Zynga 2011 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2011 Zynga annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

upon sale or transfer of shares of either Class B common stock or Class C common stock, whether or not for value, each such transferred share

shall automatically convert into one share of Class A common stock, except for certain transfers described in our amended and restated

certificate of incorporation, including, without limitation, transfers for tax and estate planning purposes, so long as the transferring holder

continues to hold sole voting and dispositive power with respect to the shares transferred. Our Class B common stock and Class C common stock

will convert automatically into Class A common stock on the date on which the number of outstanding shares of Class B common stock and

Class C common stock together represent less than 10% of the aggregate combined voting power of our capital stock. Once transferred and

converted into Class A common stock, the Class B common stock and Class C common stock may not be reissued

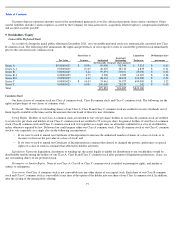

Founder’s Shares

On November 2, 2007, our founder purchased 128.7 million shares of Class B common stock (the Class B Shares) and 20.5 million shares

of Class C common stock (the Class C Shares) for an aggregate purchase price of $0.4 million. At the date of purchase, all of the Class C

common shares and 50% of the Class B common shares were fully vested. The remaining 50% of the Class B Shares vest ratably over a vesting

period of 48 months and are subject to Zynga’s repurchase right at the original purchase price. We recognized compensation expense related to

the vesting Class B Shares over the vesting period. For the years ended December 31, 2011, 2010 and 2009, we recorded compensation expense

of $40 thousand annually in connection with these shares.

Warrants

In July 2008, in connection with the issuance of Series B Preferred Stock, we issued warrants to purchase 18.2 million shares of our

Class B Shares at an exercise price of $0.00625 per share to an investor. The warrants were allocated a value of $1.4 million, which reduced the

proceeds of the Class B Shares and increased paid-in capital. On December 9, 2011, prior to the initial public offering, the investor exercised the

warrants and simultaneously elected to convert 16.9 million shares to Class A common stock, with the remainder of the shares converting to

Class B common stock.

In July 2009, in connection with a third-party service arrangement, we issued a warrant to purchase 0.7 million shares of our Class B

Shares at an exercise price of $0.50375 per share to a service provider. This warrant vested ratably over a period of two years, expires in

July 2019, and is exercisable upon issuance. We determined the fair value of the warrant using the Black-Scholes option-pricing model. We

recorded $2.8 million, $1.9 million and $0.3 million of expense related to this warrant in 2011, 2010 and 2009, respectively. As of December 31,

2011, these warrants remained outstanding and exercisable.

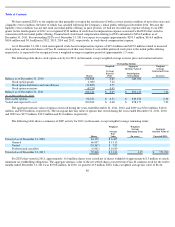

During 2010, concurrent with the sale of 23.3 million shares of Series B-2 convertible preferred stock, we granted an investor a contingent

right to a warrant to purchase 7.8 million shares of Class B common stock at an exercise price of $0.005 per share. We allocated $150 million of

proceeds from the investor to the Series B-2 preferred stock and the contingent right to a warrant based on their relative fair values. The amount

allocated to the contingent warrant right of $4.6 million was recorded to additional paid-in capital on the date the right was granted and

accounted for as a beneficial conversion feature. Because the Series B-2 shares have no stated redemption date, the discount was immediately

charged to retained earnings as a deemed dividend. In April 2011, a distribution agreement was executed and the investor’s right to receive the

warrant was extinguished.

In June 2011, in connection with a service arrangement with a related party, we issued a warrant to purchase 1.0 million shares of our Class

B common stock at an exercise price of $0.05 per share to a service provider. The warrant vests ratably over an eight quarter service term

beginning in April 2010 and the warrant expires in April 2012. We determined the fair value of the warrant using the Black-Scholes option-

pricing model. We will revalue this warrant each period as services are performed and expense the portion of the warrant that vests each period.

In 2011, we recorded $14.0 million of expense related to this warrant, which related to services that were performed from April 2010 through the

current period. In June 2011, the service provider fully exercised the warrant. As of December 31, 2011, 0.75 million shares were vested and

0.25 million shares were unvested and subject to repurchase.

78