 2011 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2011 Zynga annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

compensation in compliance with Rule 701 or (2) Section 4(2) of the Securities Act as transactions by an issuer not involving any public

offering, or because they did not involve a sales of securities. The recipients of securities in each of these transactions represented their intention

to acquire the securities for investment only and not with view to or for sale in connection with any distribution thereof and appropriate legends

were affixed to the stock certificates and instruments issued in such transactions. All recipients had adequate access, through their relationships

with us, to information about us.

The offers, sales, and issuances of the securities described in paragraph (b) above were deemed to be exempt from registration under the

Securities Act in reliance on Section 4(2) of the Securities Act or Regulation D promulgated thereunder as transactions by an issuer not

involving a public offering. The recipients of securities in each of these transactions acquired the securities for investment only and not with a

view to or for sale in connection with any distribution thereof and appropriate legends were affixed to the securities issued in these transactions.

Each of the recipients of securities in these transactions was an accredited or sophisticated person and had adequate access, through employment,

business or other relationships, to information about us.

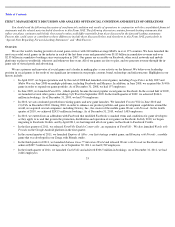

Use of Proceeds

On December 15, 2011, our registration statement on Form S-1 (File No. 333-

175298) was declared effective for our initial public offering

pursuant to which we sold 100,000,000 shares of Class A common stock at a public offering price of $10.00 per share for an aggregate offering

price of $1.0 billion. Morgan Stanley & Co. LLC and Goldman, Sachs & Co. acted as joint bookrunning managers and representatives of the

underwriters for the offering, BofA Merrill Lynch, Barclays Capital Inc. and J.P. Morgan Securities LLC acted as additional joint bookrunning

managers and Allen & Company LLC acted as senior co-manager for the offering.

As a result of our initial public offering, we received net proceeds of $961.4 million, after deducting underwriting discounts and

commissions and other offering expenses. None of the expenses associated with the initial public offering were paid to directors, officers or

persons owning ten percent or more of our common stock or to their associates, or to our affiliates.

We intend to use the net proceeds to us from the initial public offering for general corporate purposes, including working capital, game

development, marketing activities and capital expenditures. In addition, we may use a portion of the proceeds from the initial public offering for

acquisitions of or investments in complementary businesses, technologies or other assets. We also intend to contribute a portion of the net

proceeds to charitable causes through Zynga.org, our philanthropic initiative. As of February 29, 2012, the net offering proceeds have been

invested in money market funds, debt instruments of the U.S. government and its agencies and high credit quality corporate issuers. There has

been no material change in the planned use of proceeds from our initial public offering as described in our final prospectus filed with the SEC

pursuant to Rule 424(b) on December 15, 2011.

27