Zynga 2011 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2011 Zynga annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

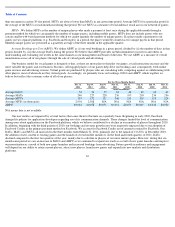

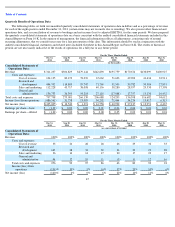

than one game in a given 30-day period, MUUs are always lower than MAUs in any given time period. Average MUUs for a particular period is

the average of the MUUs at each month-end during that period. We use MUU as a measure of total audience reach across our network of games.

MUPs . We define MUPs as the number of unique players who made a payment at least once during the applicable month through a

payment method for which we can quantify the number of unique payers, including mobile payers. MUPs does not include payers who use

certain smaller web-based payment methods for which we cannot quantify the number of unique payers. If a player made a payment in our

games on two separate platforms (e.g. Facebook and Google+) in a period, the player would be counted as two unique payers in that period.

Monthly unique payers are presented as a quarterly average of the three months in the applicable quarter.

Average Bookings per User (ABPU).

We define ABPU as (i) our total bookings in a given period, divided by (ii) the number of days in that

period, divided by, (iii) the average DAUs during the period. We believe that ABPU provides useful information to investors and others in

understanding and evaluating our results in the same manner as our management and board of directors. We use ABPU as a measure of overall

monetization across all of our players through the sale of virtual goods and advertising.

Our business model for social games is designed so that, as there are more players that play our games, social interactions increase and the

more valuable the games and our business becomes. All engaged players of our games help drive our bookings and, consequently, both online

game revenue and advertising revenue. Virtual goods are purchased by players who are socializing with, competing against or collaborating with

other players, most of whom do not buy virtual goods. Accordingly, we primarily focus on bookings, DAUs and ABPU, which together we

believe best reflect the economic value of all of our players.

N/A means data is not available.

Our user metrics are impacted by several factors that cause them to fluctuate on a quarterly basis. Beginning in early 2010, Facebook

changed its policies for application developers regarding use of its communication channels. These changes limited the level of communication

among users about applications on the Facebook platform, which we believe contributed to a decline in our number of players throughout 2010.

In addition, beginning with the third quarter of 2010, our bookings and revenue growth rates were negatively impacted due to our adoption of

Facebook Credits as the primary payment method on Facebook. We account for Facebook Credits net of amounts retained by Facebook. Our

DAUs, MAUs and MUUs all increased in the three months ended March 31, 2011, primarily due to the launch of CityVille in December 2010,

the addition of new content to existing games and the launch of several mobile initiatives. In the third and fourth quarters of 2011, DAUs

declined compared to the first two quarters of the year, mainly due to a decline in players of our more mature games. However, during that six-

month same period we saw an increase in MAUs and ABPU as we continued to expand our reach as a result of new game launches and improve

our monetization as a result of both new game launches and increased bookings from advertising. Future growth in audience and engagement

will depend on our ability to retain current players, attract new players, launch new games and expand into new markets and distribution

platforms.

36

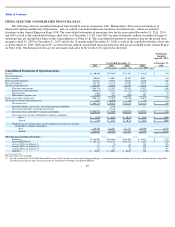

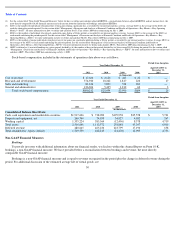

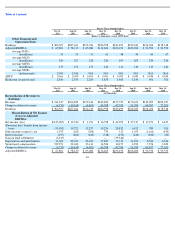

For the Three Months Ended

Dec 31,

2011

Sep 30,

2011

Jun 30,

2011

Mar 31,

2011

Dec 31,

2010

Sep 30,

2010

Jun 30,

2010

Mar 31,

2010

(users in millions)

Average DAUs

54

54

59

62

48

49

60

67

Average MAUs

240

227

228

236

195

203

234

236

Average MUUs

153

152

151

146

111

110

119

124

Average MUPs (in thousands)

2,901

2,568

N/A

N/A

N/A

N/A

N/A

N/A

ABPU

$

0.061

$

0.058

$

0.051

$

0.051

$

0.055

$

0.049

$

0.036

$

0.030