Zynga 2011 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2011 Zynga annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

7. Income Taxes

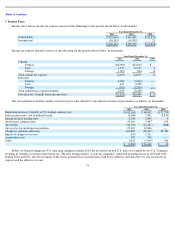

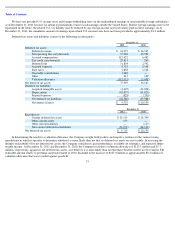

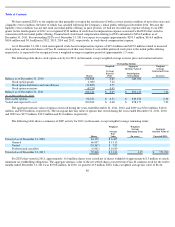

Income (loss) before income tax expense consists of the following for the periods shown below (in thousands):

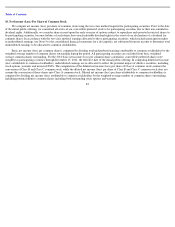

Income tax expense (benefit) consists of the following for the periods shown below (in thousands):

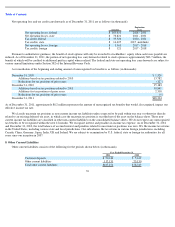

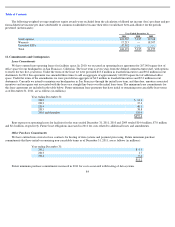

The reconciliation of federal statutory income tax provision (benefit) to our effective income tax provision is as follows (in thousands):

Before we began forming non-U.S. operating companies during 2010, the revenue from non-U.S. users was earned by our U.S. Company,

resulting in virtually no foreign profit before tax. The new foreign entities, as start-up companies, generated operating losses in 2010 and 2011.

During 2010 and 2011, the net tax impact of the losses generated in tax jurisdictions with lower statutory rates than the U.S. rate increased tax

expense and the effective tax rate.

74

Year Ended December 31,

2011

2010

2009

United States

$

(379,800

)

$

141,401

$

(52,831

)

International

(26,342

)

(14,342

)

21

$

(406,142

)

$

127,059

$

(52,810

)

Year Ended December 31,

2011

2010

2009

Current:

Federal

$

(8,990

)

$

34,092

$

—

State

1,195

10,537

1

Foreign

1,600

304

11

Total current tax expense

(6,195

)

44,933

12

Deferred:

Federal

4,689

(9,264

)

—

State

441

2,209

—

Foreign

(761

)

(1,414

)

—

Total deferred tax expense/(benefit)

4,369

(8,469

)

—

Provision for / (benefit from) income taxes

$

(1,826

)

$

36,464

$

12

Year Ended December 31,

2011

2010

2009

Expected provision / (benefit) at U.S. federal statutory rate

$

(142,166

)

$

44,452

$

(17,790

)

State income taxes

-

net of federal benefit

(6,340

)

7,841

(5,859

)

Income taxed at foreign rates

6,338

3,894

4

Stock

-

based compensation

43,064

5,447

659

Tax credits

(34,769

)

(14,231

)

(888

)

Tax reserve for uncertain tax positions

29,303

12,846

—

Change in valuation allowance

101,489

(28,647

)

23,780

Impact of change in tax rates

(205

)

5,211

—

Acquisition costs

397

700

—

Other

1,063

(1,049

)

106

$

(1,826

)

$

36,464

$

12