Zynga 2011 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2011 Zynga annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

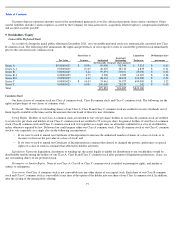

2.5 million shares of non-vested Series Z convertible preferred stock with a total fair value of $38.9 million and 7.1 million ZSUs with a total

fair value of $94.9 million and paid retention and incentive cash bonuses totaling $8.9 million. During 2010, we issued 21.1 million shares of

non-vested Series Z convertible preferred stock with a total fair value of $135.8 million, 6.3 million ZSUs with a total fair value of $39.7 million

and paid retention and incentive cash bonuses totaling $6.7 million.

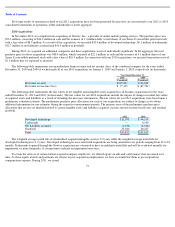

6. Goodwill and Other Intangible Assets

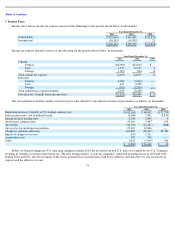

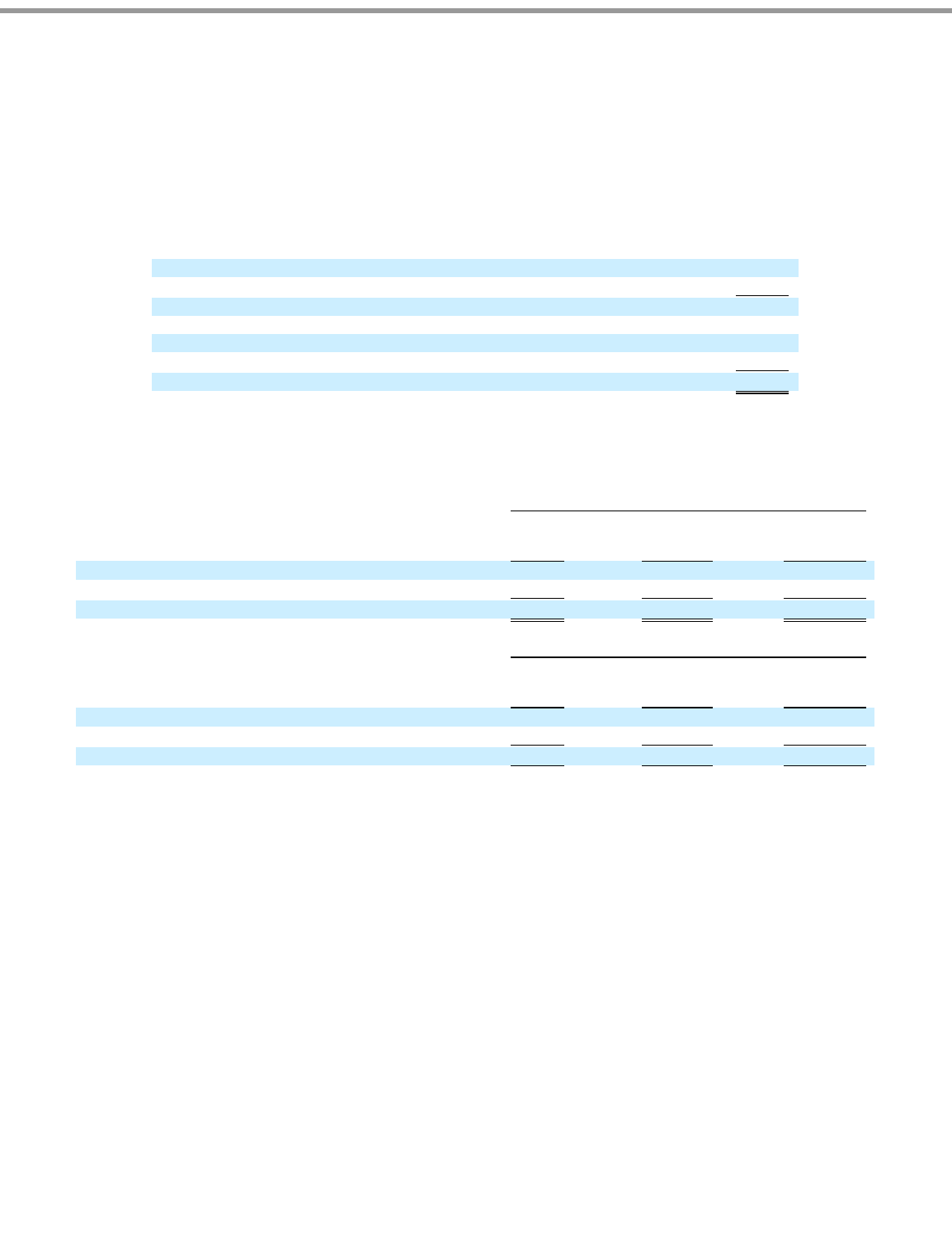

From inception to 2009, there were no additions to goodwill. Changes in the carrying value of goodwill for 2010 and 2011 are as follows

(in thousands):

The changes in initial fair values of acquired assets and liabilities as a result of obtaining the necessary information reflected in the table

above represents a change to the acquired deferred tax assets as a result of filing the final pre-

acquisition tax return of an entity acquired in 2010.

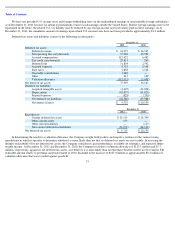

The details of our acquisition-related intangible assets are as follows (in thousands):

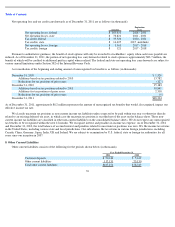

Amortization expense associated with other intangible assets for the years ended December 31, 2011, 2010 and 2009 was $26.6 million,

$8.8 million and $2.3 million, respectively, and is included in cost of revenue on the accompanying consolidated statements of operations. As of

December 31, 2011, future amortization expense related to the intangible assets of $21.7 million and $3.9 million is expected to be recognized in

2012 and 2013, respectively.

73

Goodwill

–

December 31, 2009

$

—

Additions

60,217

Goodwill

–

December 31, 2010

60,217

Additions

35,946

Foreign currency translation adjustments

63

Goodwill adjustments

(4,461

)

Goodwill

–

December 31, 2011

$

91,765

December 31, 2011

Gross

Carrying

Value

Accumulated

Amortization

Net Book Value

Developed technology

$

63,702

$

(40,510

)

$

23,192

Trademarks and domain names

10,537

(1,617

)

8,920

$

74,239

$

(42,127

)

$

32,112

December 31, 2010

Gross

Carrying

Value

Accumulated

Amortization

Net Book Value

Developed technology

$

52,384

$

(14,907

)

$

37,477

Trademarks and domain names

6,775

(251

)

6,524

$

59,159

$

(15,158

)

$

44,001