Zynga 2011 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2011 Zynga annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

value of assets acquired and liabilities assumed against goodwill. After the final determination of the fair value of assets acquired or liabilities

assumed, any subsequent adjustments are recorded to our consolidated statements of operations. Subsequent to the measurement period, our final

determination of any acquired tax attributes’ value will affect our provision for income taxes in our consolidated statement of operations and

could have a material impact on our results of operations and financial position.

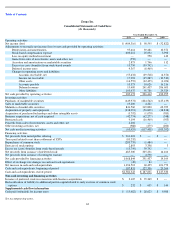

Stock-Based Compensation

We grant ZSUs to our employees that generally vest upon the satisfaction of both a service-based condition of up to four years and a

liquidity condition, the latter of which was satisfied in connection with our initial public offering in December 2011. Because the liquidity

condition was not satisfied until our initial public offering, in prior periods, we had not recorded any expense relating to the granting of our

ZSUs. In the fourth quarter of 2011, after the initial public offering, we recognized $510 million of stock-

based compensation expense associated

with ZSUs that vested in connection with our initial public offering. This expense is in addition to the stock-based compensation expense we

recognize related to outstanding equity awards other than ZSUs as well as expenses related to ZSUs or other equity awards that may be granted

in the future. As of December 31, 2011, we had an additional $454.0 million in unamortized stock-based compensation expense related to ZSUs

granted prior to the initial public offering.

For ZSUs granted prior to the initial public offering, we recognize stock-based compensation expense using the accelerated attribution

method, net of estimated forfeitures, in which compensation cost for each vesting tranche in an award is recognized ratably from the service

inception date to the vesting date for that tranche. For ZSUs granted after the initial public offering, which will only be subject to a service

condition, we will recognize stock-based compensation expense on a ratable basis over the requisite service period for the entire award.

We have historically issued unvested Series Z preferred stock to employees of certain acquired companies. As these awards are generally

subject to post-acquisition employment, we have accounted for them as post-acquisition stock-based compensation expense. We recognize

compensation expense equal to the grant date fair value of the Series Z preferred stock on a straight-line basis over the four-year service period,

net of estimated forfeitures. These unvested Series Z preferred shares automatically converted to restricted class B common shares upon

completion of our initial public offering in December 2011.

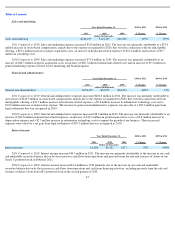

We estimate the fair value of stock options using the Black-Scholes option-pricing model. This model requires the use of the following

assumptions: (i) expected volatility of our common stock, which is based on our peer group in the industry in which we do business;

(ii) expected life of the option award, which we elected to calculate using the simplified method; (iii) expected dividend yield, which is 0%, as

we have not paid and do not anticipate paying dividends on our common stock; and (iv) the risk-free interest rate, which is based on the U.S.

Treasury yield curve in effect at the time of grant with maturities equal to the grant’s expected life. Option grants generally vest over four years,

with 25% vesting after one year and the remainder vesting monthly thereafter over 36 months. The options have a contractual term of 10 years.

If any of the assumptions used in the Black-Scholes model changes significantly, stock-based compensation for future awards may differ

materially compared with the awards granted previously.

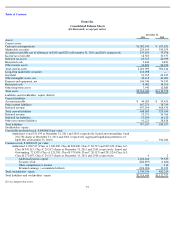

The following table summarizes the assumptions relating to our stock options granted in 2011, 2010 and 2009:

52

Year Ended December 31,

2011

2010

2009

Expected term, in years

6

6

6

Risk

-

free interest rates

2.04

%

2.70

%

1.5

–

2.4

%

Expected volatility

64

%

73

%

70

–

77

%

Dividend yield

—

—

—

Fair value of common stock

$

6.44

-

$

17.09

$

6.44

$

0.13

–

$

3.81