Zynga 2011 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2011 Zynga annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

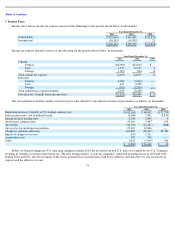

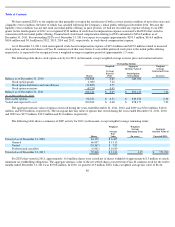

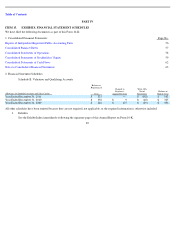

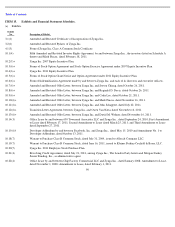

The following table sets forth the computation of basic and diluted net income (loss) per share of common stock (in thousands, except per

share data):

83

Year Ended December 31,

2011

2010

2009

Class

Class

Class

Class

Class

Class

Class

Class

Class

A

B

C

A

B

C

A

B

C

BASIC:

Net income (loss)

$

(8,522

)

$

(367,051

)

$

(28,743

)

$

—

$

82,293

$

8,302

$

—

$

(

46,512

)

$

(6,310

)

Deemed dividend to a Series B-2 convertible

preferred stockholder

—

—

—

—

(

4,169

)

(421

)

—

—

—

Net income attributable to participating

securities

—

—

—

—

(

52,785

)

(5,325

)

—

—

—

Net income (loss) attributable to common

stockholders

$

(8,522

)

$

(367,051

)

$

(28,743

)

$

—

$

25,339

$

2,556

$

—

$

(

46,512

)

$

(6,310

)

Weighted average common shares outstanding

6,083

261,999

20,517

—

203,364

20,517

—

151,234

20,517

Basic net income per share

$

(1.40

)

$

(1.40

)

$

(1.40

)

$

—

$

0.12

$

0.12

$

—

$

(

0.31

)

$

(0.31

)

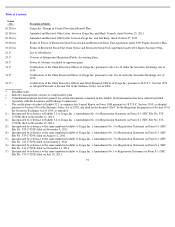

DILUTED:

Net income (loss) attributable to common

stockholders

$

(8,522

)

$

(367,051

)

$

(28,743

)

$

—

$

25,339

$

2,556

$

—

$

(

46,512

)

$

(6,310

)

Reallocation of net income (loss) attributable

to participating securities

—

—

—

—

6,860

—

—

—

—

Reallocation of net income (loss) as a result of

conversion of Class C shares Class B to

Class B shares and Class A shares

$

(28,743

)

—

—

—

2,556

—

—

(

6,310

)

—

Reallocation of net income (loss) as a result of

conversion of Class B shares to Class A

shares

$

(367,051

)

—

—

—

—

—

—

—

—

Reallocation of net income (loss) to Class B

and Class C shares

—

—

—

—

—

(

390

)

—

—

—

Net income (loss) attributable to common

stockholders for diluted net income (loss)

per share

$

(404,316

)

$

(367,051

)

$

(28,743

)

$

—

$

34,755

$

2,166

$

—

$

(

52,822

)

$

(6,310

)

Number of shares used in basic computation

6,083

261,999

20,517

—

203,364

20,517

—

151,234

20,517

Conversion of Class C to Class B and Class A

common shares outstanding

20,517

—

20,517

—

—

20,517

—

Conversion of Class B to Class A common

shares outstanding

261,999

—

—

—

—

—

—

—

—

Weighted average effect of dilutive securities:

Employee stock options

—

—

—

—

94,301

—

—

—

—

Warrants

—

—

—

—

11,074

—

—

—

—

ZSUs

—

—

—

—

—

—

—

—

—

Number of shares used in diluted net income

(loss) per share

288,599

261,999

20,517

—

329,256

20,517

—

171,751

20,517

Diluted net income (loss) per share

$

(1.40

)

$

(1.40

)

$

(1.40

)

$

—

$

0.11

$

0.11

$

—

$

(

0.31

)

$

(0.31

)